How to Support Employee Financial Well-being at Work in 2025

Financial stress reduces engagement and performance. Learn how to develop impactful financial wellness policies that support employee financial well-being at work and build a more resilient workforce.

On this page

- What is financial well-being at work?

- Why is financial well-being important in the workplace?

- Employee financial wellness: Problems your employees are facing right now

- Types of benefits that promote employee financial well-being

- How can you develop an effective employee financial wellbeing policy at work?

- How can employee financial wellness benefits be managed effectively?

- Empuls: Empowering employee financial wellbeing at work

- FAQs

Financial distress—one of the key symptoms of poor financial well-being—can directly impact employee performance and mental health. As CIPD’s report Financial Well-being: An Evidence Review highlights, supporting employee financial well-being is no longer optional; it’s a business necessity.

As companies recover from the pandemic, the challenges around hiring and retention have only intensified. In an unstable economic and political environment, a growing number of workers face in-work poverty—and in many cases, standard wages are no longer enough.

This rise in financial stress doesn’t just affect employees personally—it reduces motivation, productivity, and loyalty. Prioritizing financial well-being in the workplace is one of the most strategic ways to build a resilient, engaged workforce that can thrive in today’s uncertain market.

What is financial well-being at work?

Financial well-being at work refers to being secure and in control of your finances, both in the present and future. The peace of mind comes with knowing you can meet your living costs and deal with unexpected emergencies, and it's the freedom of choice when you're no longer pinching pennies.

But it goes beyond the employee's financial position; it's also about the employer's mindset towards their employees and their attention towards the things that matter most to them. As income providers, employers are critical in supporting their workers' financial well-being.

💡Among employers with health and well-being strategies, only 11% actively focus on financial well-being. (Source: CIPD)

Most companies follow a carrot-and-stick policy, offering only short-term solutions to their employee's economic problems instead of helping them create and build long-term assets. This explains why

Emerging from the economic devastation wrought by the pandemic, the new generation workforce's focus is financial security. Especially considering that 66% of millennials don't have a retirement plan.

With the rising household debt, many employees are turning to their employers for long-term financial wellness support and comprehensive benefits programs. If they fail to find it, they quit and move on to greener pastures or give in to the lure of the gig economy.

Why is financial well-being important in the workplace?

Financial well-being is the most significant driver of retention and employee engagement. It also attracts the right talent which ensures the company's survival during disruptions and accelerates its growth.

Employers must collaborate with their workforce to understand their needs, identify support areas, and formulate solutions that benefit their employees while aligning with the company's revenue generation goals.

Employees need to feel financially secure and appreciated, and companies prioritizing financial wellness get higher returns on their human investments.

Employee financial wellness: Problems your employees are facing right now

Before structuring a financial benefits program, it is first essential to understand the anatomy of the financial issues of an average employee, as given in the PWC Employee financial wellness survey conducted in 2019.

This survey studied 1,686 full-time employed adults with representation from Gen Z, Millennial, Gen X, and Baby Boomer generations.

1. Cash flow and debt challenges

The inability to save sufficiently is one of the top problems employees face and is associated with insufficient cash flows and mismanaged debts. The PWC 2019 employee financial wellness survey finds that meeting even small, unexpected expenses becomes challenging for 62% of Millenials.

The survey further uncovers that compensations tend not to keep up with the surging cost of living and that covering even everyday expenses is a struggle. Accumulated debts are another critical issue, owing to credit card penalties and student loans.

2. Inefficient retirement plans

Employees end up saving less and thus are more likely to raid retirement plans before retirement. 80% of US workers expect to work even after retirement because they project themselves being financially insufficient shortly.

Traditional retirement planning programs fail to address these newer expense trends and do not address factors that could cause employee stress.

3. Lack of financial planning

Lack of sufficient financial awareness training and support makes employees myopic of their future finances. For instance, only 43% of the Baby Boomers who are due to retire in the next five years have estimated how much they would spend during retirement. The inability to look into future expenses contributes heavily to the financial stress that impacts work productivity.

4. The burgeoning sandwiched generation

Family spending has increased because many employees have dependent children and parents. Nearly half of the employees with adult children surveyed in the PwC study provide financial support. To address this problem, employers should plan benefits around the employees' family spending.

5. Student loans

The student loan predicament is here to stay. Almost 50% of millennials have at least one student loan. Even 10% of Baby Boomers still have a student loan. 80% of the millennials claim that these loans take the rest of their financial plans off-track.

A few employers like Staples and PricewaterhouseCoopers have taken up student loan repayments to reduce this debt burden on their employees.

Types of benefits that promote employee financial well-being

Since the relationship between the employee's financial health and the company's overall well-being is reciprocal,

Some companies have cracked the code to their employee's financial well-being by taking a total rewards approach toward long-term wealth creation. They provide extrinsic motivation in the form of

1. Legally mandated financial wellness benefits

These are a standard set of government-mandated benefits companies offer to help their employees make, save, or better manage their money. These benefits are provided over and above the standard wages and at the company's discretion.

- Supplemental pay – This offering shows the workforce that the company is committed to charting a path to their employees' financial well-being. Supplemental income includes stock options, 401 (k) plans, bonuses, etc. Additionally, companies can offer 401(a) or 401(k) plans to help employees save for retirement. These plans differ in funding structure, investment options, and eligibility requirements.

- Retirement plans – Employer-funded retirement plans can match the employees' contributions up to a certain amount, creating an asset for retirement. Since they are tax-exempted, they also lower the employee's average tax bill by reducing the taxable income.

- Legal assistance – Employee-sponsored legal assistance can offer legal support or access to lawyers and attorneys to help with family law, community laws, fraud, Medicare, tax assistance, identity theft, unemployment benefits, or transactions with legal implications.

- Healthcare coverage – Health is wealth. Employers must offer comprehensive healthcare coverage for employees and sometimes immediate family members (spouse and kids) to deal with any medical emergency. While the insurance premium is discretionary, plans include regular check-ups and eye and dental coverage. Some employers also offer short or long-term disability insurance for those affected and unable to work.

- Workplace life insurance – Some employers offer their workers limited-term life insurance at reduced costs, also called a group plan. Others go beyond by providing disability insurance for when an employee becomes disabled and cannot work. The coverage for the former is long-term, while the latter can be either short or long-term.

- Additional paid time-off – Some employers go the extra mile to ensure their employees can avoid burnout and work stress. They provide extra paid leaves to allow employees to take vacations or rejuvenate and recharge.

2. Financial incentives

While they vary across employers, from a privilege to a monetary reward, financial incentives drive motivation, engagement, and good performance, improving productivity and morale across the organization.

- Sales and partner incentives – Vastly different from annual performance bonuses, on-the-spot, target-based sales commissions, or partner incentives monetarily reward an employee who has contributed significantly to the company's revenue or sales targets.

- Referral cash incentives – Employees are encouraged to earn cash or cashback through referral signups. Every time a newly referred candidate comes on board, the referrer receives some financial benefit in cash or vouchers.

- Gamification – Some employers enthuse their employees or attract new talent using points, badges, challenges, and leaderboards to measure and celebrate good performance. Employees can exchange these for cash or financial rewards through gift cards, vouchers, coupons, discounts, cashback, etc.

- Profit-sharing – Some employers give their workforce a share in the company's profits as a retirement benefit to show their appreciation for employees. The share percentage differs across organizations but usually ranges from 2.5% to 7.5%.

- Celebratory incentives – Some employers offer cash or gift cards on anniversaries, birthdays, marriages, childbirth, etc., as a thoughtful gesture to celebrate and recognize their employees.

- Financial education and planning – Financially educated employees are in better control of their finances and, by extension, less stressed and more productive. So, employers must empower their workforce with the right budgeting tools, strategies, and resources to make confident financial decisions.

3. Financial perks

While they vary across employers ranging from a privilege to a monetary reward, financial incentives drive motivation, engagement, and good performance, improving productivity and morale across the organization.

- Employee allowances – Employers who offer lifestyle stipends, travel, and relocation allowances to cover initial travel, rent, food, insurance, moving costs, etc., win their employees' hearts.

- Child-care and tuition assistance – Employees that sponsor childcare programs through onsite day-care or corporate tie-ups and/or provide tuition assistance ensure a good work-life balance and reduced absenteeism in a stable workforce.

- Education stipend – Some employers boost their employee's growth and development by providing financial support for learning initiatives, higher education, job training, or certifications.

- Student loan or college fund assistance – Although rare, some truly caring employers motivate their employees by offering financial assistance with pre-existing student loans or college funds for themselves or their kids.

4. Supplementary benefits

Aside from the standard benefits, perks, and incentives, some employers enhance the employer-employee relationship and encourage loyalty by offering additional fringe benefits.

- Emergency savings fund – When bills don't align with the traditional paycheck cycle, on-demand, short-term solutions like instant credit or a salary advance called 'earned wage access' can act like a financial cushion for unexpected expenses. Employees can avail of instant, short-term credit or early salary advances for sudden car repairs, marriage or divorce, house repairs, accidents, medical emergencies, unplanned travel, paying bills during extended sick leaves, etc.

- Home buying or rental assistance – Most employees worry about buying or renting a house in an ever-exorbitant housing market. Since long-distance commute impacts overall productivity and presenteeism rates, employers can address it by offering housing support as a part of their benefits packages.

- Cashbacks or cash cards – Near-cash benefits like cashback, meal coupons, travel cards and fuel vouchers are perfect for employers to stand out in the market. These fringe benefits act as an added support to the employee's financial security goals and create a motivated, engaged workforce to drive business success.

- Exclusive employee discounts/vouchers – Some organizations motivate and enthuse their best talent by offering supplementary financial benefits such as exclusive employee discounts for shopping, paid lifestyle experiences, and health club memberships. While these are 'good-to-have' benefits, they are also great crowd pullers, helping an organization to attract and retain good talent.

How can you develop an effective employee financial wellbeing policy at work?

A robust financial wellbeing policy is no longer a luxury—it’s a necessity for forward-thinking organizations that value employee happiness, retention, and productivity. Crafting a policy that genuinely makes a difference involves strategic planning, cross-functional collaboration, and a people-first mindset. Here’s how you can build one:

1. Assess employee needs first

Begin with employee listening tools like surveys, one-on-ones, and feedback forms to uncover financial stressors. Look for insights on:

- Common debt burdens (e.g., loans, credit cards)

- Emergency fund status

- Retirement preparedness

- Financial literacy levels Tailor your policy around these insights to ensure it's relevant and impactful.

2. Define clear objectives

Be explicit about what your financial wellbeing policy aims to achieve. Common goals include:

- Reducing employee financial stress

- Enhancing financial literacy

- Improving retention and productivity

- Supporting life-stage needs (e.g., child education, elder care)

Setting KPIs such as participation rates, savings utilization, or improvement in eNPS can help track effectiveness.

3. Offer a mix of short-term and long-term benefits

A balanced policy supports both immediate financial needs and long-term financial resilience. This might include:

- Short-term: Salary advances, emergency funds, discount programs, on-demand pay

- Long-term: Retirement planning support, insurance coverage, investment advisory sessions

4. Promote financial literacy

Education is at the core of any financial wellbeing strategy. Offer access to:

- Workshops/webinars on budgeting, saving, and investing

- One-on-one financial coaching

- Partner resources from fintech or financial institutions

Make these resources ongoing and easily accessible—via an employee app, intranet, or HR portal.

5. Personalize with flexible benefits

Every employee has unique financial priorities. Empower them with Lifestyle Spending Accounts (LSAs) and flexible fringe benefits that can be tailored to:

- Wellness

- Upskilling

- Commute/travel

- Family care

Platforms like Empuls make this easy by enabling HR teams to customize benefits while maintaining budgetary control.

6. Communicate transparently and frequently

A good policy fails without awareness and adoption. Ensure:

- Regular updates and nudges through email, intranet, and team meetings

- Manager enablement so leaders can advocate for usage

- Success stories shared internally to reinforce the policy’s impact

7. Measure, refine, repeat

Monitor employee participation, feedback, and satisfaction regularly. Use data analytics to:

- Identify underutilized benefits

- Improve communication strategies

- Adjust offerings to meet evolving needs

Use tools like Empuls People Analytics to gain real-time insights and drive data-backed decisions.

How can employee financial wellness benefits be managed effectively?

Doubtless, prioritizing financial well-being leads to better EVP, higher engagement, and retention. Financial wellness programs have gained a greater significance across industries as employers realize their role in alleviating their employee's monetary stress. But to effectively manage their benefits, employees must first understand the extent of their financial wellness benefits entitlement:

- What comprises financial wellness benefits, and what are its limits?

- Will the employer offer upfront payment support, or will it be reimbursed?

- What is the eligibility to avail of such benefits?

- What are the tax implications of these benefits?

- What is the procedure when an employee quits?

Once the employer clarifies the extent of its financial wellness support, it should leverage the power of digital technology to quickly launch, manage, and centralize financial well-being benefits across the organization. This offers a degree of transparency by helping every employee easily access and track their financial health.

Empuls: Empowering employee financial wellbeing at work

In today's work environment, financial stress can significantly impact employee productivity, engagement, and mental health. Recognizing this, Empuls by Xoxoday offers a comprehensive suite of tools designed to nurture employee financial wellbeing—going far beyond conventional benefits.

1. Salary advance and earned wage access

Empuls helps organizations support employees during financial crunches through early access to earned wages. This feature empowers employees to manage unexpected expenses without relying on high-interest loans or credit.

The digital disbursement process is quick and secure, ensuring instant cash flow when needed—at no cost or liability to the employer.

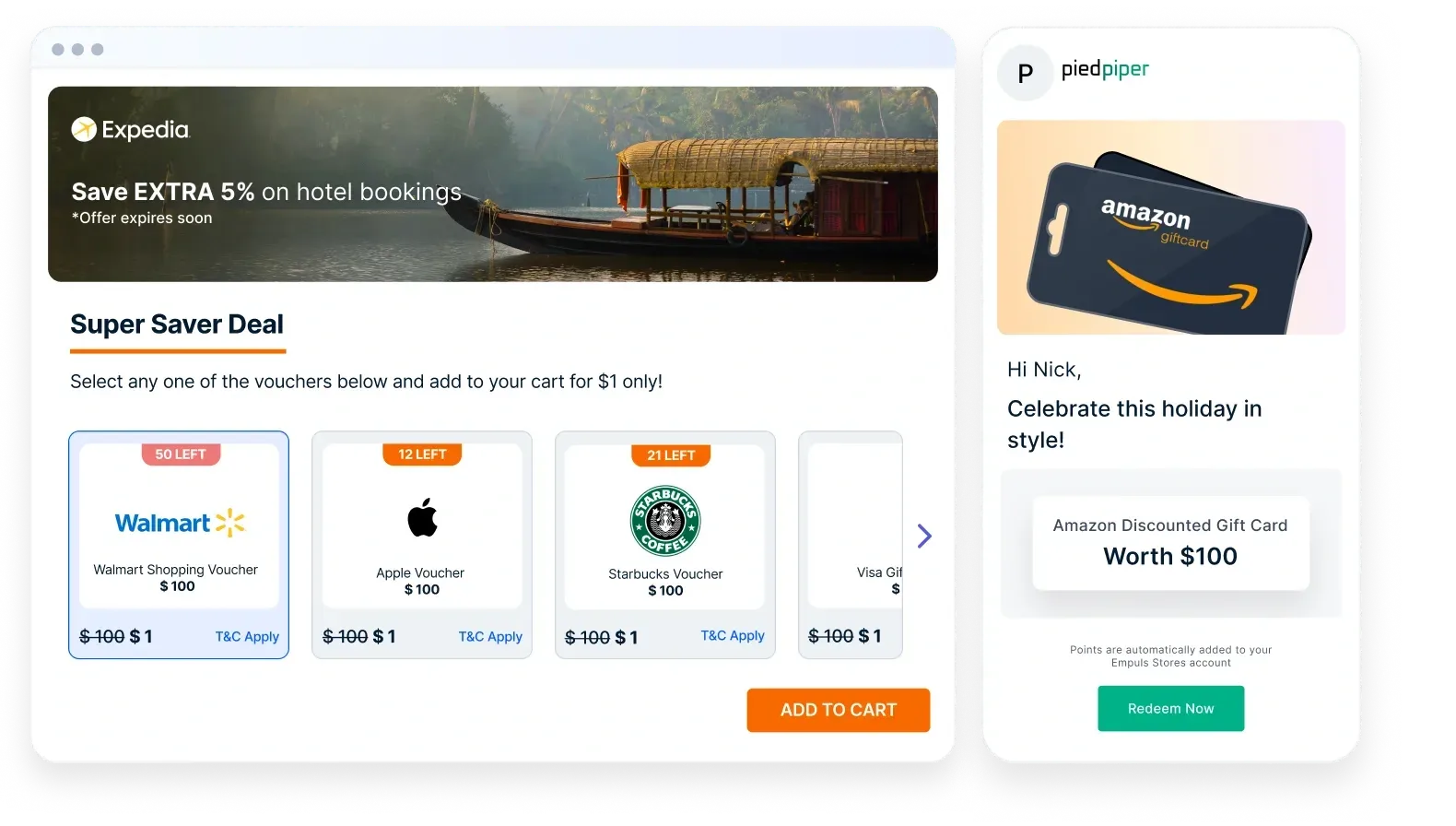

2. Exclusive perks, discounts & cashback

To help stretch employee paychecks, Empuls provides access to over 1 million offers from 6000+ global and local brands, spanning categories like groceries, travel, dining, electronics, and more.

These stackable savings, including discounts, deals, and cashback, can equate to an effective 7-8% salary raise—significantly boosting disposable income across 50+ countries.

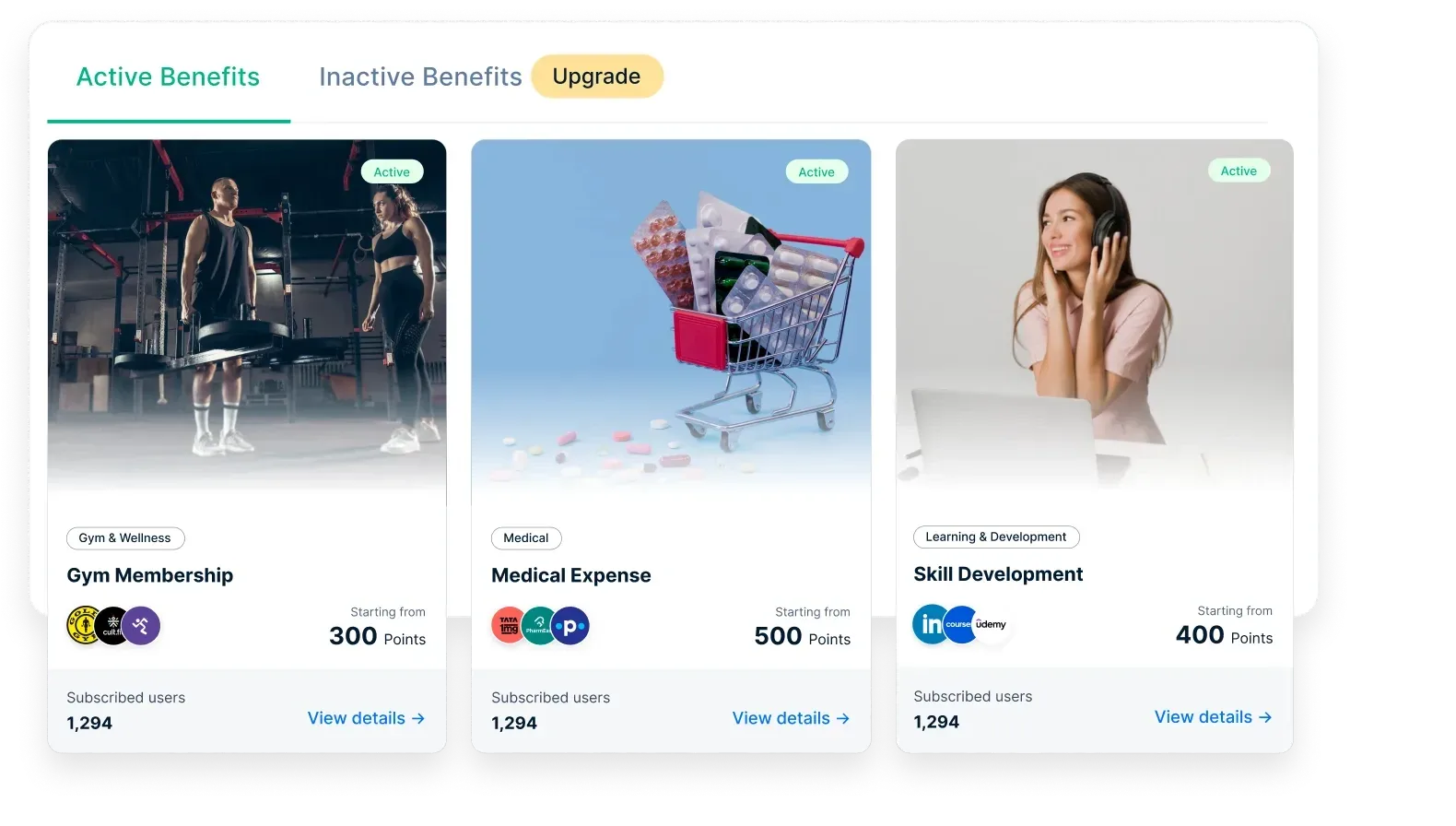

3. Flexible fringe benefits via lifestyle spending accounts

Empuls gives organizations the ability to offer customizable fringe benefits tailored to individual employee preferences. This includes allowances for:

- Fitness & wellness

- Remote work setup

- Upskilling

- Travel & commute

- Family care and more

These perks are managed through Lifestyle Spending Accounts (LSAs), which give employees the autonomy to choose benefits that align with their unique lifestyle needs, promoting both financial and emotional wellbeing.

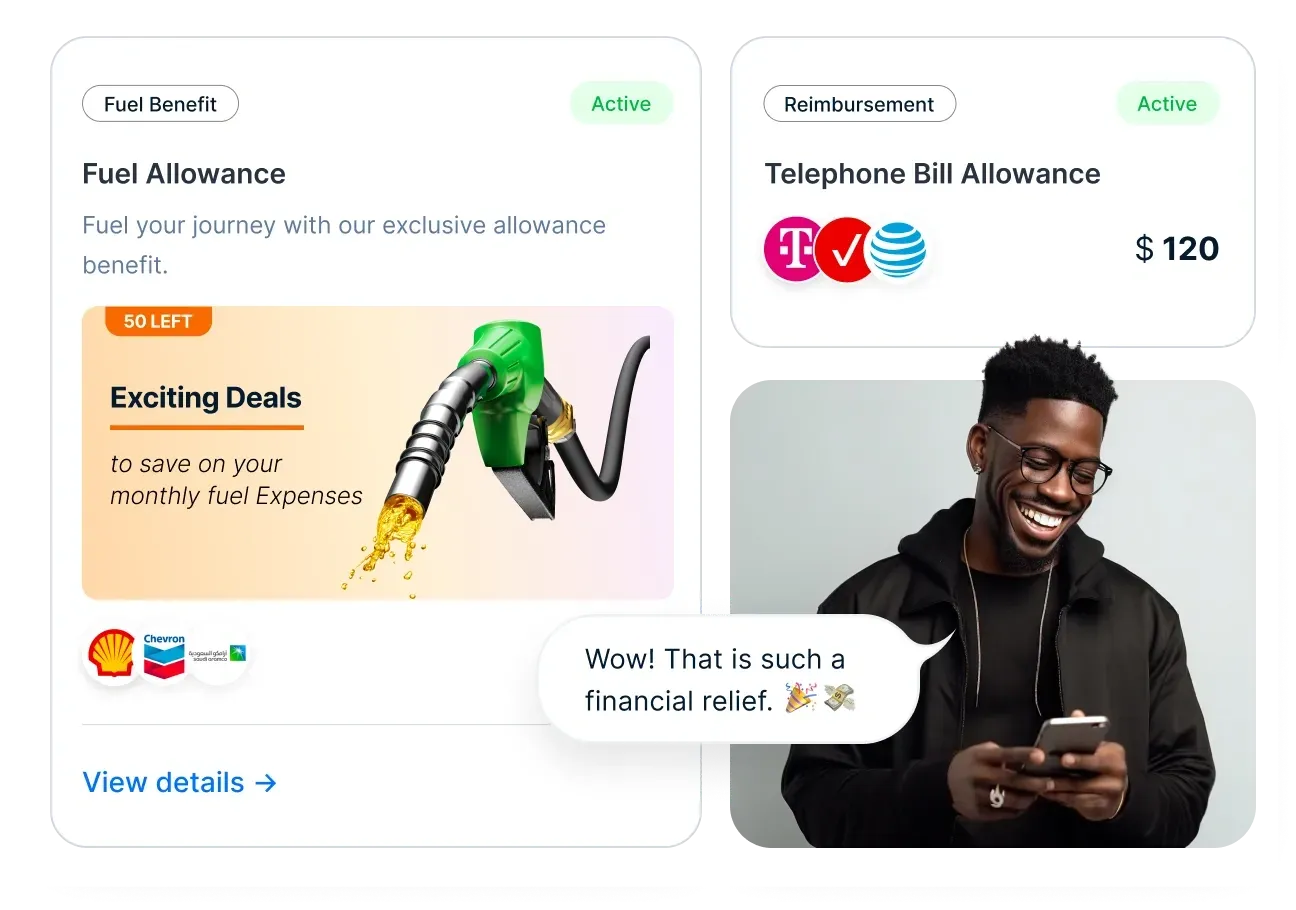

4. Tax-saving benefits

Empuls simplifies tax-compliant disbursal of common allowances such as:

- Meal and fuel cards

- Telecom reimbursements

- Books & periodicals These help employees reduce their taxable income while enjoying meaningful everyday benefits—all managed seamlessly through a multi-wallet card system.

5. A platform for all stakeholders

Empuls offers a user-friendly platform where HR leaders can configure and manage benefit programs with ease. Managers can encourage their teams to utilize these offerings for better work-life balance, and employees can track savings and redemptions via mobile apps and intuitive dashboards.

With its AI-driven automation and customizable benefits framework, Empuls transforms financial wellbeing from a “nice-to-have” into a strategic priority. By enabling employees to save more, manage cash flows better, and enjoy tax-efficient perks, it creates a happier, less stressed, and more productive workforce.

FAQs

1. How do we promote financial well-being in the workplace?

You can promote financial well-being in the workplace by leveraging the power of digital technology to quickly launch, manage, and centralize a custom financial benefits program.

2. How can employers evaluate the financial well-being of their staff?

Employers can evaluate the financial well-being of their staff by conducting regular surveys and financial counseling sessions to understand their employees’ needs and overall workforce sentiment towards their financial wellness offerings.

3. What are some examples of financial wellness programs?

Some examples of financial programs include:

- Providing financial coaching and educational material

- Offering access to emergency savings funds through payroll advances and instant credit

- Designing a comprehensive retirement benefits package

- Offering financial incentives and perks like exclusive discounts, rewards, allowances, education assistance, and more

4. How does poor financial well-being affect the workplace?

A poor financial well-being program in the workplace leads to economic stress that affects mental well-being and burnout for the employee ,ultimately resulting in low morale, disengagement, and attrition.