Fuel Cards for Employees: Benefits, Tax Perks & How They Work

Explore the value of fuel cards for employees—how they work, why they matter, and the tax benefits they offer. Discover how Empuls helps companies roll out fuel cards as a seamless, compliant, and employee-friendly fringe benefit.

On this page

- What is a fuel card and how does it work?

- Why company fuel cards make sense—for both sides

- Benefits of fuel cards for employees

- How Empuls makes it easy to offer fuel cards as a tax-free fringe benefit

- Implementing a fuel card policy in your organization

- Fuel cards are a practical way to support your employees

With rising fuel prices and longer commute times, employees today spend more just to show up to work. This adds an extra layer of stress and logistical complexity for businesses, especially those with field staff, hybrid teams, or employees using personal vehicles for work.

That’s where employee fuel cards come in—not just as a perk, but as a practical benefit. They help companies streamline fuel reimbursements, cut down on administrative workload, and offer real, usable support to their workforce.

Modern platforms like Empuls simplify the process of offering fuel cards under tax-free fringe benefits, making it easy to roll them out, manage usage, and keep everything compliant. It’s a small benefit that can significantly impact how employees feel about their company.

What is a fuel card and how does it work?

A fuel card for employees—an employee gas card—is a prepaid or postpaid card provided by a company to cover fuel expenses. It’s a more innovative alternative to traditional reimbursement methods, giving employees instant access to fuel funds and reducing paperwork for HR and finance teams.

So, how do fuel cards work for employees? Employees receive a physical or digital card that can be used at partnered fuel stations. Depending on the setup, companies can load a fixed monthly amount or allow usage up to a specific limit. Some cards are integrated with fleet tracking tools, making them ideal for field staff and logistics teams.

And if you're wondering how a company fuel card works on the backend, it’s pretty simple. The company partners directly with a fuel card provider or uses a benefits platform like Empuls to manage allocations, track expenses, and comply with tax regulations. Everything is transparent, digital, and easy to monitor.

Fuel cards take the guesswork out of fuel reimbursements, ensuring employees are never left covering business-related travel from their own pockets.

Why company fuel cards make sense—for both sides

Fuel expenses are a constant for employees who commute or travel for work, and managing those expenses can be messy—from collecting receipts to reconciling reports. A company fuel card benefit removes that friction and replaces it with ease, visibility, and control.

It’s one of those rare benefits that both sides genuinely appreciate.

Here’s what employees gain:

- No more spending out-of-pocket and waiting for reimbursements

- Easy access to fuel funds—especially helpful for field staff or hybrid workers

- Tax-free savings when offered as part of a compliant fringe benefit program

- More freedom to focus on work without worrying about travel expenses

Here’s what employers gain:

- Fewer reimbursement claims to process and verify

- Greater control over how travel-related expenses are managed

- Visibility into fuel spending patterns across teams

- A cost-effective benefit that supports employee satisfaction and retention

When you offer fuel cards as a formal benefit, primarily through a structured platform like Empuls, you’re doing more than covering fuel—building trust, offering convenience, and showing your team that their daily efforts matter.

Benefits of fuel cards for employees

Fuel cards seem like a small benefit, but they make a noticeable difference for employees who commute daily or travel for work. A well-structured employee fuel card program helps reduce financial pressure and offers peace of mind, directly influencing engagement and productivity.

Here’s a closer look at what makes fuel cards for employees such a valuable perk:

1. Immediate access to fuel funds

Instead of dipping into their wallet and waiting for reimbursements, employees can use the fuel card at the pump—right when needed. It eliminates delays, paperwork, and awkward follow-ups for pending claims.

2. Reduced financial stress

Fuel costs can eat into an employee’s monthly budget, especially those who rely on personal vehicles for work-related travel. A fuel card provides that extra financial cushion, letting employees focus on their tasks—not the rising commute cost.

3. Tax savings under fringe benefit schemes

When structured correctly, a company fuel card benefit can qualify as a tax-free fringe benefit. That means employees enjoy the full value of the benefit without any added tax burden. Platforms like Empuls help manage this easily, ensuring compliance while increasing take-home value.

4. Ease of use and digital tracking

Modern fuel cards have mobile apps or dashboards that let employees view their balance, track transactions, and check fuel usage—anytime, anywhere. This transparency makes the benefit more user-friendly and trustworthy.

5. Better planning and budgeting

With a fixed fuel allowance each month, employees can plan and manage their commute confidently. It creates predictability and helps them avoid unplanned spending on transport.

A gas card for employees isn’t just a cost-saving tool—it’s a thoughtful benefit that shows the company understands everyday challenges and is willing to support its people where it counts.

How Empuls makes it easy to offer fuel cards as a tax-free fringe benefit

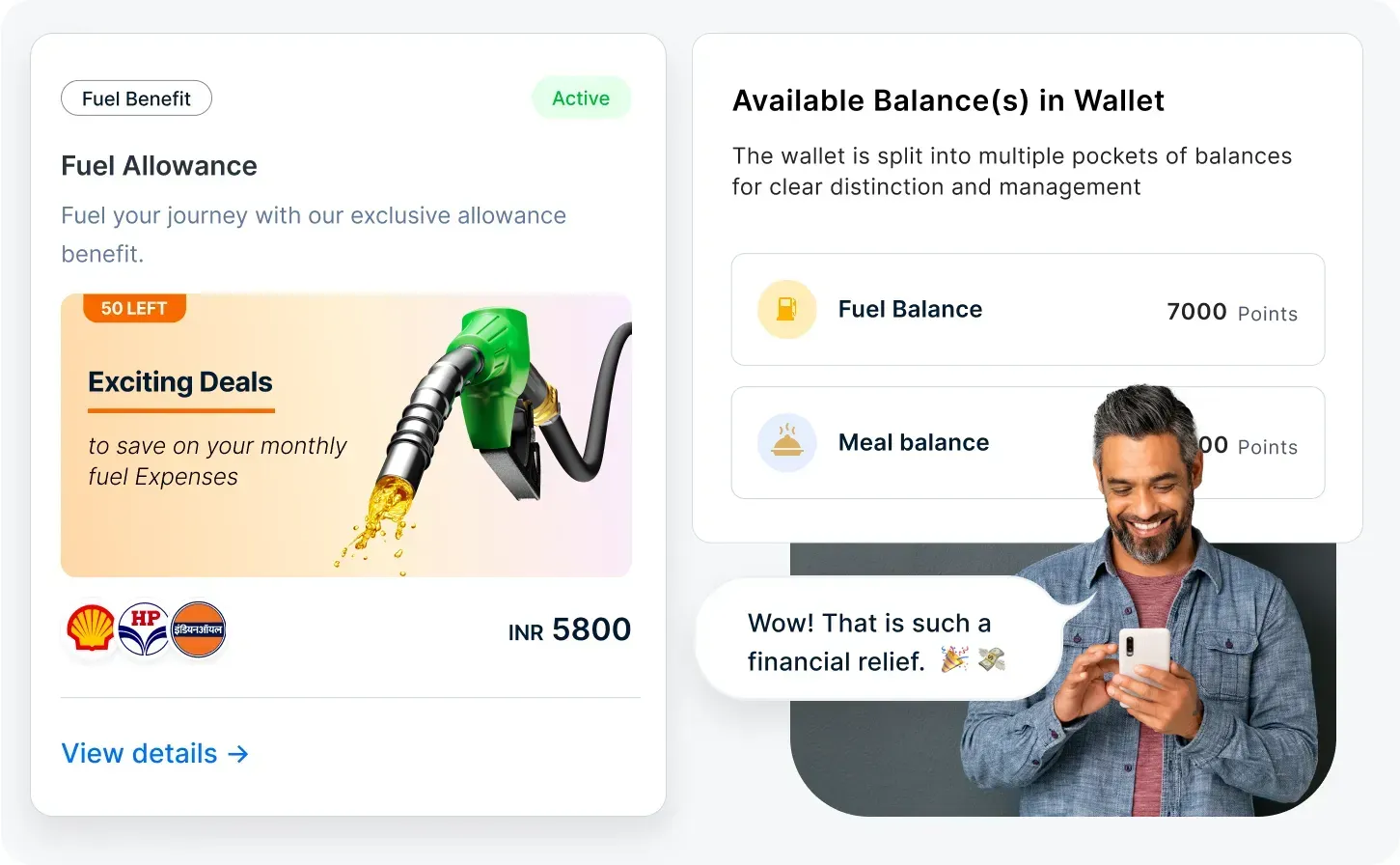

Offering a fuel card for employees might seem like a logistical challenge—but it doesn’t have to be. With platforms like Empuls, the entire process becomes streamlined, compliant, and easy to scale across your organization.

Empuls brings everything under one roof, allowing companies to offer fuel cards as part of a tax-free fringe benefits program. This helps employees reduce taxable income and ensures HR and finance teams stay compliant with statutory guidelines.

Let’s break it down.

Simple configuration and distribution

Empuls allows HR teams to define fuel card allowances by role, location, or department. Funds can be allocated monthly, quarterly, or based on travel frequency. Everything is managed digitally, so chasing receipts or approving manual claims is unnecessary.

Tax-compliant fringe benefit management

Fuel cards offered through Empuls are aligned with India's tax regulations, making them eligible as non-taxable perks. Employees get more value in their take-home salary, and companies avoid tax complications or audit risks.

Unified platform for all benefits

Empuls doesn’t just stop at fuel. It also offers other fringe benefits like meal cards, LTA, gadget allowances, and wellness reimbursements. Everything is managed through a single interface, saving time and reducing admin overhead.

Real-time tracking and reporting

Admins can view usage patterns, monitor allocated amounts, and generate reports at any time. This visibility helps control costs, improve budgeting, and ensure fair usage across the workforce.

Seamless employee experience

For employees, it’s a frictionless process. They receive a fuel card with clear usage limits, access to a dashboard for balance checks, and instant visibility into past transactions. No paperwork. No confusion. Just a practical benefit that works.

In short, Empuls turns what could be a complex fuel allowance program into a smart, self-service benefit that strengthens trust, improves financial wellness, and supports day-to-day operations—especially for teams on the move.

Implementing a fuel card policy in your organization

You don't want to roll out a fuel card for employees on the fly. It’s essential to build a clear framework that supports employees while maintaining control and compliance. Here’s how to put a firm fuel card policy in place:

1. Define who is eligible

Start by identifying which employees truly need this benefit. It could be sales executives, field technicians, delivery teams, or even those working in remote locations with long commutes. Consider their travel frequency and whether their role demands regular personal vehicle use. This helps you avoid blanket distribution and ensures the benefit reaches those who will use it.

2. Set spending limits and usage rules

A clear limit on monthly or quarterly usage keeps costs under control and sets expectations for employees. For example, you might offer ₹2,000/month for junior staff and ₹5,000/month for field leads. Define whether the card covers only fuel or if it also includes tolls or maintenance. Also, clarify if it’s meant for work-related travel only or includes commute-related fuel. Clear rules reduce confusion and the chances of misuse.

3. Choose a reliable provider or platform

Partner with a provider that offers broad fuel station coverage, easy tracking, and integration with your finance systems. Alternatively, use a platform like Empuls to manage fuel cards under a more extensive tax-free fringe benefits suite. Empuls handles everything—fund distribution, employee tracking, compliance, and reporting—so you don’t have to deal with multiple vendors or manual work.

4. Communicate the benefit clearly

Once the policy is in place, roll it out with detailed communication. Let employees know how much allowance they’ll receive, how they can use the fuel card, which stations it works at, how to check balances, and who to contact in case of issues. A good launch email, a short FAQ, and a help guide boost adoption and avoid repeated queries.

5. Monitor usage and gather feedback

Don’t set it and forget it. Use the data to monitor usage trends—who’s using the card consistently, who’s not, and where most of the allowance is spent. Watch for unusual patterns or repeated excess usage. At the same time, ask employees for feedback—are the limits fair, is the card accepted at most stations, are there any usability issues?

6. Review and improve

Business needs change. Commute patterns change. So should your fuel card policy. Plan to review it at least once or twice a year. You should adjust limits, expand coverage, or shift vendors based on usage data and employee feedback. A well-managed program shows employees that you listen and adapt to their real needs.

A strong fuel card policy balances structure with flexibility. It shows employees you care about the little things that affect their daily lives—while keeping processes efficient, fair, and scalable.

Fuel cards are a practical way to support your employees

Fuel cards might not sound like a big-ticket benefit, but for employees who commute, travel for work, or use their vehicles in the line of duty, it’s a game-changer. Offering a fuel card for employees removes financial friction, builds trust, and makes everyday work feel a little easier.

It’s also a smart move for businesses. You get better cost control, fewer reimbursement headaches, and a benefit that gets used and appreciated. The process becomes effortless when combined with a tax-free fringe benefits platform like Empuls—from configuration to compliance.

In a fast-paced work environment, the small, thoughtful benefits often leave the most significant impact. Fuel cards are one of them.

Explore Empuls and simplify how you manage fringe benefits like fuel cards, meal allowances, and more—all from a single platform.

Learn more →