Emergency Loan Program: Instant Financial Assistance for Employees

An emergency loan program helps employees tackle financial challenges with instant access to funds, reducing stress and enhancing productivity. Discover how it improves retention and workplace satisfaction.

On this page

- What is meant by instant emergency loans for employees?

- Financial assistance services for new employees

- Pros of issuing instant emergency loans for employees

- Impact of instant emergency loans on employee retention

- Important considerations before you loan money to employees

- Alternatives to company-sponsored emergency loan program

- How Empuls can help companies in early wages & loan programs for their employees financial well-being

- Conclusion

According to research “Financial stress and employee satisfaction,” personal financial stress has contributed to the lack of employee satisfaction. It is one primary reason why most organizations go above and beyond to provide better welfare programs and other things that help them take care of their employees.

In addition, the poor financial status of employees has given rise to a lack of productivity in the workforce. It has been one of the major reasons for lower employee retention, making the allowance of instant loans to those in need the most honorable and required policy in the workplace. But what are these instant loans, and how can they help with employee retention? Learn about them in this blog post.

What is meant by instant emergency loans for employees?

Employee instant loans refer to a loan some employers offer their employees as a benefit. These loans are usually small, short-term loans designed to help employees meet their financial needs quickly and easily.

The loan amount is typically limited to a certain percentage of the employee's salary, and the repayment terms may vary depending on the employer's policies. In some cases, the loan amount may be deducted from the employee's salary in installments, while in others, it may be repaid in a lump sum.

Employee instant loans can be a useful way for employees to access cash quickly in case of an emergency or unexpected expense.

Provide your employees with the perfect solution to meet their short-term cash needs. Experience hassle-free digital loan applications for a seamless borrowing experience.

Financial assistance services for new employees

Starting a new job can be an exciting and challenging experience. While adjusting to the new workplace, getting to know your colleagues, and familiarizing yourself with your responsibilities, life's unexpected emergencies can still arise.

Emergency loan program for new employees are financial assistance initiatives some companies offer to support their newest team members during unexpected financial crises.

These loans are designed to help employees bridge short-term financial gaps, allowing them to address urgent needs without resorting to high-interest credit cards or payday loans.

They can be a valuable resource to employees who may not have built up substantial savings yet. The policies for obtaining such a loan can differ significantly from company to company.

Similarly, the amount you can get in emergency funds also depends upon your employer’s policies.

In 2020, Google recognized that they had a student loan debt crisis for new employees and vowed to match student loans up to $2,500 to help employees pay them off. Since this policy was implemented, Google employees have been polled as one of the happiest in the nation.

There’s also Nvidia, a tech company that facilitates new employees with financial assistance services. New employees at Nvidia can apply for over 350$ per month in reimbursements if they have graduated within the past three years to pay for their student loans. They finance most student loans, including health professional loans and consolidation loans. These initiatives make Nvidia one of the most sought-after companies.

Pros of issuing instant emergency loans for employees

There are so many benefits of issuing instant loans to employees:

1. Reduced financial stress among employees

Some so many employees live from one paycheck to another, and they struggle to meet their ends in between their salary dates. These distractions can affect their work productivity as well.

Employers can reduce financial stress among their employees by giving out these instant loans. A personal loan can help employees catch up with financial obligations that are common stressors affecting work performance. When an employee works without any external stress, they would perform better at the workplace as well.

2. Improved employee satisfaction and retention

Financial struggling employees can be stressed, anxious, and distracted at work, leading to poor job performance and low morale. By offering instant loans, employers can provide employees with a valuable financial resource that can help alleviate some of this stress and improve their overall financial well-being.

This can lead to increased job satisfaction and better retention rates, as employees are likelier to stay with a company that shows they care about their financial needs.

3. Increased productivity

Financial stress can have a significant impact on employee productivity, as it can lead to distractions, absenteeism, and poor job performance. By offering instant loans, employers can help alleviate some of this stress and promote better focus and productivity.

Employees less worried about their finances are likely to be more engaged and motivated at work, which can lead to better job performance and increased productivity.

4. Cost-effective

Offering instant loans can be relatively low-cost for employers compared to other employee benefits, such as health insurance or retirement plans. This is because the loans are typically small and short-term, and the repayment terms are usually designed to minimize risk for the employer.

Additionally, offering instant loans can be a cost-effective way to attract and retain top talent, as it provides employees with a valuable benefit without incurring significant expenses.

5. Reduced financial risk

If employees are unable to pay back their loans, the employer may be at risk of financial loss. However, with proper loan management and collection practices, employers can reduce this risk and ensure that they are able to recoup their funds in a timely manner.

Additionally, by providing employees with a reliable source of financing, employers can help prevent employees from turning to high-interest loans or other risky financial products that can be detrimental to their financial health.

6. Boost in business reputation

Company management that supports and provides aid to their employees during the time of crisis gets a good reputation among their employees. The act of kindness sends a good message into the market as well. This reputation will attract more hard working and good willed talent.

7. Flexibility and convenience

Instant loans are designed to be quick and easy to access, which can be a major benefit for employees who need money quickly. By offering instant loans, employers can provide employees with a convenient and flexible source of financing that can be accessed when they require it the most.

This can be especially valuable for employees who may not have access to traditional banking or lending options.

Impact of instant emergency loans on employee retention

Instant loans can have a significant impact on employee retention. By offering instant loans, employers can help alleviate some of the financial stress on employees and promote better focus and productivity, which can lead to higher job satisfaction and retention rates.

1. Boost employee morale

Employees who feel financially secure and supported by their employer are more likely to feel valued and invested in their job, which can lead to higher job satisfaction and retention rates. By offering instant loans as a benefit, employers can show them that they care about their financial well-being and are committed to supporting them both inside and outside the workplace.

2. Retain top talent

Instant loans can also be a valuable retention tool for employers who want to attract and retain top talent. In today's competitive job market, many employees are looking for more than just a competitive salary and benefits package. By offering instant loans as a benefit, employers can differentiate themselves from other employers and provide a unique value proposition that can help attract and retain top talent.

Important considerations before you loan money to employees

Although loaning money to your employees is important, there are some of the important things that you must consider before you loan money. Make sure to keep all of these things in your mind before you go ahead with the loan process:

- Legal and regulatory requirements: Employers need to ensure that they comply with all legal and regulatory requirements when offering loans to employees. This includes complying with state and federal laws related to lending, such as usury laws, which regulate interest rates, and consumer protection laws, which regulate loan terms and disclosures.

- Loan terms and conditions: Employers need to establish clear loan terms and conditions, including interest rates, repayment periods, and other fees or charges. Loan agreements should be documented in writing and should clearly outline the terms and conditions of the loan, including repayment schedules and consequences of default.

- Creditworthiness of employees: Employers need to assess the creditworthiness of employees before loaning them money. This includes reviewing credit reports and considering factors such as income, debt-to-income ratio, and payment history. Employers may also want to consider requiring collateral or a co-signer for higher-risk loans.

- Risk management: Employers need to establish appropriate risk management policies and procedures to mitigate the risk of loan defaults. This may include establishing credit limits, monitoring loan activity, and having a process in place for collections and legal action in the event of default.

- Confidentiality and privacy: Employers need to ensure that loan information is kept confidential and is not shared with other employees or third parties. Employers should also establish appropriate privacy policies and procedures to protect employee information.

Alternatives to company-sponsored emergency loan program

Not every company offers such assistive programs, leaving new employees with future options. In case you are stuck in such a scenario and your company does not offer an emergency loan program, here are some alternatives you can consider.

1. Personal loans

Personal loans can be used for any purpose. You can take out these loans from your local bank without explaining or justifying the purpose. These usually require a credit score check, so you may be ineligible if you have a bad credit score.

However, if you get the loan on bad credit, your interest rate will be higher, and repayment terms will be stricter.

If you are starting out in the job market, your lack of credit history could ring alarms for lenders. Even with a good credit score, some lenders may consider you a high-risk creditor due to your lack of job security, so expect that some lenders may refuse to lend. Asking for a low amount as a new employee also helps.

Other than that, personal loans usually come with lower interest rates and longer repayment terms, allowing you to pay them off conveniently. In personal loans, you receive as much as $10,000 at an interest of 7.5%, making it ideal for financing emergencies.

According to a survey by statistica conducted in the United Kingdom, 71% of the respondents chose personal loans because of their APR, while 61% considered the repayment terms when making their decision.

Before applying for a personal loan, carefully research multiple lenders and compare their rates and fees. You will need proof of income and documentation, so ensure your documents are ready. To increase your chances of getting approved as a new employee, consider getting a cosigner with a good credit score on your application.

The lender will give you a form to fill out, which you must complete honestly. After submitting your application, the lender will perform a credit check on you, and after approval, the loan amount will be disbursed to your bank account in a week.

2. Payday loans

Personal loans can finance your emergency, but they require a credit check and make you wait several days before receiving the payment. Fortunately, you can get a payday loan on bad credit and get money on the same day. They are a suitable option for new employees who cannot get a personal loan approved.

Payday loans are small-sum loans designed to last until your next payday. They are short-term loans and don’t involve a credit check. They have high interest rates, and you must repay most loans within two to four weeks. 75% of the individuals who take payday loans in the United Kingdom struggle with paying them back.

While payday loans can quickly get you money, they are risky. Several lenders offering payday loans are loan sharks that can trap you in a cycle of debt with APRs as high as 300%. You must thoroughly research your lender and take out the loan only from a reputable lender. Some employers also offer payday loans, so consider asking your company for their loan policy before you scout for other, riskier lenders.

3. Car title loans

Personal loans are unsuitable for emergencies because they take too long and require a good credit score. While payday loans can be an alternative, they often have a high APR and may not unlock much funding. A third option for you is to get a car title loan, but it requires you to have a personal car.

A car title loan is a secured loan in which you put collateral against your loan amount. The lender can seize the collateral to recoup their losses if you fail to pay back the loans, which, in this case, will be your car. However, a lender only has your car’s title, proof of ownership, and a duplicate set of keys, so you can drive your car freely as long as you make regular payments.

A car title loan generally allows emergency funding up to 25% to 50% of your car’s value. If your vehicle is in good condition, you can unlock more funding, and vice versa. Your car’s value is checked by an on-site inspection of your vehicle or by the pictures you provide the lending company.

As car title loans are without a credit check, they have a higher interest rate than personal loans. However, since lenders secure their loans with collateral, their risk decreases, so the interest rates are not as high as payday loans.

Remember that you need a lien-free car title to qualify for a car title loan. If your car is in someone else’s name, or you are driving a car on lease or have any outstanding auto loan, you cannot get a car title loan. Getting approved can be difficult since these loans don’t require a credit check. Generally, if you have a stable day job that pays well, you can get approved for a car title loan.

How Empuls can help companies in early wages & loan programs for their employees financial well-being

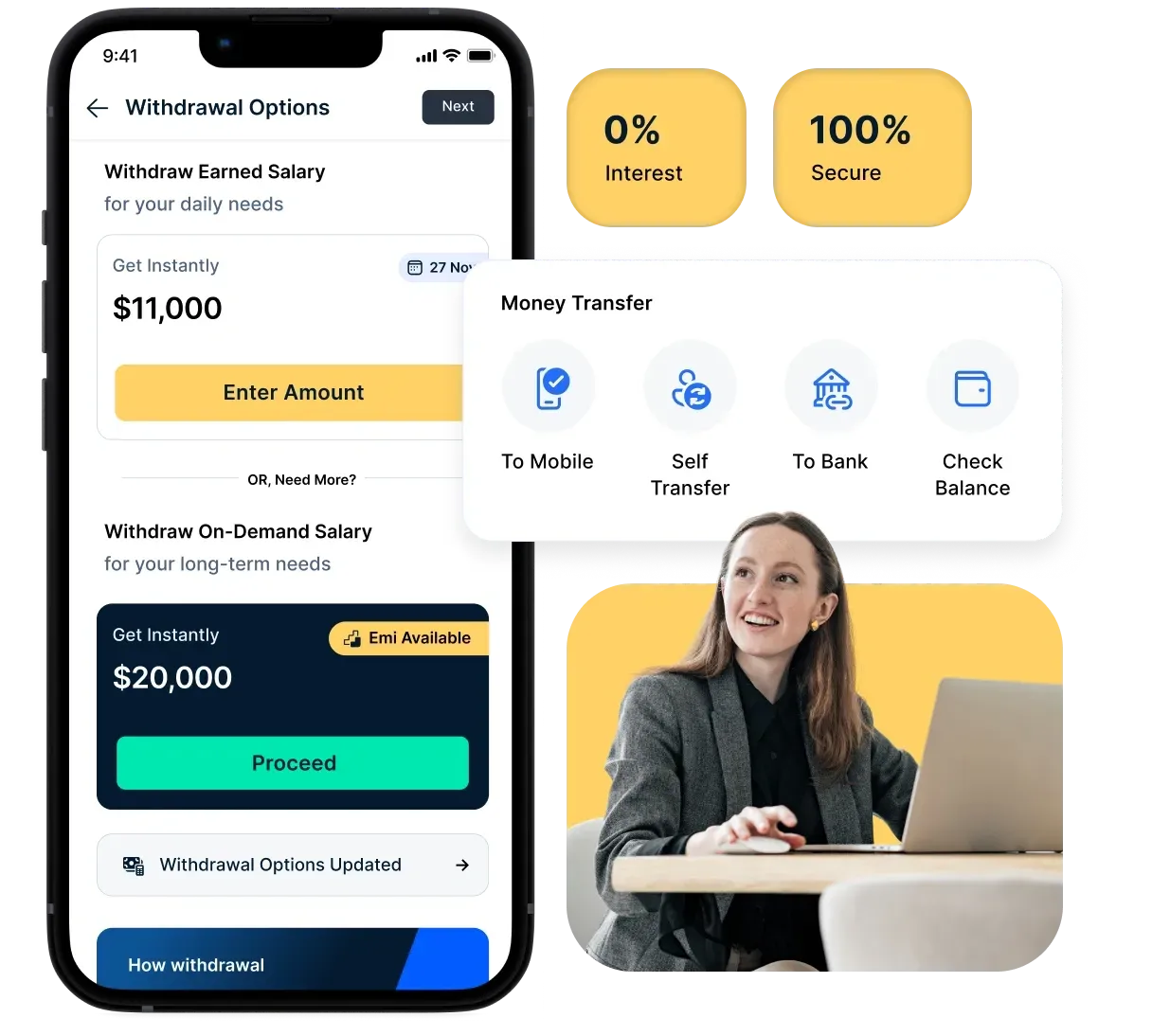

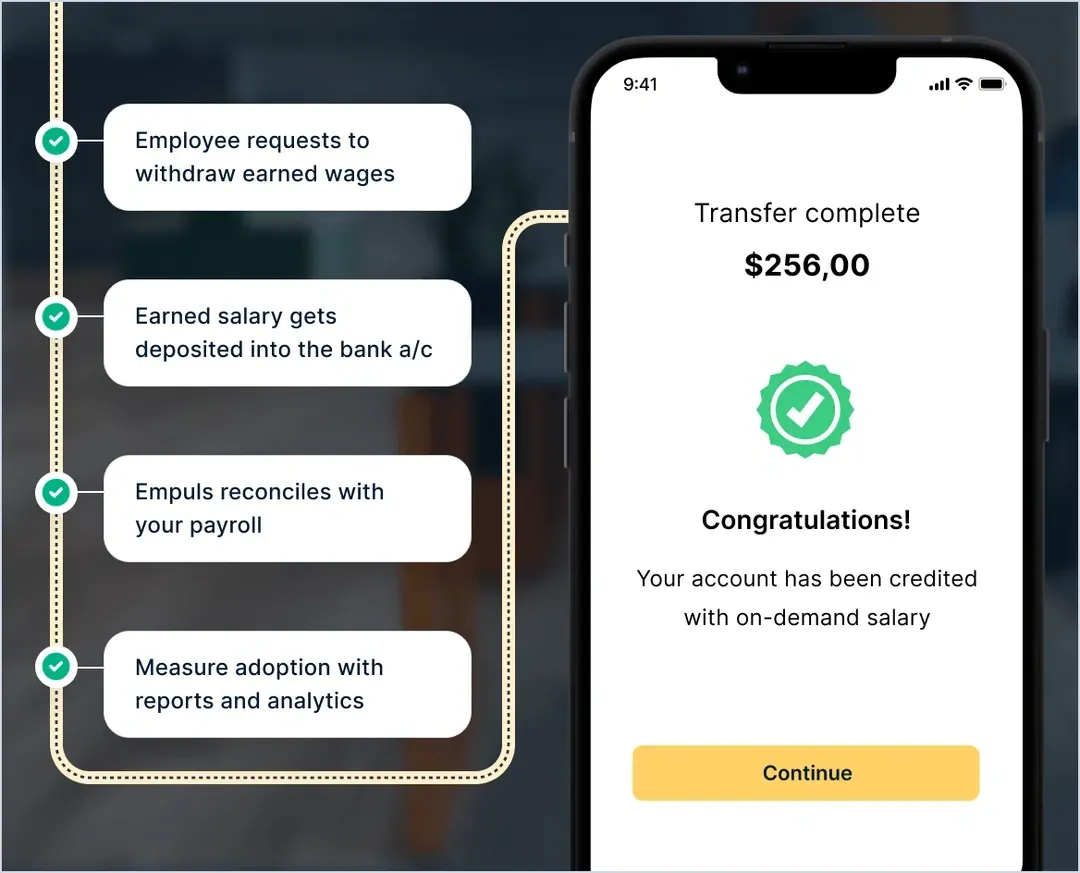

Empuls offers seamless solutions for companies looking to prioritize their employees' financial well-being through early wages and emergency loan programs.

1. Instant credit

Empower your workforce with Instant Credit, a hassle-free digital loan application process. No more waiting in queues or dealing with lengthy paperwork. Extend this benefit to all employees, including those with no credit history. Employees can tailor their repayment schedule with flexible tenure options ranging from 3 to 36 months. Enjoy great offers like a 75% processing fee discount for the first transaction and enticing gift vouchers.

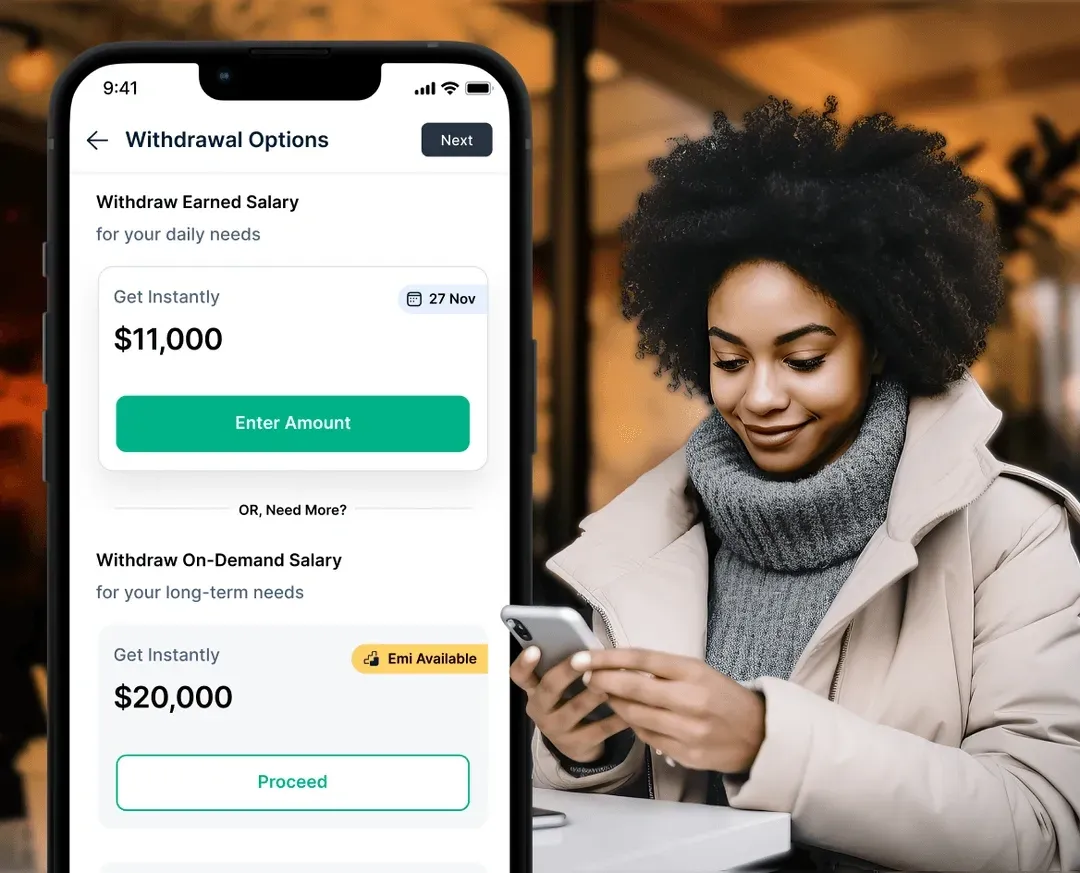

2. Early wages

Ensure your employees have the financial flexibility they need with Early Wage Access. Provide them with early access to their earned wages at zero interest between pay cycles. This not only helps employees manage unplanned expenses but also contributes to higher productivity and a stress-free work-life balance. The result? Happy employees and a delighted HR team with no additional liabilities or costs to the company.

3. Loan categories

Empuls understands that financial needs vary. Whether it's planned or unplanned expenses, emergencies, or personal milestones, employees can utilize Early Wages and Instant Credit for various purposes:

- Bike & Car

- Electronics & Gadgets

- Engagement & Wedding

- Medical Emergencies

- Education & Upskilling

- Home Renovation

- Travel & Vacation

- Home Appliances

- Kitchen Appliances

Benefits for HR and employees

- HR benefits: Demonstrate your commitment to employee well-being by enhancing your benefits package. Empuls helps HR teams efficiently manage expenses with zero liability to the company and no impact on working capital. It's an excellent tool for talent retention and attraction.

- Employee benefits: Empuls ensures a 100% digital process with approval in just 5 minutes. Quick cash transfers directly into employees' bank accounts provide immediate relief. Enjoy early access to earned wages multiple times a year, with no credit checks and access to interest-free cash.

Empuls is the key to unlocking financial freedom for your employees. By implementing Early Wages and Loan Programs, companies can enhance their benefits package, show genuine care for their workforce, and contribute to a stress-free and productive work environment. Talk to our experts today and take the first step toward a financially empowered workforce!

Conclusion

Providing instant employee loans is very important for employee retention, especially in India. Organizations need to expand their horizons, especially financially. If employees are happy with the benefits and support when in need, they will be loyal to the employer and productive at work.