Best Employee Benefits Software for 2025: Top Platforms to Boost Engagement and Retention

Looking for the best employee benefits software? Explore top platforms for 2025 that help boost employee engagement, deliver flexible perks, and improve workforce retention and loyalty.

On this page

Choosing the right employee benefits providers and employee perks software can transform how your workforce feels, performs, and stays loyal. Today’s employees expect more than just a paycheck — they want experiences that support their lifestyle, well-being, and ambitions.

That's where powerful employee benefits software comes in, helping businesses design and deliver rewards that truly resonate. In this article, we explore the top platforms that are helping companies rethink, revamp, and revolutionize their employee perks strategy.

What are employee perks and benefits?

Employee perks are additional benefits offered by companies that go beyond standard compensation and benefits packages. While traditional benefits include health insurance, retirement plans, and paid time off, perks are often more varied and tailored to improve employees’ overall work experience.

Perks can range from wellness programs and flexible work arrangements to free meals and career development opportunities. They play a crucial role in enhancing job satisfaction, fostering a positive work environment, and increasing overall productivity.

Types of employee perks and benefits

Following are the different types of employee perks and benefits:

1. Traditional perks

Organizations like Google, Johnson & Johnson, and Microsoft offer a variety of health and wellness facilities like mental health, wellness programs, and memberships while Amazon, Apple, and Intel offer financial perks such as 401(k) plans, stock options, etc.

- Health and wellness: Gym memberships, wellness programs, mental health support, and on-site health screenings help employees maintain a healthy lifestyle.

- Financial benefits: Stock options, 401(k) matching, and student loan repayment programs provide employees with financial security and incentives.

2. Modern perks:

Slack, Airbnb, and Zoom Video Communications give their employees the choice of remote work and flexible working hours. Firms like Google, Amazon, IBM, and LinkedIn help their employees upskill by providing them with a wide array of courses, and training programs.

- Work-life balance: Flexible working hours, remote work opportunities, and paid parental leave allow employees to better balance personal and professional responsibilities.

- Professional development: Companies offer training programs, educational stipends, and access to online courses to help employees grow their skills and advance their careers.

3. Unique perks

Etsy and Bumble allow their employees to bring their pets to work while Patagonia, Google, and Microsoft offer onsite childcare services.

- On-site childcare: Providing on-site childcare facilities helps parents manage their work and family commitments more effectively.

- Pet-friendly policies: Allowing pets at work or offering pet insurance can create a more relaxed and enjoyable work environment.

What are employee benefits providers?

Employee benefits providers are organizations that specialize in designing, administering, and managing employee benefits packages on behalf of employers.

These providers handle the complex tasks of negotiating with insurance companies, managing enrollment processes, and ensuring compliance with regulations. They offer a range of benefits, including health insurance, retirement plans, wellness programs, dental and vision coverage, and more specialized services like mental health support and child care assistance.

Partnering with an employee benefits provider allows businesses to offer competitive benefits without the administrative burden. The provider manages the logistics, ensuring that employees receive the benefits they need, which, in turn, can boost job satisfaction, reduce turnover, and improve overall company performance. Examples of employee benefits providers are MetLife, Cigna, Guardian Life, and many more.

Top 5 employee benefits software in 2025

Choosing the right employee perks software can dramatically boost employee happiness and retention. In this guide, we bring you a listicle of top platforms that offer flexible benefits, perks, and rewards solutions. If you are looking for the best employee benefits provider, these companies stand out for their features, ease of use, and impact.

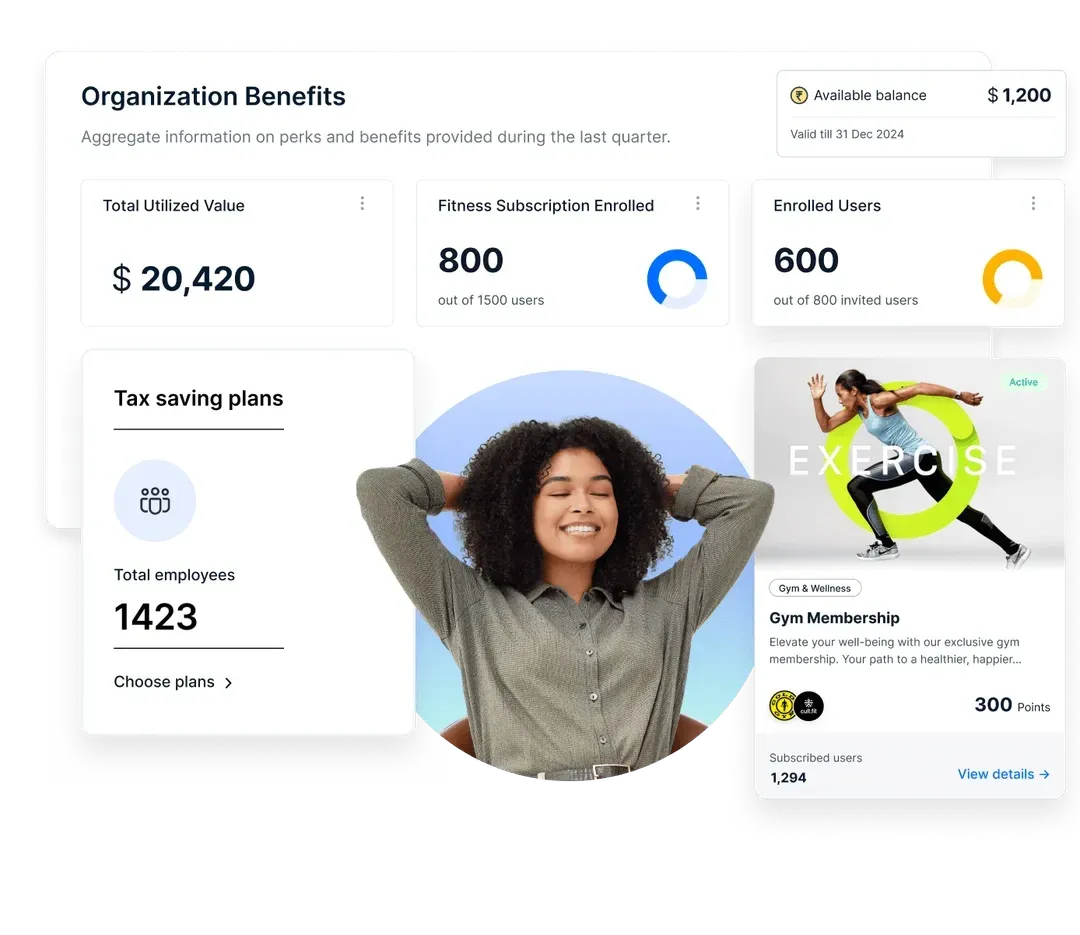

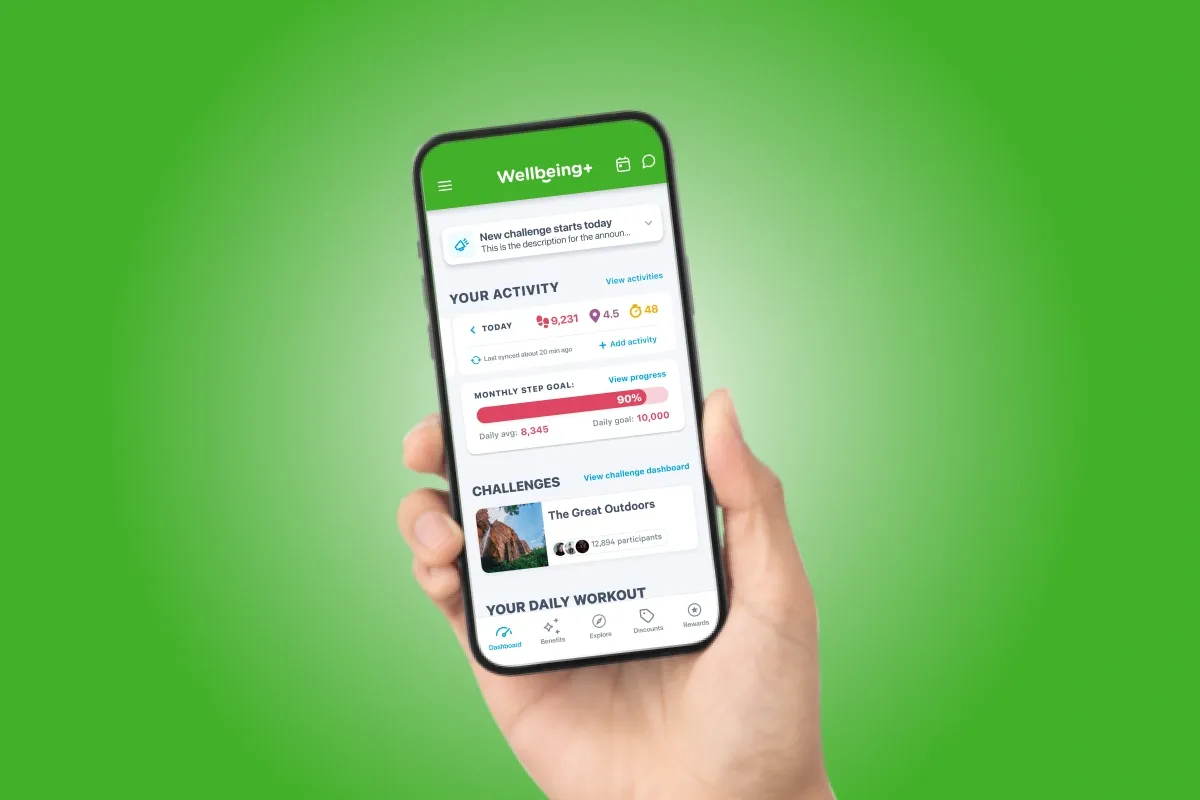

1. Empuls

Empuls is an award-winning, AI-powered employee engagement platform that seamlessly brings together employee benefits, perks, tax-saving programs, early wage access, and holistic well-being initiatives — all on one intuitive platform. With Empuls, organizations can delight employees, boost financial wellness, and create a thriving workplace culture without the complexity of managing multiple vendors.

Core features for employee benefits:

Following are the core features Empuls provides:

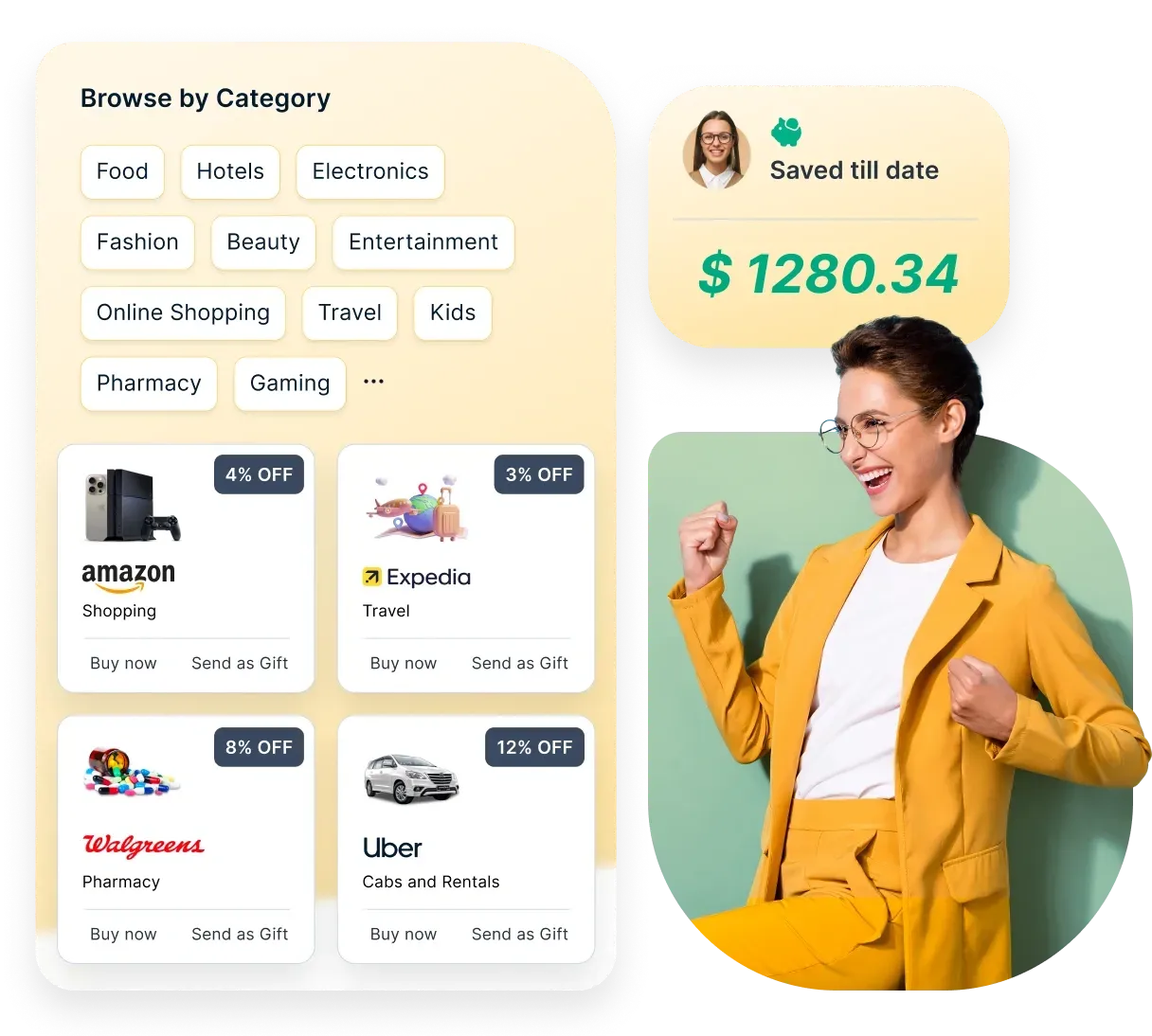

1. Employee perks and discounts

Empuls offers an expansive global discounts platform, providing employees access to over 10,000+ exclusive offers from 6,000+ brands across 25+ categories in more than 50 countries.

Employees can enjoy savings on essentials like dining, travel, fitness, entertainment, electronics, groceries, and wellness subscriptions. This not only stretches their salaries but also boosts financial well-being, helping companies become true partners in employees’ everyday lives.

Highlights:

- Curated marketplace for exclusive offers and cashback.

- Deeper discounts compared to regular market prices.

- Personalized perks catalog based on location and preferences.

- Available via web, mobile app, and integrations with Microsoft Teams and Slack.

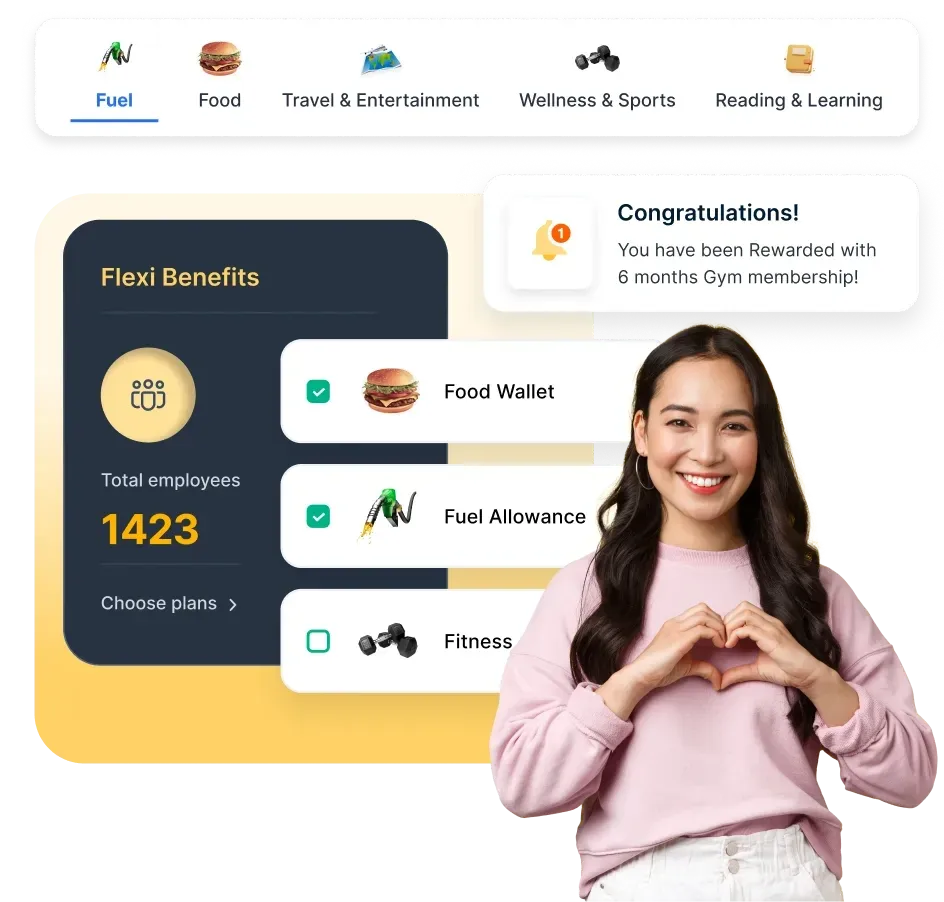

2. Flexible fringe benefits

Empuls revolutionizes flexible benefits by offering a centralized platform to administer diverse employee allowances across meals, fuel, telecom, books, health, learning, fitness, and travel.

Powered by the Empuls Multi-Benefit Card, employees can seamlessly utilize allowances across online and offline stores without dealing with fragmented vendors.

Highlights:

- Tax-free meal, fuel, telecom, and periodical allowances.

- RBI-compliant, RuPay-powered multi-wallet card for Indian markets.

- Fringe lifestyle benefits like wellness apps, learning subscriptions, mental health support, and gym memberships.

- Single digital platform for claiming and tracking benefits — with 100% flexibility and transparency.

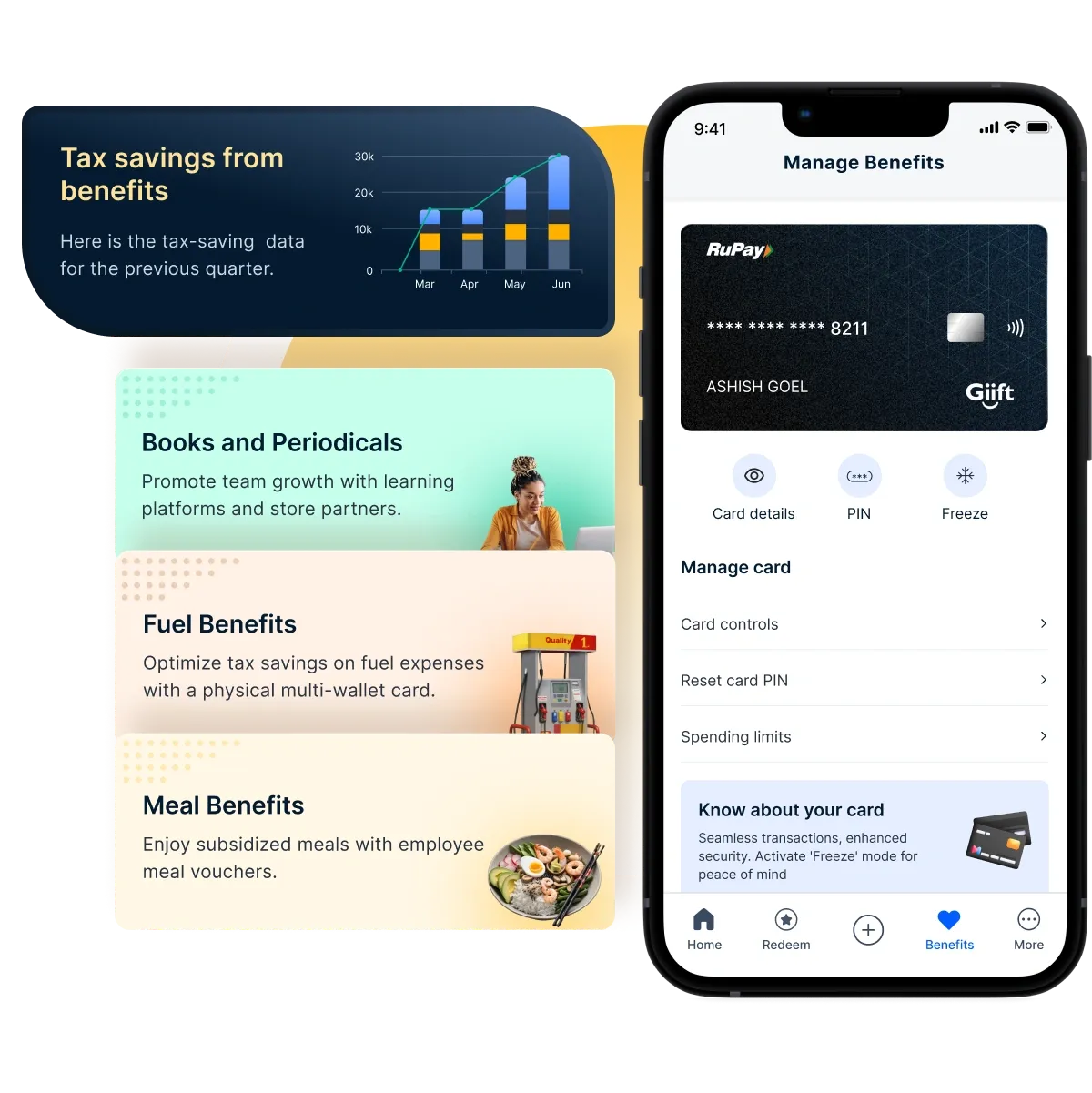

3. Tax-free benefits administration

Empuls empowers employers to offer maximum tax-saving benefits while keeping administration effortless and compliant.

Using the Empuls platform, companies can easily distribute tax-free benefits and allowances without the usual paperwork nightmares.

Highlights:

- Streamlined loading and tracking of allowances.

- Supports tax-saving categories: meals, fuel, telecom, books.

- RBI, PPI, and MCC compliant digital wallets.

- 100% digital tracking, saving employees up to INR 36,000 per annum in taxes (India-specific).

Why it matters: Employees experience an increase in take-home salary without additional CTC cost to the employer, making it a true win-win.

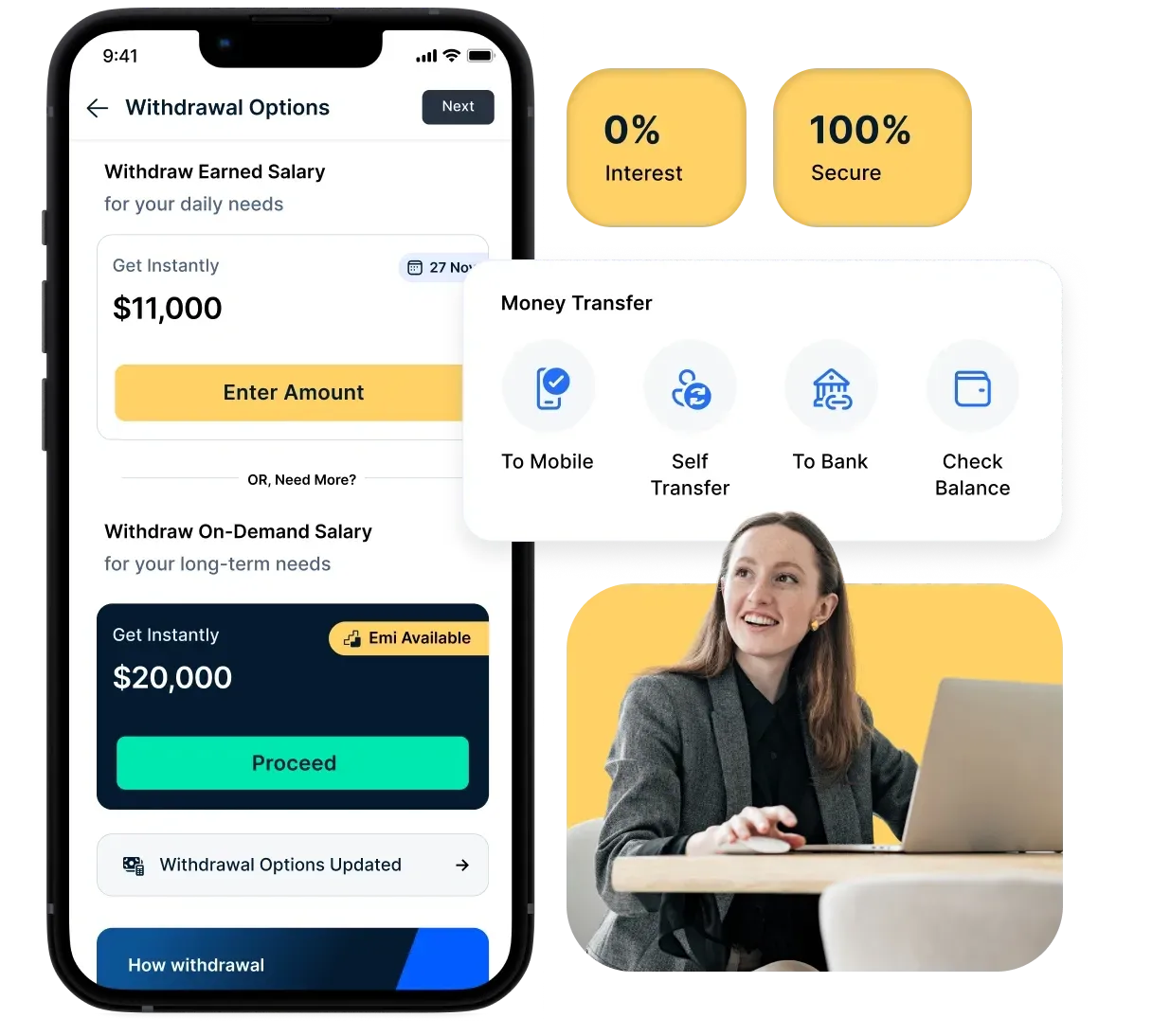

4. Early wage access

With Empuls' Early Wage Access solution, employees can unlock a portion of their earned salary before payday — providing financial flexibility to deal with emergencies, avoid debt traps, and reduce financial stress.

Highlights:

- Instant digital application and disbursal via mobile and desktop.

- No credit checks, hidden charges, or interest.

- Helps employees manage unplanned expenses without relying on costly loans.

- Drives employee satisfaction, loyalty, and well-being.

Why it matters: Companies using early wage access see reduced attrition rates, better employee morale, and higher overall productivity.

Why choose Empuls?

- Unified platform: No need to juggle multiple vendors — manage perks, benefits, tax-free programs, rewards, recognition, and surveys from a single platform.

- Cost-effective: Zero markups, bill-on-redemption, and tax-optimized plans to save money for both employees and employers.

- Truly global: Covers 100+ countries and offers currency and language flexibility.

- AI-powered insights: Smart nudges, predictive analytics, and intelligent automation to maximize program participation and effectiveness.

- Seamless integrations: Works inside Microsoft Teams, Slack, Outlook, and integrates with all leading HRMS platforms.

- Enterprise-grade security: SOC 2, ISO 27001, GDPR, and HIPAA compliant.

G2 Rating: 4.6 out of 5

2. Reward Gateway

Description: Reward Gateway is a global platform that connects, recognizes, and supports employees with discounts, communications, and engagement tools.

Core features:

- Employee discounts and cashback platform

- Early wage access and wellbeing services

- Employee recognition and communications hub

Why choose Reward Gateway: Perfect for organizations focused on creating a culture of appreciation alongside benefits. It offers robust tools for perks and employee engagement.

G2 Rating: 4.6 out of 5

3. Perkbox

Description: Perkbox is an employee perks software focused on wellbeing, perks, and recognition. It helps employees save on everyday expenses and improves company culture.

Core features:

- Global perks and discounts marketplace

- Wellbeing hub with mental health support

- Peer-to-peer recognition system

Why choose Perkbox: Best suited for companies seeking to offer practical financial perks and wellbeing initiatives across international teams.

G2 Rating: 4.5 out of 5

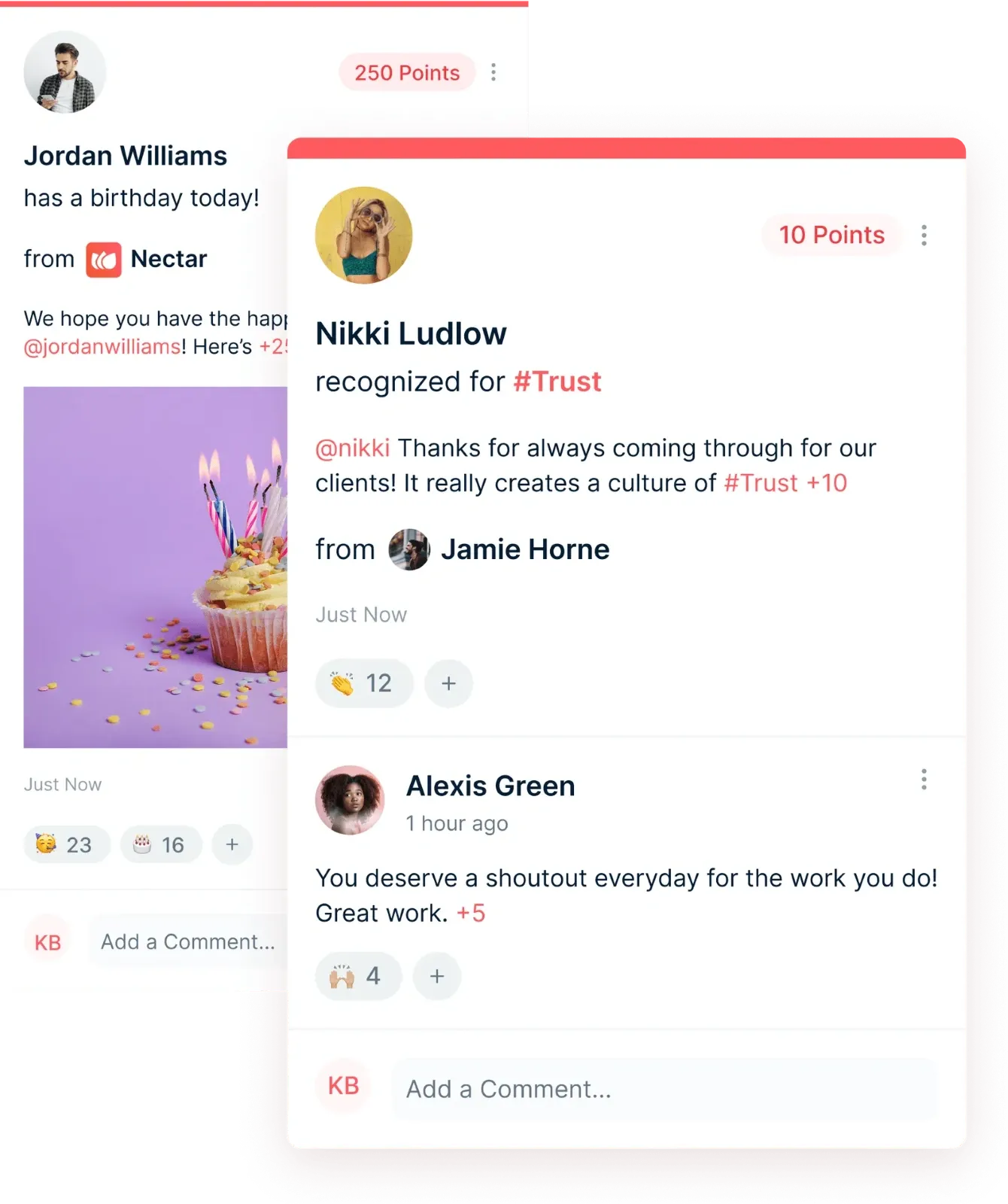

4. Nectar HR

Description: Nectar HR is a simple and flexible platform for peer-to-peer recognition, rewards, and employee engagement programs.

Core features:

- Peer recognition and points system

- Customizable rewards catalog

- Budget control for rewards spending

Why choose Nectar HR: Great for companies looking for a cost-effective way to manage recognition and micro-rewards within tight budgets.

G2 Rating: 4.7 out of 5

5. Level

Description: Level is a modern benefits platform offering flexible health, wellness, and lifestyle stipends to employees.

Core features:

- Tax-free and post-tax benefits management

- Easy employee expense reimbursement

- Customizable allowances for health, fitness, travel, and learning

Why choose Level: Best suited for organizations focused on flexible and employee-driven benefits programs beyond just traditional health insurance.

G2 Rating: Not available

Here is a quick comparative summary:

Company | Perks/Discounts | Fringe/Tax-Free Benefits | Early Wage Access | Engagement/Recognition | Global Reach |

Empuls | ✅ | ✅ | ✅ | ✅ | ✅ |

Reward Gateway | ✅ | ✅ | ✅ | ✅ | ✅ |

Perkbox | ✅ | Partial | ✅ | ✅ | ✅ |

Nectar HR | ❌ | ❌ | ❌ | ✅ | ✅ |

Level | ❌ | ✅ | ❌ | ❌ | ❌ |

How to choose the right employee benefits providers?

Selecting the right employee benefits provider is a crucial decision that can significantly impact your company’s ability to attract and retain talent. Here are some key factors to consider when choosing a provider:

- Assess your company’s needs: Before selecting a provider, it's essential to understand what benefits are most important to your employees. Conduct surveys or focus groups to gather feedback on what your workforce values most. For example, if healthcare is a top priority, you might consider a provider like Providence Employee Benefits, known for its comprehensive health services.

- Evaluate provider expertise: Look for providers with a proven track record in your industry. Experienced providers will be more adept at understanding the unique challenges and needs of your business, ensuring that your benefits program is tailored to your specific requirements.

- Consider cost and value: Research indicates businesses typically spend 1.25 to 1.4 times each employee's base salary on employee benefits, or add 20-50% to the employee's salary to cover benefits. While it's important to provide competitive benefits, it's equally important to ensure that the costs are sustainable for your business. Compare the costs of different providers and consider the overall value they offer. Remember, the cheapest option may not always be the best in the long term.

- Review provider reputation: Research potential providers by reading customer reviews, testimonials, and case studies. A provider with a strong reputation for customer service and reliability is more likely to be a valuable long-term partner.

- Assess flexibility and customization options: Choose a provider that offers customizable plans, allowing you to tailor benefits to meet the specific needs of your workforce. Flexibility is crucial, especially as your company grows and your employees' needs evolve.

- Examine support services: Ensure that the provider offers robust support services, including employee education, assistance with claims, and easy-to-use digital tools. These services can significantly enhance the employee experience and ensure that your workforce fully utilizes their benefits.

Conclusion

In today's competitive business environment, selecting the right employee benefits provider is more important than ever. A well-chosen provider can help you attract top talent, reduce turnover, and create a more engaged and productive workforce. By carefully evaluating your options and considering factors like provider expertise, cost, and flexibility, you can find the ideal partner to support your company’s growth and success.

To streamline your benefits administration and boost employee engagement, consider exploring solutions like Empuls. Empuls offers a comprehensive platform that simplifies benefits management and helps you create a thriving workplace culture. Talk to an expert today to build a comprehensive employee benefits package!