Employee Retirement Benefits and Rewards Planning for Maximum Impact

Discover how to create meaningful employee retirement benefits and rewards that celebrate service, support financial wellness, and enhance long-term engagement. Learn from best practices and real company examples.

On this page

- What are employee retirement benefits and rewards?

- Types of employee retirement plans

- Types of employee retirement rewards

- Types of employee retirement benefits

- Thoughtful employee retirement benefits and reward ideas that leave a lasting impact

- How to structure employee benefit and retirement planning

- Employee benefit and retirement planning examples to learn from

- The importance of retirement benefits and rewards for employees to drive engagement

- Conclusion

Retirement isn’t just the close of a professional chapter—it’s a defining milestone that deserves recognition, planning, and care. For employees, it marks the transition to a new phase of life.

For employers, it’s a powerful moment to show appreciation and reinforce the values of loyalty, trust, and long-term support. This is where well-structured employee retirement benefits and rewards truly shine—not just as financial safeguards, but as meaningful tools that celebrate a lifetime of service.

In today’s workforce, where expectations around well-being and future security are rising, employee benefit and retirement planning has become more than a standard HR practice. It’s a cornerstone of engagement, retention, and employer branding.

In this blog, we’ll dive deep into the importance of retirement rewards, explore the types of benefits organizations can offer, and look at how leading companies are crafting thoughtful, lasting experiences for their retiring employees.

What are employee retirement benefits and rewards?

Retirement benefits and rewards are a combination of financial support, recognition, and ongoing engagement initiatives provided by organizations to employees as they conclude their professional journey. These benefits go beyond the final paycheck—they reflect the organization’s gratitude for years of service, dedication, and contributions.

At their core, retirement benefits are designed to ensure a smooth and dignified transition into post-employment life. They acknowledge not just the employee’s output, but their role in shaping the organization’s culture, success, and legacy.

If used as an organizational tool, retirement benefits and rewards have the following advantages:

- Employee engagement since retirement benefits can keep an employee engaged.

- Perfectly structured retirement benefits can be used as a strong recruitment and retention tool to make employees stay with the employer.

- Improve the employees' retirement preparedness by making them financially literate.

- Harbor a sense of trust between employees and employers.

- A thoughtfully crafted retirement plan can positively impact employee morale.

- Increase the productivity of employees nearing retirement.

- A handsomely distributed retirement plan increases job satisfaction.

Let's quantify the significance of retirement rewards.

- According to Pew Research, 79% of the working professionals have shared that they understand the basic structure of the retirement plan and have limited knowledge about their specifics. However, 71% of those working professionals under 40 do not know what happens to their benefits once they change jobs or leave before retirement.

- SHRM Employee Benefits Survey has revealed that 55% of employees believe that retirement benefits are one of the most valued benefits employers can offer.

- In fact, it also revealed that 82% of working professionals selected retirement and savings as an important benefit.

- The same study also revealed that 94% of the employers in the U.S. mostly provided traditional 401(k), while 68% also offered Roth 401(k) plans.

- According to Forbes, companies that provide well-structured and comprehensive retirement plans are seen as 76% more attractive by employees who prioritize financial well-being.

- A PwC study has reported that financial worries severely or majorly have impacted the productivity of up to 73% of employees.

The statistics highlighted the importance of retirement benefits and rewards for employee retention, and engagement. Psychologically, financial security can give an employee the sense of stability that one looks for after retirement.

So, it goes without saying that retirement incentives, benefits, and rewards can create an impact on employees' productivity. So, let's cover the types of employee retirement rewards and benefits you can avail to be stress-free upon retirement.

Types of employee retirement plans

Retirement plans are placed in an organization to provide financial wellness to an employee. One reason behind this is the 'great resignation'. While fair remuneration is one of the attractive reasons for employees to choose over a company, one cannot go over the fact that not having a good retirement plan in place prompted many to serve in their resignation.

A Zippia study has shown that 62% of employees consider the availability of a retirement plan while switching to another job.

Recognizing the fact that the majority of the employees are opting for a safety net backed by financial security, the government introduced The Secure Act 2.0. Also known as the 401(k) bill, this makes it mandatory for businesses with 10 or more employees to offer a retirement solution to their employees.

With such solutions put in place to assure safety, let us go through the types of retirement plans you need to be aware of to avail of the one that suits your requirements the most.

- Defined benefit plans

This retirement benefit plan is calculated based on multiple factors, including salary and service. The plans are protected by federal insurance provided through the Pension Benefit Guaranty Corporation or PBGC.

- Defined contribution plans

Such types of retirement plans do not promise a specific number of benefits at retirement. However, the contributions are invested on the employee's behalf on their account. The value of the account may vary based on the investment gains or losses. Some examples of defined contribution plans include 403(b) plans, 401(k) plans, employee stock ownership plans, and profit-sharing plans.

With many acts, and programs in place, literacy about an employer's retirement plan is a must. In fact, 25% of employees, revealed the PwC Employee Wellness Survey, have shared that financial wellness benefits are the most desirable perk offered by employers. Moreover, these benefits should include access to educational training programs.

- The Employee Retirement Income Security Act (ERISA) governs retirement plans, including defined benefits and defined contribution plans.

- ERISA ensures that the promised benefits and rewards are adequately funded. Moreover, it states that the retirement fund needs to be kept apart from the employer's business assets. The fund can be held in trust or invested in an insurance contract for safety.

- The PBGC ensures traditional pension plans to ensure that some benefits are paid even if employers go bankrupt.

- COBRA or The Consolidated Omnibus Budget Reconciliation Act lets employees continue their health coverage under certain circumstances. This is specifically applicable if an employer files for bankruptcy under Chapter 11.

Types of employee retirement rewards

There are several ways employers can help their employees prepare for a secure retirement, beyond just offering a basic savings plan. Here's a breakdown of some common types of employee retirement rewards:

- Matching contributions: This is where your employer contributes additional money to your retirement savings account, often based on a percentage of your own contributions. It's essentially free money to boost your retirement nest egg.

- Profit-sharing programs: In some companies, a portion of the company's profits are shared with employees, often deposited into their retirement accounts. This ties your retirement savings directly to the company's success.

- Vesting schedules for company stock options: If your employer offers stock options as part of your compensation, there's usually a vesting period. This means you have to work for a certain amount of time before you officially own the stock. A clear vesting schedule helps you understand when these options become part of your retirement portfolio.

- Retirement wellness programs: These programs offer educational resources and guidance to help employees make informed decisions about their retirement savings. They can cover topics like investment strategies, budgeting for retirement, and estimating future needs.

- Recognition programs tied to retirement savings goals: Some companies acknowledge and celebrate employees who reach specific milestones in their retirement savings journey. This can be a great way to publicly reinforce the importance of saving for the future.

Types of employee retirement benefits

Here are 3 common types of employee retirement benefits offered by organizations to support employees in their post-retirement life:

1. Defined benefit plans (pension plans)

Also known as traditional pension plans, these provide employees with a guaranteed monthly income after retirement. The benefit amount is typically calculated based on a formula that considers factors like years of service and final salary. The employer is responsible for funding and managing the plan.

Example: Government pension plans or legacy corporate pensions.

2. Defined contribution plans

In these plans, the employer, employee, or both make regular contributions to the employee’s retirement account. The final benefit depends on the investment performance of these contributions. A popular example is the 401(k) plan in the U.S. or Provident Fund (PF) in countries like India.

Example: 401(k), 403(b), or Employee Provident Fund (EPF).

3. Employee stock ownership plans (ESOPs)

ESOPs are retirement plans that invest primarily in the employer’s stock. Employees gain ownership in the company and receive shares over time, which can be sold or cashed out upon retirement or exit, providing financial support post-employment.

Example: Offered by startups and large corporations to reward long-term service.

Thoughtful employee retirement benefits and reward ideas that leave a lasting impact

Retirement is more than just the end of a career—it’s the beginning of a new chapter. By offering meaningful retirement benefits, organizations can show lasting appreciation for years of dedication and service.

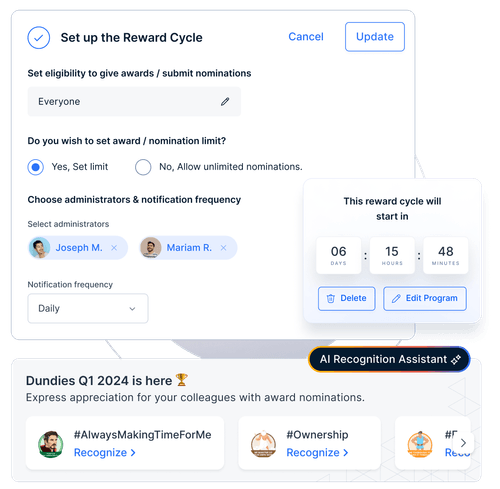

From personalized farewells to ongoing perks and support, these gestures help employees transition with dignity, pride, and a deep sense of belonging. With platforms like Empuls, you can automate, personalize, and elevate every step of the retirement experience.

1. Retirement gift and recognition ceremony

One of the most meaningful ways to honor a retiring employee is through a personalized recognition event. Whether it’s a small team gathering or a full company-wide virtual celebration, this moment should reflect the individual’s unique contributions.

With Empuls, companies can create a memorable send-off by:

- Publishing a retirement announcement on the social feed

- Collecting heartfelt messages, photos, and videos from colleagues using a digital wishboard

- Automating the delivery of a personalized retirement gift from the global rewards catalog, such as curated hampers, gift cards, or experience vouchers

- Including a branded certificate of appreciation, adding an official and personal touch

This not only celebrates the retiree but reinforces a culture of gratitude across the organization.

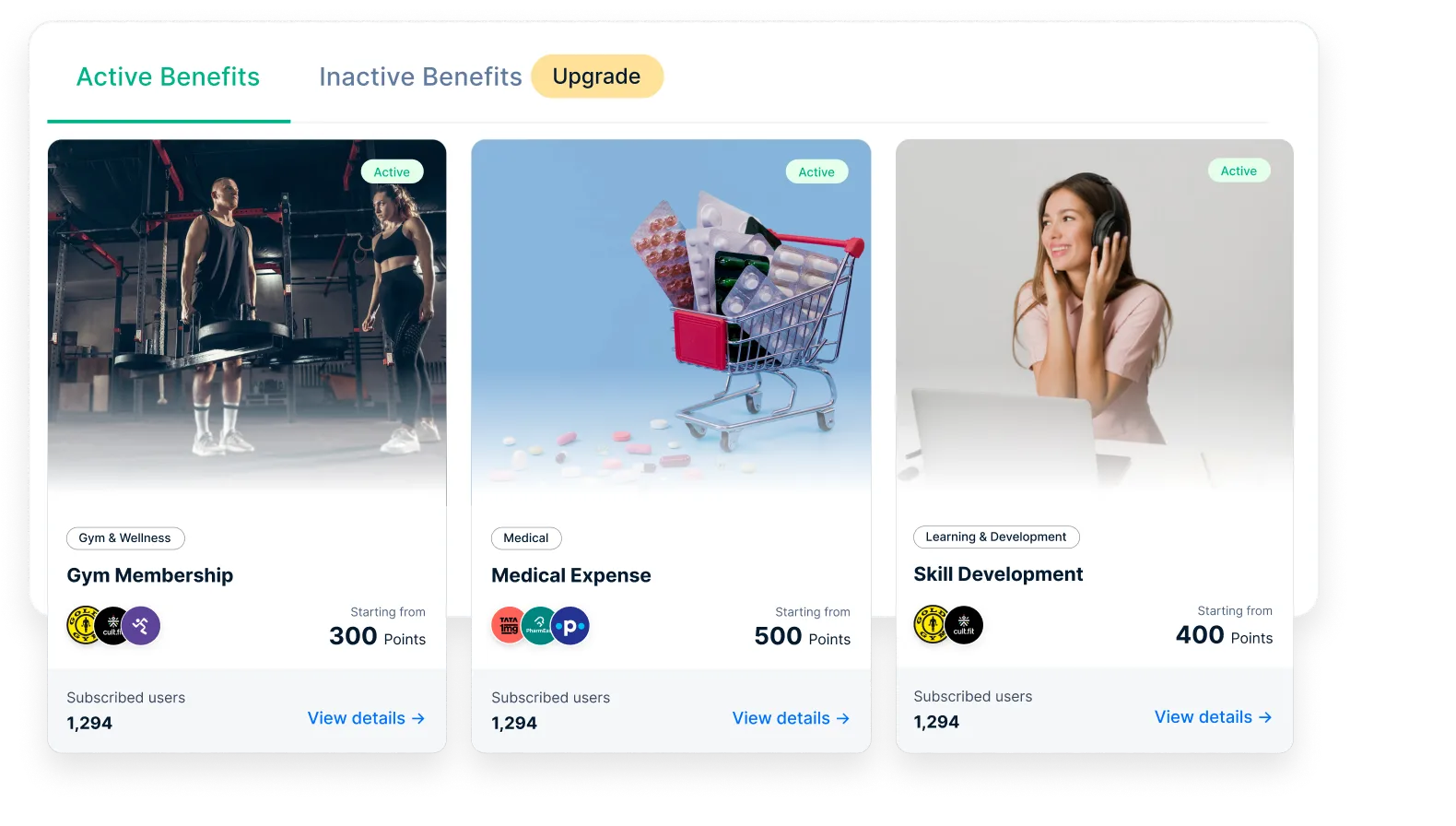

2. Post-retirement health benefits

Healthcare is one of the most valuable post-retirement needs. Offering continued access to health insurance, wellness programs, or discounted medical services for a limited time after retirement can greatly ease the transition for employees.

Companies can partner with providers or leverage platforms like Empuls to give retirees access to:

- Wellness perks and discounts on health checkups, fitness programs, or mental health services

- Fringe benefits through Lifestyle Spending Accounts (LSAs), which can be customized to cover medical needs even post-employment

- Exclusive offers on pharmacies, therapy apps, or home-care services through the Empuls Perks Store

This benefit shows long-term care for employees beyond their working years.

3. Lump-sum gratuity or pension plans

Financial security is key during retirement. Many organizations offer a lump-sum gratuity payout, structured pension plans, or retirement fund contributions as part of their offboarding benefits. These benefits acknowledge the employee’s loyalty and provide a strong financial foundation for their next chapter.

Empuls can support this process by:

- Automating the milestone reward trigger based on years of service

- Offering retirees the ability to choose their farewell gift or financial reward via the platform

- Generating insights on program costs and reward redemption with full transparency for HR and finance teams

This structured approach combines appreciation with financial prudence.

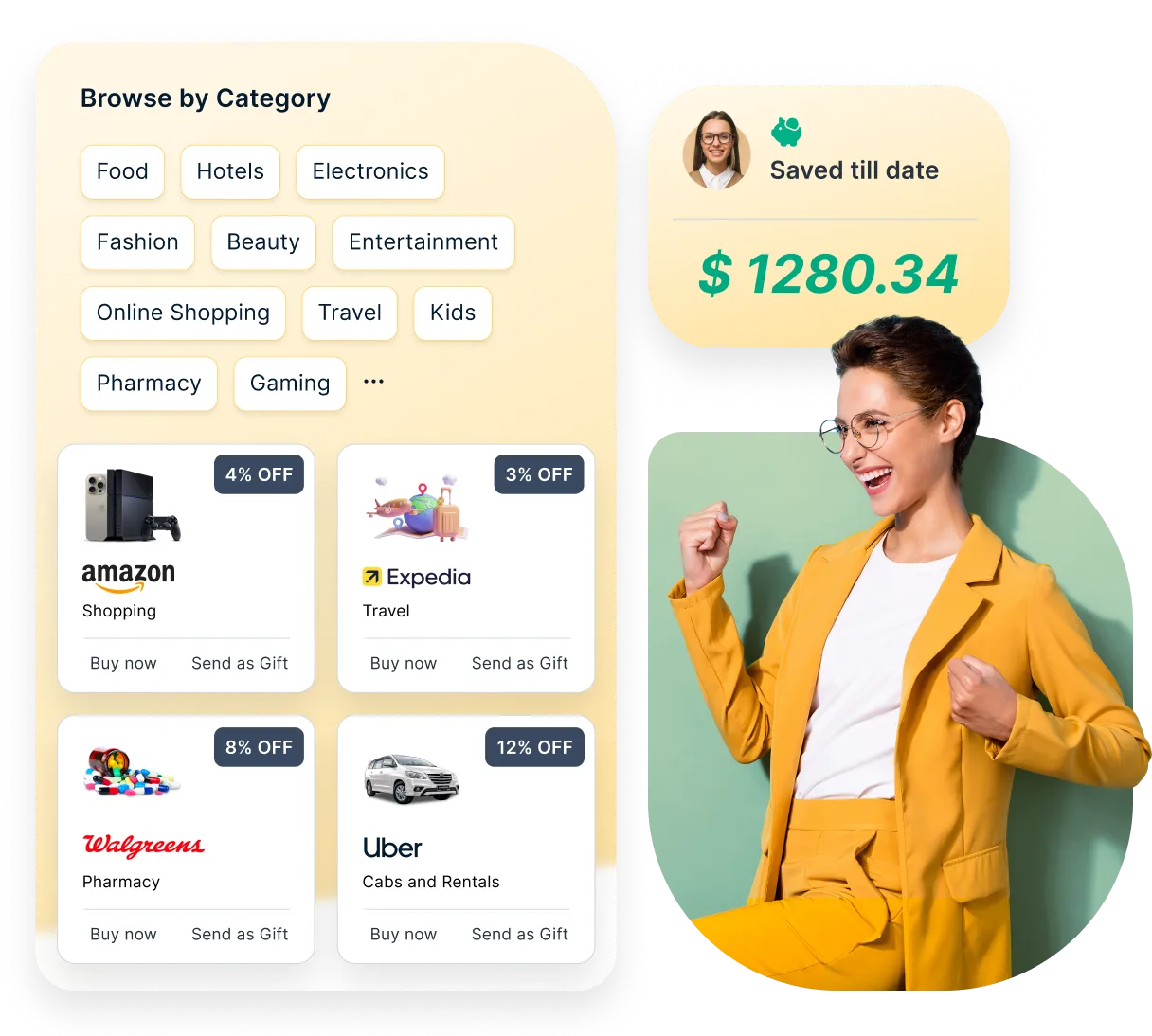

4. Access to perks and discounts

Retirement doesn’t mean losing connection with the company or its benefits. Extend access to corporate perks and discount programs for a defined period post-retirement. This helps retirees save on daily expenses and feel included.

With Empuls, organizations can:

- Grant retiree access to the Perks Store, offering 1M+ discounts, cashback, and gift cards from over 6,000 brands

- Share exclusive lifestyle offers like travel, leisure, wellness, and insurance

- Customize access with time-bound login credentials or alumni tiers

This is an affordable yet impactful way to continue supporting former employees.

5. Alumni network or consulting opportunities

Retired employees often have invaluable institutional knowledge and leadership experience. Setting up an alumni network gives them the opportunity to stay connected and contribute in meaningful ways—whether through mentoring, knowledge-sharing, or project-based consulting.

Empuls makes this easy with:

- Community groups where retirees can interact with current employees

- Event invites and newsletters shared via the Empuls intranet

- A dedicated consulting rewards system where alumni can be recognized for ongoing contributions

This not only boosts engagement but fosters a lasting relationship between the organization and its former team members.

6. Legacy storytelling and knowledge sharing sessions

Retiring employees carry with them years of wisdom, cultural knowledge, and best practices that can be incredibly valuable to the next generation. Hosting a "legacy session" or knowledge-sharing workshop before their exit helps preserve this know-how while recognizing their contribution as a mentor.

With Empuls, you can:

- Organize and promote these sessions using the social intranet or community groups

- Create a tribute post where colleagues can comment on how the retiree impacted their journey

- Archive their session as a video or resource within an internal knowledge base

Why it matters: This honors the retiree’s impact and creates a knowledge bridge that benefits the organization long after they’ve left.

7. Digital memory book or video tribute

A personalized digital memory book or farewell video is a heartwarming way to capture stories, achievements, and peer messages. Instead of a simple email farewell, a curated memory keepsake can become a lifelong reminder of their time with the company.

Empuls makes it easy to:

- Collect text, images, GIFs, and video messages via Wishboards

- Export the tribute as a digital keepsake

- Share it across teams or company-wide through the social feed

Why it matters: It transforms a standard farewell into a deeply meaningful experience, reinforcing a culture that values human connection.

8. Customized retirement planning resources

Retirement is a big life shift. Supporting employees with retirement planning resources—like financial advisory sessions, health prep, or mental wellness guidance—demonstrates that your care extends beyond their tenure.

Using Empuls, HR can:

- Share relevant content via the employee intranet or community group for upcoming retirees

- Offer perks or LSA allowances to cover financial planning or upskilling services

- Create pulse surveys to understand retirees’ concerns and tailor support accordingly

Why it matters: This proactive approach prepares employees for life after work and shows that you’re invested in their overall well-being—not just their output.

How to structure employee benefit and retirement planning

A well-designed employee benefit and retirement plan isn’t just about offering perks—it’s a strategic tool to drive engagement, build trust, and support long-term employee wellbeing.

When structured thoughtfully, it can strengthen retention, boost morale, and reinforce your employer brand. Here's how to approach it for lasting impact:

1. Understand employee needs and financial goals

Start by listening to your employees. Consider their age groups, life stages, and financial priorities. While younger employees might value flexibility and saving options, older employees often seek stability and comprehensive retirement coverage. Gathering input through surveys or feedback sessions can help shape a benefits plan that truly resonates.

2. Offer a balanced mix of core and flexible benefits

A strong plan should include essential benefits like health insurance, retirement savings, and life cover, along with optional benefits such as ESOPs, lifestyle perks, or mental wellness support. Offering a customizable structure empowers employees to choose what suits them best, increasing satisfaction and perceived value.

3. Integrate financial wellness into your benefits strategy

Benefits are more impactful when employees understand them. Offer financial literacy programs, access to retirement planning tools, or even one-on-one consultations with advisors. Helping employees plan their financial future builds trust and increases engagement with your benefits program.

4. Make the process easy and transparent

Complex systems can discourage participation. Use a digital platform like Empuls to simplify enrollment, automate reminders, and provide clear information about contributions, vesting periods, and retirement options. A seamless experience makes benefits more accessible and appreciated.

5. Encourage long-term savings through contribution matching

If feasible, offer employer matching for retirement contributions, such as 401(k) or provident fund plans. This not only incentivizes savings but also demonstrates your commitment to employee wellbeing beyond their time at the company.

6. Regularly review and evolve your benefits program

Needs change over time. Periodically review your offerings to ensure they remain competitive, compliant, and aligned with both market trends and employee expectations. Gather ongoing feedback and use data to make informed adjustments.

7. Communicate the value of benefits clearly and often

Even the best benefits can go unused if employees aren’t aware of them. Use internal newsletters, onboarding presentations, and team sessions to explain how each benefit supports their long-term goals. Personalized communication makes a big difference.

Employee benefit and retirement planning examples to learn from

Let’s dissect the employee benefit and retirement plans of two Fortune 500 companies to understand their approach toward securing their employees’ financial well-being.

1. Allstate allocates $103 million for Allstate pension plan

Allstate, a leading American insurance corporation, was founded in 1931 in Illinois and committed to providing comprehensive insurance coverage and financial planning tools to its customers.

So, a company with a proven track record of ensuring its customers' financial security can be expected to extend the same commitment to its employees. This Fortune 500 company is one of the only 21 companies that offers a pension plan to its employees. Let us analyze how that fared for Allstate.

Allstate retirement rewards and benefits overview

Allstate offers a retirement rewards and benefits package to assist its employees in planning for a secure financial future. To do so, they offer:

- 401(k) Savings Plan: Allstate matches 4% of employee contributions to an employee's contribution of at least 6% of their compensation. The vesting period is two years, and full vesting is achieved after three years.

- Cash balance pension plan: Employees can enrol in this plan after their first year of service. They become fully vested after three years.

- Allstate retirement plan: This plan is for regular full-time employees, regular part-time employees, and certain employee agents of participating employers. The benefits and rewards for this plan depend on the employee's level of compensation and length of service. Moreover, the plan was placed to provide a total retirement income. What they do is combine this benefit with other sources of retirement income, such as the Allstate 401(k) Savings Plan, Social Security, personal savings, and other assets to provide 360-degree financial security post-retirement.

- Early retirement benefit: Another instalment in their myriads of well-structured retirement programs is the early retirement plan. Allstate employers are eligible for an early retirement benefit if they are 55 years old or over with at least 20 years of continuous service. They qualify for this plan if they are age 60 or over. However, they must elect their payment start date.

These lengthy yet carefully aligned retirement benefits are designed to help employees plan for their financial future and achieve a comfortable retirement.

How did they fare?

In addition to providing a thorough pension plan, Allstate offers a finance coach, and resources 24/7 to get their employees up to date regarding their financial well-being, so far, Allstate has:

- Contributed $23 million and $24 million to the retirement plans in 2020 and 2019, respectively.

- Allowed their participants to contribute $14 million and $15 million in 2020 and 2019, respectively.

- Contributed to the Allstate Plan specifically was $103 million, $93 million, and $89 million in 2020, 2019, and 2018, respectively.

Lastly, the future benefit payments expected to be paid in the next 5 years include 726 million, 27 million in 2024, 694 million, 26 million in 2025, and 2,320 million, 98 million within 2026-2030, as retirement benefits and post-retirement costs respectively. Allstate has 53,400 employees all over the world, and has kept them engaged through their comprehensive, yet phenomenally structured benefits, including their retirement plans.

2. Exxon Mobil places savings plans with a contribution of 7%

Exxon Mobil, founded in 1999, is a leading American gas and oil corporation. This Fortune 500 company is one of the leading organizations with a diverse portfolio of energy and petrochemical products. As of 2023, Exxon Mobil has 61,500 employees, with 62% of the employees reporting that they are happy to go back to work.

Exxon has managed to keep the engagement level high by presenting its employees with exciting rewards, benefits, and a 'pay-per-performance' philosophy. ExxonMobil offers competitive compensation and benefits packages to attract and retain top talent for the long term. Their belief is to offer handsome benefits throughout their career and into retirement.

Exxon Mobil retirement rewards and benefits

With a clear intention to be fair and objective, their compensation system is built on the idea that pay should reflect performance, thus 'pay-per-performance'. This approach helps ensure fairness and consistency within our company.

In addition to compensation, Exxon Mobil offers a variety of benefits and programs to support employees after they retire. These programs, which include savings and pension plans, help Exxon employees and their families achieve financial security. Their plan includes:

- ExxonMobil savings plan: Employees can elect to defer 20% of their salary into a retirement savings account on a pre-tax or Roth basis. Exxon contributes an additional 7% of the employee's salary to this plan, which becomes accessible after three years of service. The maximum annual employee contribution is aligned with the Internal Revenue Service (IRS) limit, currently $23,000, with an increased limit of $30,500 for employees aged 50 or over.

- ExxonMobil pension plan: This plan offers a monthly retirement benefit for employees at no cost. Employees become vested in the pension plan after five years of service. To be eligible for retirement benefits, employees must be at least 55 years old and have at least 15 years of service. The benefit amount is calculated based on a formula considering years of service, average salary, and Social Security benefits. This is applicable up to a maximum salary of $275,000 in 2024.

- Supplemental pension plan (SPP) and Additional payments plan (APP): These plans provide additional retirement benefits for employees earning above the IRS compensation limit, which is $275,000 in 2024 and based on years of service and final incentive compensation, respectively.

How did they fare?

According to their 2023 FY report, Exxon Mobil has successfully:

- A non-service pension and postretirement benefit expense of $0.7 million. This expense is not directly related to the cost of providing employee services.

- Allocated $217 million as the total cost associated with non-service pension and postretirement benefits under GAAP.

- Addressed the future payments for postretirement benefits of $10,494 million.

The importance of retirement benefits and rewards for employees to drive engagement

Retirement rewards and benefits are an organizational tool that can improve retention rate and improve engagement. Let's take the two Fortune 500 companies, Exxon, and Allstate as examples. From these companies, we have learned to:

- Place comprehensive retirement benefit plans, even if no one else is doing it. Allstate pension plan is something that has only been adopted by 21 companies.

- Have structured and detailed retirement benefits and rewards in place. Allstate and Exxon, both companies laid out a detailed retirement plan to improve the financial well-being of their employees, throughout their career, and after their retirement.

- Design strong retirement programs to showcase the company's commitment to its employees' future. The Allstate Pension Plan and Exxon savings plan are unique to the respective employees. However, both programs aim to deliver parity and security.

- Establish a positive work culture. Allstate has opened the option of taking early retirement if opted.

- Have an attractive retirement plan with major perks. Allstate matches 4% of employee contributions while Exxon matches 7% of the employees' contributions.

Conclusion

Retirement is more than a career milestone—it’s a defining moment of appreciation. Thoughtful employee retirement benefits and rewards not only recognize years of service but also reflect the values of the organization.

A well-crafted employee benefit and retirement planning strategy can drive trust, loyalty, and lasting engagement. From financial security to meaningful recognition, these programs shape how employees remember their journey—and how future talent views your culture.

With tools like Empuls, delivering impactful, personalized retirement experiences is easier than ever. It’s not just about saying goodbye—it’s about saying thank you, the right way.