Employee Engagement in the Financial Services Industry

Discover how to enhance employee engagement in the financial services industry. Learn practical tactics that improve productivity, retention, and team morale in fast-paced finance roles.

On this page

Employee engagement in the financial services industry plays a vital role in improving performance, retaining top talent, and strengthening client relationships. With constant pressure around compliance, customer trust, and operational efficiency, organisations in this sector need more than just skilled employees—they need motivated ones.

Financial services engagement requires a clear approach that connects employees to company goals, rewards efforts meaningfully, and fosters a strong sense of belonging. It’s not about one-time initiatives but building long-term commitment from frontline staff to leadership.

Whether you're a bank, insurance firm, or fintech company, investing in financial services employee engagement helps build a resilient and high-performing workforce.

This blog explores the key drivers of engagement, challenges specific to the industry, and proven strategies to build a more connected, productive workplace.

The state of employee engagement in the financial services industry

The financial services industry, especially banking, grapples with persistent employee engagement challenges.

Recent studies of banking professionals reveal that only 35% report high engagement levels, a concerning trend given the industry's reliance on motivated and committed staff.

Low employee engagement in financial services results in high absenteeism and turnover rates, particularly acute in the Indian banking sector, where turnover stands at 18.6%, according to a Compdata poll. The associated financial costs and disruptions to workflow and client relationships make this a pressing issue.

Recognizing these challenges, financial organizations are increasingly implementing engagement initiatives.

These aim to empower employees for enhanced performance, benefiting job satisfaction, productivity, motivation, and retention. Engaged employees tend to stay longer, reducing costly turnover.

A Gallup analysis underscores the value of engagement, revealing that engaged workers are 22% more productive. This tangible impact reinforces the importance of investing in employee engagement initiatives, which is crucial for success in the competitive world of financial services.

Challenges for employee engagement in the financial services industry

Despite being one of the most structured sectors, financial services face distinct hurdles that can weaken employee engagement if not addressed proactively. Below are the major challenges:

1. Regulatory stress and compliance fatigue

Employees in banking, insurance, and investment firms often deal with complex regulatory frameworks. With constant audits, documentation, and policy updates, teams can quickly become drained. The feeling of being constantly monitored and the fear of non-compliance can reduce autonomy and lead to burnout.

2. Repetitive tasks and process-heavy roles

Many back-office and support roles involve rule-based tasks that leave little room for creativity or autonomy. Over time, this lack of variety can cause disengagement. Employees feel like cogs in the system rather than valued contributors, which affects motivation and job satisfaction.

3. Pressure to meet aggressive targets

Frontline teams, especially in sales and advisory roles, are constantly pushed to meet monthly or quarterly targets. The pressure to upsell or cross-sell often overrides meaningful client interaction, leading to stress and emotional fatigue. Over time, this performance-driven culture can create disengagement.

4. Limited opportunities for internal growth

Large financial institutions often follow rigid promotion structures. High-potential employees may feel their career paths are unclear or too slow, which impacts retention. When internal mobility is limited or opaque, even top performers may start exploring external opportunities.

5. Disconnect between corporate and frontline staff

In large banks and financial services firms, there’s often a gap between senior leadership and branch-level employees. Communication tends to be one-way, and decisions are made without frontline feedback. This creates a sense of disconnect, lowering engagement and a shared sense of purpose.

12 Strategies for enhancing employee engagement in the financial services industry

Here are 12 practical strategies for enhancing employee engagement in the financial services industry.

1. Employee development and training programs

Investing in comprehensive employee development and training programs can significantly boost financial service engagement.

These programs should not only focus on enhancing technical skills but also on soft skills, leadership development, and career advancement opportunities.

Providing employees with access to ongoing training and development, financial institutions empower their staff to stay up-to-date with industry trends and develop new skills.

This increases job satisfaction and enhances employees' ability to contribute effectively, boosting their engagement. Furthermore, offering career advancement opportunities through these programs shows employees that their long-term growth is valued.

2. Employee well-being initiatives

Financial services companies can improve employee engagement by prioritizing their well-being. This includes initiatives focused on physical health, mental health, work-life balance, and creating a supportive work environment.

Prioritizing employee well-being improves engagement and reduces burnout and turnover rates in the financial services industry, which is known for its demanding work environment.

Companies that invest in mental health support, stress reduction programs, and flexible work arrangements demonstrate that they care about their employees' overall welfare, increasing job satisfaction and engagement.

3. Publicly celebrate employee achievements

Publicly celebrating employee achievements involves recognizing and acknowledging employees' successes and contributions visibly and appreciatively. This can be done through company-wide announcements, awards ceremonies, or internal communication channels.

Celebrating employee achievements publicly acknowledges individual accomplishments and reinforces a culture of appreciation within the organization.

When employees see their colleagues receiving recognition for their hard work, they are motivated to excel and contribute more effectively. It also fosters a sense of pride and camaraderie among the workforce, boosting overall engagement and morale.

4. Give employee perks and benefits

Providing employees with perks and benefits beyond their regular compensation is a powerful way to enhance engagement. These perks can include health and wellness benefits, flexible work arrangements, tuition reimbursement, and more.

Offering employee perks and benefits demonstrates a commitment to the well-being and satisfaction of the workforce.

When employees receive valuable perks such as comprehensive health coverage, access to wellness programs, or opportunities for professional development, they are more likely to be engaged and loyal to the organization.

These perks contribute to a positive work environment and enhance employee experience.

5. Diversity, equity, and inclusion (DEI) initiatives

Prioritizing diversity, equity, and inclusion in the workplace can significantly impact employee engagement in the financial services industry.

Creating a culture where all employees feel valued and included can lead to higher morale, collaboration, and engagement.

DEI initiatives demonstrate a commitment to fairness and equality within the workplace. When employees see that their organization values diversity and provides equal opportunities, they are more likely to be engaged and satisfied with their work.

ERGs, in particular, create a sense of community and support among employees from various backgrounds, further enhancing engagement.

6. Employee recognition and rewards programs

Implementing employee recognition and rewards programs can boost engagement by acknowledging and celebrating employees' hard work and contributions. These programs can include performance bonuses, peer recognition, and awards for outstanding achievements.

Employee recognition programs motivate and inspire employees by acknowledging their contributions to the organization.

When employees feel appreciated and rewarded for their hard work, they are more likely to stay engaged and committed to their roles. Such programs also encourage a positive and collaborative work environment.

7. Flexible work arrangements and remote work options

Offering flexible work arrangements and remote work options can greatly enhance employee engagement. The financial services industry traditionally involves long hours and a rigid office-based culture.

However, allowing employees to have more control over their work schedules and locations can lead to increased job satisfaction and work-life balance.

Flexibility in work arrangements shows that the company trusts its employees and values their well-being. It allows employees to better manage their personal and professional lives, reducing stress and increasing engagement.

Moreover, it can attract and retain top talent, as many employees today prioritize flexibility in their work environments.

8. Employee feedback and engagement surveys

Regularly collecting feedback from employees through engagement surveys and acting on that feedback can significantly improve engagement. These surveys provide a platform for employees to voice their concerns, suggestions, and overall job satisfaction.

Employee feedback and engagement surveys show that the organization values the opinions and input of its employees. When employees see that their feedback leads to positive changes within the company, they are more likely to feel engaged and motivated.

These surveys also help identify issues that, if left unaddressed, could lead to disengagement and turnover.

9. Mentorship and career development programs

Establishing mentorship and career development programs can boost employee engagement by providing opportunities for professional growth and guidance. These programs pair experienced employees with less experienced ones to foster learning and skill development.

Mentorship programs show employees that their growth and development are important to the organization. Having a mentor can boost confidence, provide guidance, and open doors to new opportunities.

Employees who participate in such programs are often more engaged and motivated to excel in their roles, as they have a clear path for career progression.

10. Transparent communication and goal alignment

Promoting transparent communication and aligning individual and team goals with the company's mission and vision can significantly improve employee engagement. When employees understand their roles and how they contribute to the overall goals of the organization, they are more motivated and engaged.

Transparent communication fosters trust and clarity within the organization. When employees are aware of the company's strategic direction and how their work fits into that strategy, they are more engaged and motivated to work toward common goals.

It also helps employees understand the impact of their contributions on the organization's success, reinforcing their sense of purpose and engagement.

11. Employee empowerment and decision-making involvement

Empowering employees by involving them in decision-making processes can boost engagement.

When employees have a say in the organization's direction and feel that their opinions are valued, they are more likely to take ownership of their roles and contribute more effectively.

Employee empowerment fosters a sense of ownership and responsibility. When employees feel that they have a voice in the organization, they become more engaged in their work and are often more innovative and motivated to contribute to the company's success.

Involving employees in decision-making processes also strengthens trust and communication within the organization.

12. Regular team building and social events

Organizing regular team-building and social events can enhance employee engagement by fostering a sense of camaraderie and connection among team members. These events can include team lunches, outings, or even virtual gatherings for remote teams.

Team-building events provide employees with opportunities to connect personally, which can improve collaboration and communication in the workplace.

Employees who strongly connect with their colleagues are likelier to be engaged and enjoy their work environment.

Transform employee engagement in financial services with Empuls

In a sector where performance, compliance, and customer trust are paramount, engaging employees isn’t just HR’s job—it’s a business priority. That’s why leading banks, insurance firms, NBFCs, and fintech companies trust Empuls to build a culture of recognition, feedback, and connection.

Here’s how Empuls elevates employee engagement in the financial services industry:

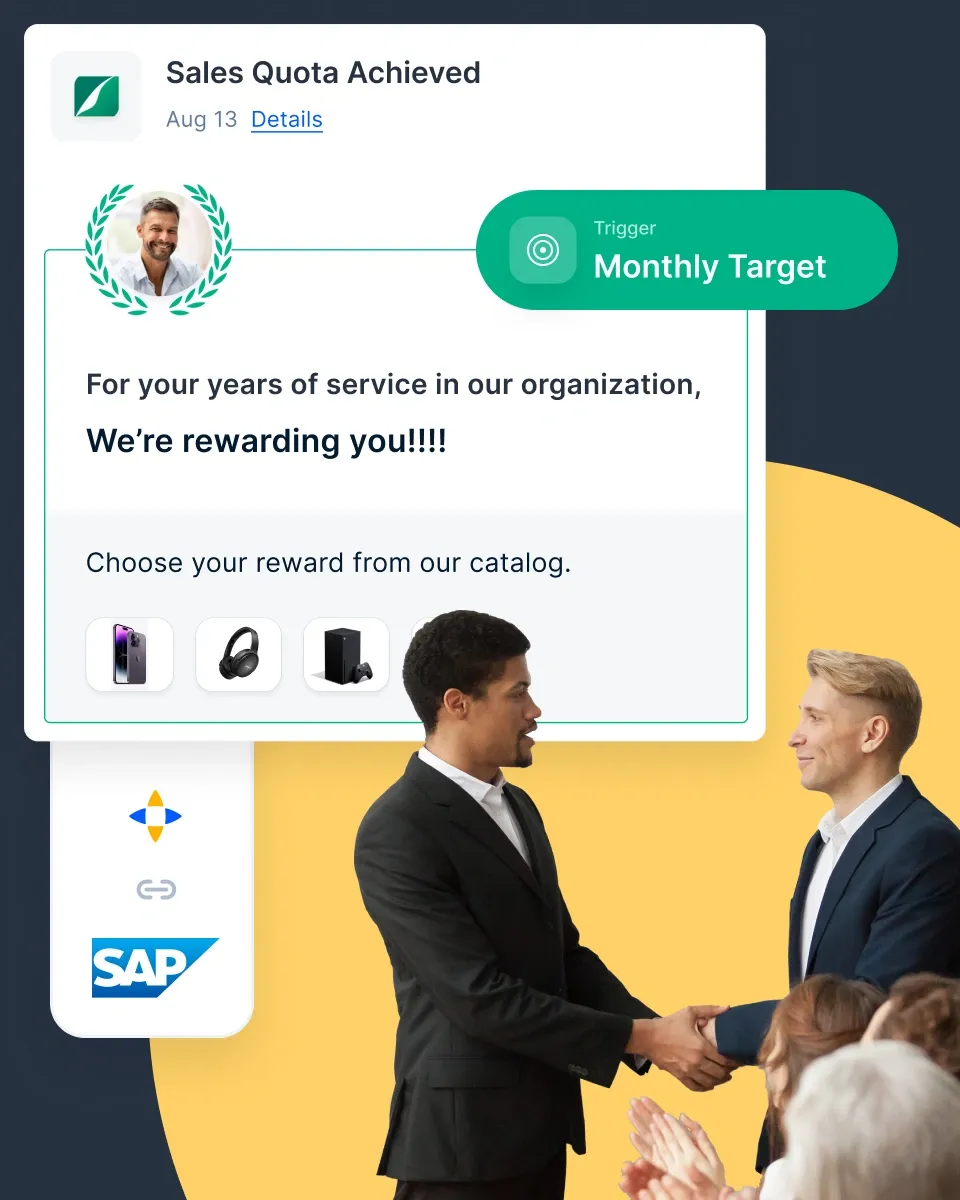

Recognize sales targets, compliance wins, and customer satisfaction milestones

Financial teams thrive on precision and performance. Empuls lets you set up tailored recognition programs to celebrate advisors hitting revenue goals, analysts flagging compliance risks, or service teams receiving customer praise.

Streamline communication across branch networks and HQs

With teams spread across branches, cities, or even continents, keeping everyone aligned is tough. Empuls offers a centralized, social intranet-style communication hub to keep frontline bankers, underwriters, and operations staff in sync.

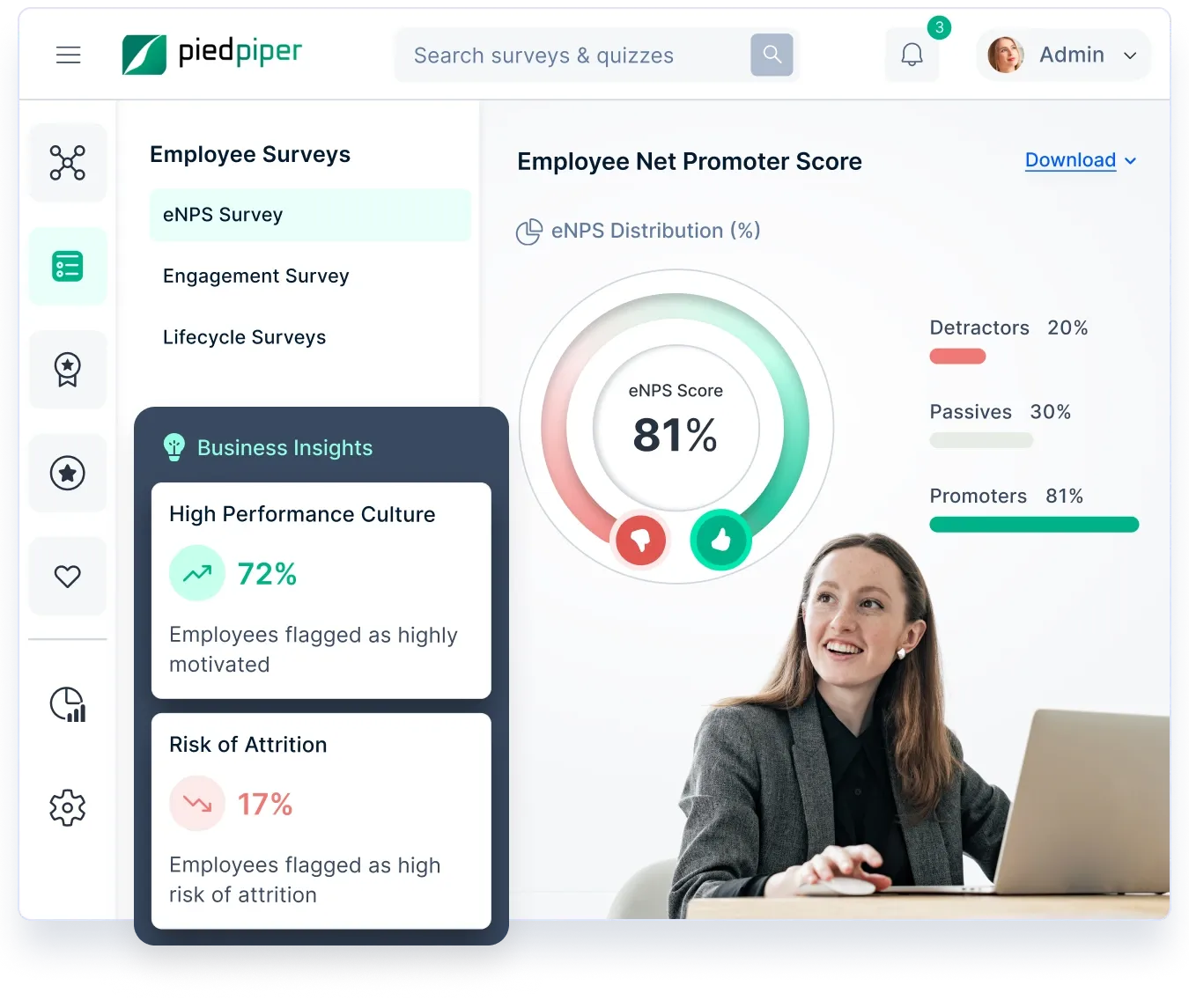

Capture real-time feedback on leadership, tools, and policies

Use Empuls to run anonymous pulse surveys and eNPS tailored for BFSI roles—such as how relationship managers perceive CRM tools or how loan processing teams feel about workload. Turn insights into action, fast.

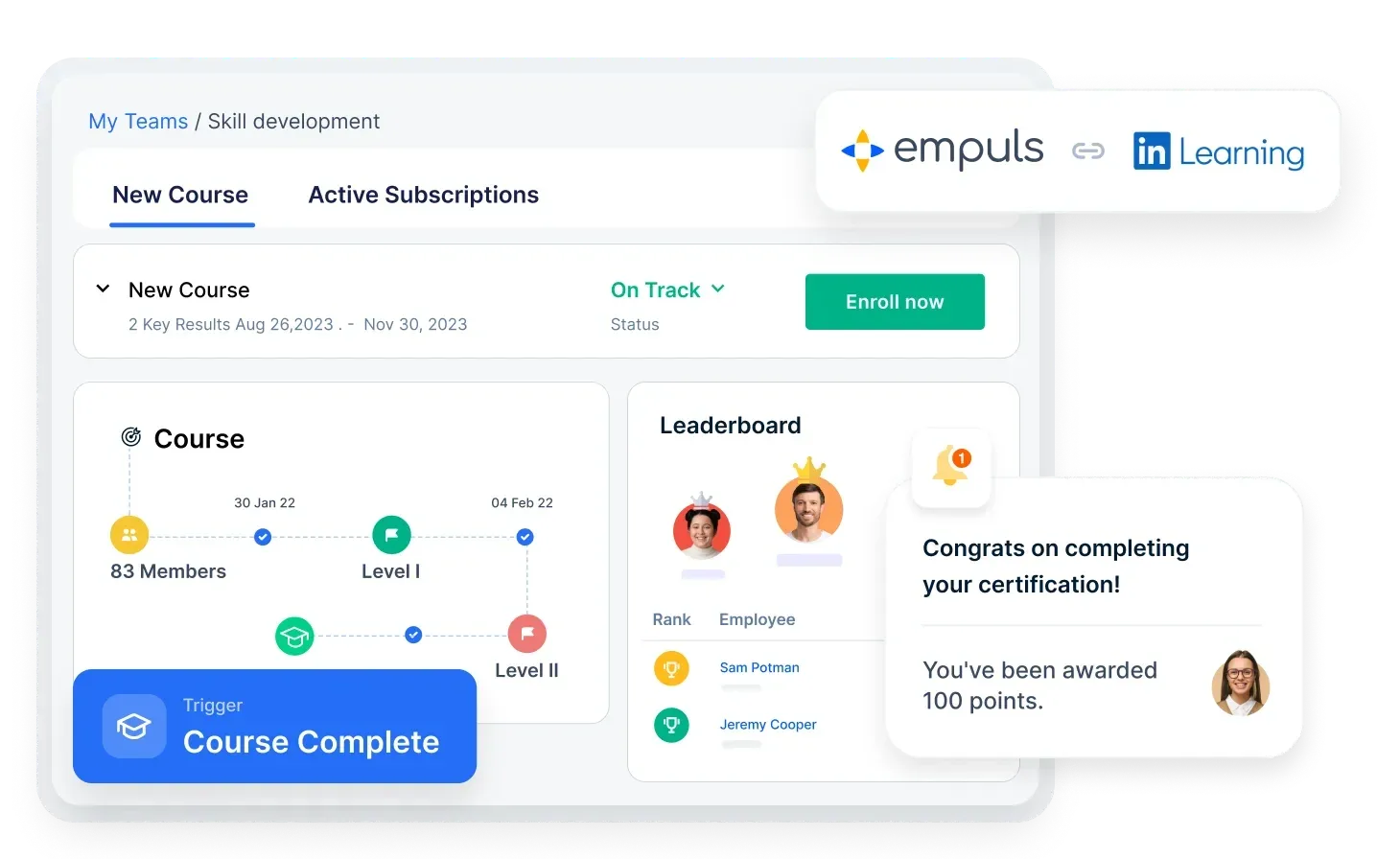

Automate celebrations for career milestones and certifications

Financial services employees earn certifications and licenses regularly. Empuls lets you automate rewards for key moments—like CFA completion, IRDAI exams, or internal job promotions—making them feel seen and valued.

Integrate easily with core HR and payroll systems used in BFSI

Whether you use SAP SuccessFactors, Darwinbox, Oracle HCM, or home-grown HRMS tools, Empuls connects seamlessly, ensuring smooth data flow across finance-compliant platforms.

See Empuls in Action

Case in point: A leading private sector bank in India used Empuls to launch a company-wide peer recognition program across 350+ branches. Within 3 months, the initiative saw a 62% rise in participation, and a 15-point jump in their internal eNPS score—proving how recognition can directly impact satisfaction and retention in a high-pressure financial environment.

Empuls makes it simple, scalable, and measurable.

👉 Explore Empuls for Financial Services

Conclusion

In the financial services industry, where trust, accuracy, and customer relationships are paramount, employee engagement is pivotal in achieving success.

By implementing these strategies and fostering a culture of engagement, financial institutions can retain top talent and enhance customer satisfaction, productivity, and compliance, ultimately contributing to their long-term growth and competitiveness.

Prioritizing employee engagement is not just a choice but a strategic necessity for the financial services industry.