Everything You Need to Know About the Cost of Living Bonus in the UK: An Updated Guide for Employers and Employees

Learn about the cost of living bonus in the UK, its importance for employee retention, and how businesses can structure bonuses to keep up with rising living costs.

On this page

- What is a cost of living bonus?

- Why does the cost of living bonus matter?

- Government perspective on cost of living support

- The cost of living challenges in the UK

- Why did inflation rise so much?

- Cost of living bonus ideas

- How is the cost of living bonus calculated?

- Companies paying cost of living bonus in the UK

- How to help employees with cost of living: 7 strategies for employers

- Using technology to personalize and scale bonuses

- Conclusion

- FAQs

In today's fast-paced world, where the cost of living seems to constantly be on the rise, many employees in the UK find themselves grappling with the challenge of making ends meet.

It's no secret that the United Kingdom is renowned for its dynamic job market, diverse culture, and picturesque landscapes. Yet, behind the allure of cityscapes and rolling hills, there's a pressing concern that affects both employers and employees alike: the ever-evolving cost of living.

This concern has given rise to a crucial conversation in the realm of compensation and benefits - the concept of cost of living bonus for employees. What exactly are these bonuses, and how do they play a pivotal role in the lives of UK employees?

In this blog you’ll learn about the intricacies of cost of living bonuses, understanding their significance, and uncovering the key factors that shape them.

We'll also equip you with the knowledge you need to make informed decisions about your workforce's financial well-being and explore the intricate relationship between employers, employees, and the cost of living in the UK.

But before getting started let's uncover the basics.

What is a cost of living bonus?

A cost of living bonus, often referred to as a COLA (Cost of Living Allowance) or a living wage supplement, is a financial incentive provided by employers to help their employees offset the rising costs associated with living in a specific location or region.

It is designed to bridge the gap between an employee's standard salary and the expenses required to maintain a certain quality of life in their geographical area.

The main objective of a COLA is to ensure that employees can maintain a comparable standard of living, regardless of whether they work in an expensive urban center like London or a more affordable rural area.

In a recent survey conducted by Randstad, it was discovered that nearly half, specifically 48%, of employees in the UK express a desire for their employers to offer a monthly cost of living bonus. The good news is that the research into market trends indicates a high level of willingness among employers to assist their workforce.

According to the latest job market outlook report from the CIPD (Chartered Institute of Personnel and Development), over a third, precisely 36%, of businesses are planning to increase salaries in order to tackle the challenges posed by the rising cost of living.

Additionally, Randstad's data also reveals that nearly two-fifths, or 37%, of UK employees have received additional support from their employers to help them navigate the economic circumstances. This support includes non-monetary measures aimed at alleviating financial pressures.

Why does the cost of living bonus matter?

Here is why giving the cost of living bonus matters for employers.

1. Geographic cost disparities

The United Kingdom is characterized by significant variations in the cost of living from one region to another.

For instance, housing, transportation, and general living expenses are considerably higher in London compared to other parts of the country. A cost of living bonus helps employees in high-cost areas manage their finances more comfortably.

2. Employee attraction and retention

Offering a COLA can make an employer more attractive to potential candidates, especially in competitive industries or locations with a high cost of living. It can also be a powerful tool for retaining current employees, as it demonstrates a commitment to their well-being.

3. Fairness and equity

By providing a COLA, employers promote fairness and equity in their compensation structures. Employees in expensive regions won't feel disadvantaged compared to their counterparts in more affordable areas.

4. Employee productivity and satisfaction

When employees are not constantly worried about making ends meet, they are more likely to be productive and satisfied in their roles. This can have a positive impact on overall workplace morale and performance.

Government perspective on cost of living support

In addition to employer-driven initiatives, the UK government has addressed the cost of living challenges through various policies and support measures. The House of Commons Library briefing CBP-9428 provides an in-depth analysis of the government's response to the cost of living crisis, including:

- Energy price guarantee: Measures to cap energy bills for households.

- Cost of living payments: Targeted financial support for low-income households.

- Universal credit adjustments: Changes to benefit rates to reflect inflation.

These government interventions complement employer-provided cost of living bonuses, collectively aiming to alleviate financial pressures on UK residents.

According to the UK Parliament's Commons Library Research Briefing (CBP-9428), average earnings in the UK, including bonuses, have shown a steady increase over recent years. In 2024, the average annual full-time earnings were approximately £36,611, with bonuses contributing a significant portion to this figure.

The Office for National Statistics (ONS) reported that in the three months to February 2025, average weekly earnings, including bonuses, rose by 5.6% compared to the same period the previous year. This growth reflects the ongoing adjustments employers are making to address the rising cost of living.

Furthermore, data indicates that the average bonus in the UK stands at around £2,242, representing a notable component of total compensation packages. This figure underscores the importance of bonuses in supporting employees' financial well-being amidst economic challenges.

These statistics highlight the critical role that cost of living bonuses play in maintaining employees' purchasing power and overall financial stability. Employers are increasingly recognizing the need to offer competitive compensation packages that include such bonuses to attract and retain talent.

The cost of living challenges in the UK

In September 2021, the United Kingdom faced several cost of living challenges that impacted its residents. These challenges included:

- Rising housing costs: The cost of housing, particularly in major cities like London, was a significant burden for many people. High rents and property prices made it difficult for individuals and families to find affordable housing.

- Inflation: Inflation can erode the purchasing power of people's incomes. Rising prices for goods and services, including food and energy, put pressure on household budgets.

- Wage stagnation: While some sectors experienced wage growth, many individuals faced stagnant wages that did not keep pace with the rising cost of living. This made it harder for people to make ends meet.

- Utility bills: Energy costs, including electricity and gas bills, were a concern. Fluctuations in energy prices could impact household budgets, especially during the winter months.

- Transportation costs: The cost of public transportation and fuel prices could strain the finances of commuters and car owners.

- Food prices: The price of groceries and food items could increase due to various factors, including supply chain disruptions and global market conditions.

- Healthcare expenses: While the UK has a publicly funded healthcare system (the NHS), some individuals still face out-of-pocket healthcare expenses, including prescription costs and dental fees.

- Education costs: University tuition fees and the cost of private education remained a financial challenge for many families.

- Social benefit changes: Changes in social benefit policies and eligibility criteria affected the financial support available to low-income individuals and families.

- Pension concerns: Some retirees faced challenges related to the adequacy of their pensions in covering their living expenses.

Suggested Read: How Can Employers Help Employees With the Cost of Living Crisis?

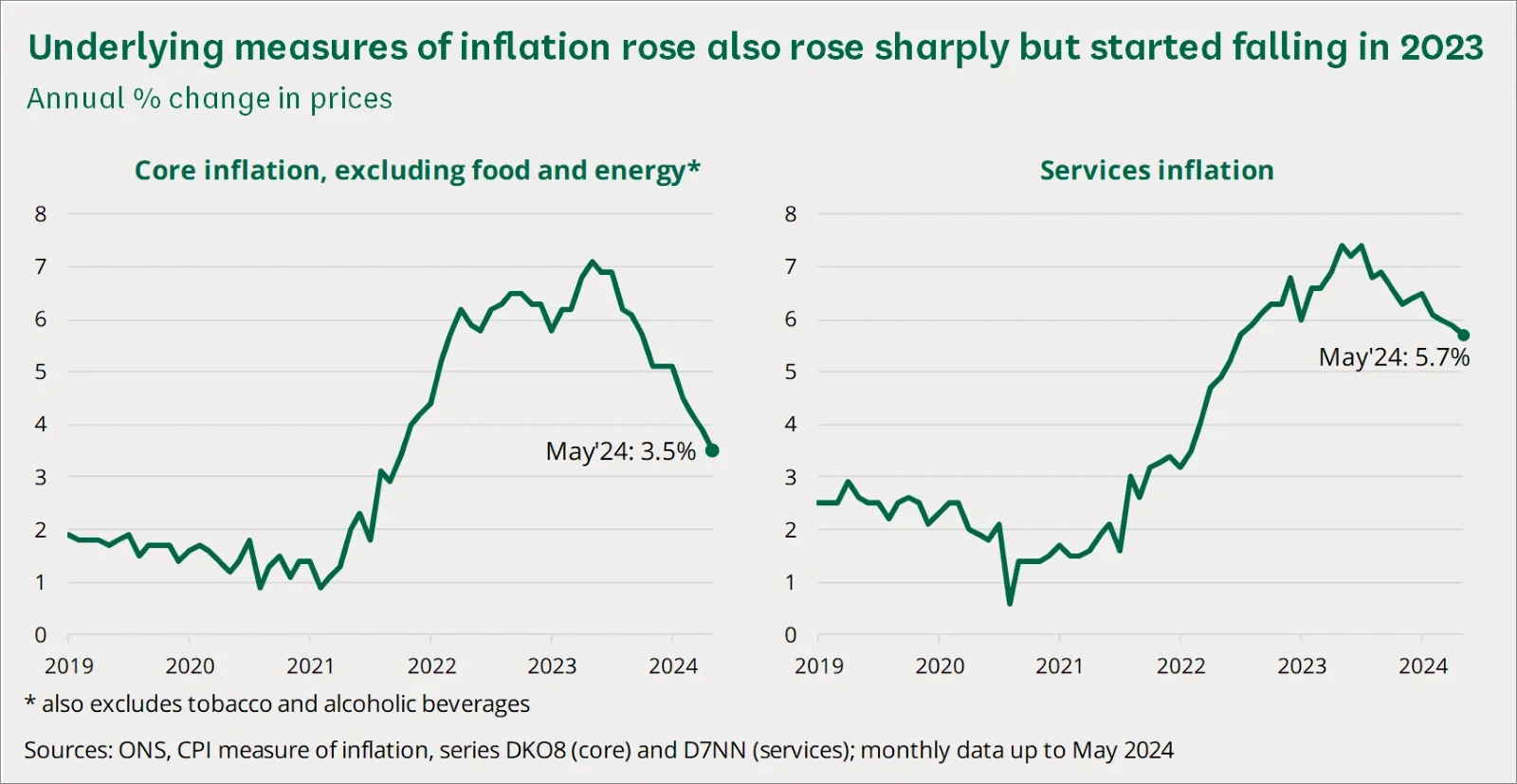

Why did inflation rise so much?

The rise in inflation during 2021 and 2022 was primarily driven by a combination of global and domestic factors:

- Global demand and supply chain disruptions: The COVID-19 pandemic led to increased global demand for consumer goods, coupled with significant supply chain disruptions.

- Energy and fuel prices: The full-scale invasion of Ukraine by Russia in February 2022 caused a surge in energy and fuel prices, impacting costs worldwide.AP News

- Domestic factors: Strong pay growth contributed to higher labor costs, especially in the services sector, leading to increased prices domestically.

These factors collectively resulted in a significant rise in the Consumer Prices Index (CPI), affecting the overall cost of living in the UK. This is where the cost of living bonus ideas come into place.

Cost of living bonus ideas

Cost of living bonuses are typically offered by employers or government entities to help individuals or families cope with rising living expenses. Here are five cost of living bonus ideas:

1. Utility bill relief

Provide a one-time bonus to employees or citizens to help cover their utility bills, such as electricity, water, gas, or internet. This can be especially helpful during extreme weather conditions or when utility costs rise significantly.

2. Grocery vouchers

Issue grocery vouchers or gift cards to local supermarkets. These vouchers can help individuals and families purchase essential food items, reducing the financial strain of rising food prices.

3. Transportation subsidies

Offer transportation subsidies, such as public transit passes or fuel vouchers, to help individuals with commuting costs. This can be a significant relief for those who rely on transportation to get to work or school.

4. Child Care assistance

Provide financial assistance for childcare services, such as daycare or after-school programs. High childcare costs can be a major burden on working parents, and this bonus can help alleviate some of the financial stress.

5. Education and training grants

Offer grants or bonuses to support continued education and skills development. This could include covering the costs of courses, workshops, or certifications that can enhance an individual's career prospects and earning potential.

6. Housing assistance

Provide a bonus or subsidy to help with housing costs. This could include rent or mortgage assistance, property tax relief, or down payment assistance for first-time homebuyers. Housing costs are a significant portion of most people's budgets, and assistance in this area can make a substantial difference in their financial stability.

7. Healthcare support

Offer a one-time bonus to help cover healthcare-related expenses, such as health insurance premiums, medical bills, or prescription medications. Rising healthcare costs can be a major financial burden, and this bonus can help individuals and families access the care they need.

8. Student loan relief

For regions or organizations with a significant student loan burden, consider providing a cost of living bonus to help individuals with student loan repayment. This could be a one-time payment or a contribution toward their monthly loan payments, helping to reduce their debt load and improve their financial well-being.

8. Emergency fund contributions

Encourage individuals or employees to build emergency savings by matching their contributions to an emergency fund. For example, an employer or government entity could match every dollar contributed to an employee's emergency fund up to a certain limit. This can help people prepare for unexpected financial challenges and reduce reliance on high-interest loans or credit cards.

How is the cost of living bonus calculated?

Calculating a Cost of Living Bonus (COLA) for employees in the UK involves several steps, and the specific methodology can vary from one employer to another. However, here's a general overview of how a COLA is typically calculated in the UK:

1. Determine the base salary

The first step is to establish a base salary for the employee. This base salary is often determined based on market research, industry standards, the specific job role, and the company's budget. It serves as the starting point for calculating the COLA.

2. Identify the location

The next step is to identify the location or region where the employee is based. The cost of living can vary significantly across different areas of the UK, so it's important to pinpoint the exact location to ensure accuracy.

3. Gather cost of living data

Employers need to collect data on the cost of living in the employee's location. This data typically includes:

- Housing costs: The cost of rent or mortgage payments in the area.

- Transportation expenses: the cost of public transportation, fuel, and vehicle maintenance.

- Food prices: The average cost of groceries and dining out.

- Utilities: The cost of electricity, water, gas, and other essential utilities.

- Healthcare costs: The expenses associated with health insurance and medical care.

- Other living expenses: Miscellaneous expenses such as clothing, education, and entertainment.

4. Compare to a benchmark location

To calculate the COLA, employers often compare the cost of living in the employee's location to a benchmark location. In the UK, London is commonly used as the benchmark due to its relatively high cost of living. The difference in living costs between the employee's location and the benchmark location is a key factor in determining the COLA percentage.

5. Calculate the COLA percentage

The COLA percentage is calculated based on the difference in living costs. Here's a simplified formula:

COLA Percentage = (Cost of Living in Employee's Location - Cost of Living in Benchmark Location) / Cost of Living in Benchmark Location

For example, if the cost of living in the employee's location is 10% higher than in London, the COLA percentage might be 10%.

6. Apply the COLA to the Base Salary: Finally, the COLA percentage is applied to the employee's base salary. This results in the additional amount the employee will receive to help offset the higher living costs in their area.

COLA Amount = Base Salary × (COLA Percentage / 100)

The COLA amount is then added to the base salary to determine the employee's total compensation package, which reflects the cost of living adjustment for their specific location.

It's important to note that the specific calculations and benchmarks used can vary between employers. Some companies may use more complex formulas that take into account a wider range of factors, while others may use simpler methods. Additionally, COLAs are typically reviewed and updated periodically to ensure they remain accurate in light of changing economic conditions and cost of living fluctuations.

Companies paying cost of living bonus in the UK

When it comes to offering a cost of living boost to their staff, several prominent companies are taking the lead.

John Lewis cost of living bonus: John Lewis has declared that its full-time employees will receive a one-time cost of living grant of £500, while part-time employees will receive a smaller amount. In the financial sector, banks such as HSBC and Nationwide are granting bonuses of £1,500 and £1,200, respectively, to their lowest-paid workers.

Amazon cost of living bonus: Amazon has also committed to providing a special payment of up to £500 to its frontline employees. Additionally, Virgin Media O2 is extending cost of living allowances of £1,400 to employees earning up to £35,000 in basic pay to assist them with the escalating expenses.

Here are just some of the other major UK companies giving a cost of living bonus to employees:

- Lloyds Bank

- Co-operative Bank

- Barclays

- Rolls Royce

- Bloomsbury

- Oxford University

- British Airways

- Aldi

- Tesco

- Marks and Spencer

Here is how the top companies like Google and Deloitte are giving cost of living bonuses to their employees.

How to help employees with cost of living: 7 strategies for employers

Here are the 7 effective strategies for employers to support employees with cost of living crisis.

1. Salary adjustments and cost-of-living increases

One of the most effective solutions to help with cost of living expenses is to increase the salary, provide rewards, perks or benefits etc so that employees can pay bills easily and procure essential supplies for the family. In the UK, many companies have provided a 5 to 10 percent hike based on the management hierarchy.

PwC is offering 1000 to 1500 pounds for employees who earn less than 50,000 pounds a year. This payment is spread over 5 months to help in curbing the rising inflation and cost of living expenses in the UK.

2. Employee financial wellness programs

Employee financial wellness programs are an excellent way to help employees with cost of living and promote learning resources that help in aiding the wellness of employees. This can include learning and development programs, training, budgeting and cost cutting measures for personal life and many other resources that are available at the employees’ disposal.

John Lewis is offering employees a one-off payment between 300 and 1000 pounds to its employees to help with the cost of living crisis. They also offer free meals for the employees in their offices to help with inflation of supplies in the market.

3. Flexible work arrangements

Flexible work with flexible working hours, hybrid work environments, option to support parental leave, day care and other support for women can all be very helpful in battling rising expenses. With options to cover shifts and report to work with flexible programs, employee morale and productivity is boosted proportionally.

Unsurprisingly, Dell, a leading computer firm, fully adopted technology as they initiated their flexible work environment in 2009.Dell took this step after recognizing the high value its employees placed on flexibility. Although an informal policy existed before, it wasn't well-defined. Recognizing that many staff members often have preferences or necessities to work beyond typical hours, Dell aimed to empower them to work based on their distinct preferences and rhythms

4. Affordable healthcare options

Health and safety is an important cost of living support for employees and needs to be addressed for employees as per the labor laws. It is important that employers provide a comprehensive healthcare scheme and offer a safe workplace for employees.

Training for work, protection gear and a safe workplace are top priorities to prevent injuries and accidents in an expensive economy today.

Campbell soup company, a renowned brand in the food industry, takes pride in offering its employees an extensive range of healthcare benefits. Among the standout features of their benefits package is the inclusion of a 401K savings plan, an attractive incentive for those thinking about their financial future.

Notably, Campbell goes the extra mile by contributing 4 percent as an employer match to these retirement savings, illustrating their commitment to the long-term well-being of their staff. In addition to these retirement perks, employees also receive a substantial $1,000 in health savings account funding.

This provision ensures that they have a cushion to cover medical expenses, underlining Campbell's dedication to the health and financial security of its workforce.

5. Housing assistance programs

Many companies are also offering housing assistance due to the high rents which is pushing employees into forgoing home rents and home loan payments because of cost of living expenses. Housing loan allowances and other such schemes to protect employees from rising rent prices can be provided by companies.

KEA , the globally recognized furniture and home goods retailer, is taking a significant step towards employee welfare in Reykjavik, Sweden. Recognizing the challenges and expenses associated with commuting, the company has initiated the construction of an apartment complex in close proximity to their showroom.

This strategic move is designed to offer their employees a convenient housing option, allowing them to live near their workplace.

6. Education and upskilling opportunities

Training and learning opportunities are one of the best ways to promote employee skills and utilize them to better serve the company. Not only does this improve the employees’ productivity and gives them a scope to earn better, it also allows employees to make use of these skills to improve company revenue.

Amazon has a healthy and positive learning and training environment that helps non technical employees a chance to move to software and other technical jobs by making use of their learning and development opportunities.The company intends to augment its current training initiatives and launch new ones.

For instance, the Amazon Technical Academy is designed to equip non-technical staff with the expertise required for software engineering professions.Associate2Tech is aimed at training front-line workers, responsible for order fulfillment, to transition into tech positions, even if they lack prior IT background.

Additional schemes will be geared towards grooming employees for various positions within Amazon and roles in diverse sectors. Participation in all these training sessions is optional.

7. Remote work and telecommuting options

Remote work such as work from home, hybrid work schedules can help in cutting down on fuel and commute expenses. This is one of the best ways to support employees with cost of living and promote physical and mental well being in workplaces as many employees prefer to work from home whenever possible.

Using technology to personalize and scale bonuses

For organizations looking to scale and personalize their bonus programs—whether you're aligning with the average bonus percentage in the UK, rolling out cost of living bonuses, or rewarding top performers—HR tech solutions can play a pivotal role.

Empuls, for instance, enables businesses to:

- Design tailored bonus workflows across personas and job levels

- Automate bonus distribution with approval workflows

- Gain insights into average UK bonus trends vs internal distributions

- Boost employee satisfaction with transparent bonus communication

This kind of platform ensures your bonus strategy is not only data-driven but also scalable and engaging.

Conclusion

The cost of living bonus is a valuable for both employers and employees in the UK. It addresses the challenges posed by regional cost disparities, enhances financial security, and contributes to a more satisfied and productive workforce.

As the job market continues to evolve, employers who embrace such innovative compensation practices are likely to stand out in attracting, retaining, and motivating top talent. Ultimately, a well-implemented COLA demonstrates a commitment to the well-being of employees and the success of the organization as a whole.

FAQs

1. What is the average cost of living in the UK?

The average monthly expenses for a single person in the UK range from £1,500 to £2,500, depending on lifestyle and location. For a family of four, monthly costs can be between £3,000 and £5,500. Living in London typically requires a higher budget compared to other regions.

2. How much money do you need to live comfortably in the UK?

To live comfortably, a single person might need at least £1,400 per month, while a couple with no children would require around £2,100 monthly. However, these figures can vary based on personal circumstances and location.

3. Is it cheaper to live in the US or UK?

Overall, the cost of living in the UK is slightly lower than in the US. Consumer prices in the UK are 15.9% lower than in the US, not including rent. When rental prices are included, UK consumer prices are 23.1% lower than in the US.

4. What is the living cost in the UK per year?

For a single person, annual living expenses range from £18,000 to £30,000, while a family of four might spend between £36,000 and £66,000 annually, depending on lifestyle and location.

5. Is the cost of living bonus from employers taxable?

Yes, cost of living bonuses from employers are generally taxable as part of an employee's income. They are subject to income tax and National Insurance contributions in the UK.