9 Nontaxable Employee Benefits for Maximizing Your Income and Workplace Satisfaction

Non taxable employee benefits offer a smart way to boost employee take-home pay and satisfaction without increasing taxable income. Discover key employee benefits that are tax free, explore real-world examples, and learn how to offer these perks seamlessly through platforms like Empuls.

On this page

- What are non taxable employee benefits?

- Common types of tax free or non taxable employee benefits

- Other lesser-known tax free employee benefits

- Considerations and limitations to consider when giving nontaxable employee benefits

- Empower your workforce with nontaxable benefits via Empuls

- Conclusion

- FAQs about non taxable employee benefits

When it comes to employee compensation, salary is just one piece of the puzzle. In today’s competitive job market, organizations are going beyond base pay to offer benefits that enhance the employee experience—while also providing financial relief. One of the most valuable yet often overlooked components of a total rewards package is non taxable employee benefits.

These are perks and incentives provided by employers that are exempt from federal income tax, offering a win-win scenario: employees receive added value without an increase in taxable income, and employers enjoy improved retention, engagement, and morale. From health insurance and commuter benefits to childcare assistance and educational support, a wide variety of employee benefits are tax free under certain conditions.

Understanding which benefits qualify can help both HR professionals and employees make informed decisions that maximize value while staying compliant with tax regulations.

In this blog, we’ll break down the definition of non-taxable benefits, explore their advantages, and share real-world non taxable benefits examples that can transform the way you think about compensation and workplace well-being.

What are non taxable employee benefits?

Non taxable employee benefits refer to various perks and incentives provided by employers that are exempt from certain taxes and deductions. These benefits offer financial advantages for employees by reducing their taxable income, resulting in lower tax liabilities. Additionally, employers can benefit from tax deductions or exclusions for providing these benefits.

Non taxable or tax free employee benefits are an integral part of a comprehensive compensation package, complementing salary and other traditional benefits. They can range from health insurance coverage to retirement plans, flexible spending accounts, transportation benefits, education assistance, and more.

One of the key advantages of tax free benefits is that they help employees stretch their compensation further. By reducing the taxable portion of their income, employees can effectively increase their take-home pay. This allows them to allocate more funds toward their financial goals, whether it be saving for retirement, paying for education, or meeting daily expenses.

Other advantages of non taxable employee benefits:

- Cost savings for employees.

- Enhanced employee satisfaction and well-being.

- Attracting and retaining top talent.

- Tax savings for employers.

Common types of tax free or non taxable employee benefits

There are several types of tax free employee benefits that employers can offer to enhance their employees' compensation packages. Let's explore some of the most common ones:

1. Health insurance benefits

Employer-provided health insurance is a widely offered benefit that often comes with tax advantages. The premiums paid by employees for employer-sponsored health insurance are typically exempt from income and payroll taxes. This reduces employees' taxable income, resulting in lower tax liabilities. Additionally, employers can deduct the cost of providing health insurance as a business expense.

Furthermore, Health Savings Accounts (HSAs) are another tax-advantaged benefit associated with health insurance. Contributions to HSAs are made on a pre-tax basis, and the funds can be used to pay for qualified medical expenses. HSA contributions and earnings grow tax free, and withdrawals for qualified medical expenses are also tax free.

2. Retirement benefits

Retirement benefits, such as 401(k) plans and Individual Retirement Accounts (IRAs), offer employees the opportunity to save for their future while enjoying tax advantages. Contributions made to these retirement plans are typically tax-deferred, meaning they are not subject to income tax in the year they are made. Instead, taxes are deferred until withdrawals are made during retirement.

Employers may also provide matching contributions to employees' retirement accounts, which are often tax-deductible for the employer. This matching contribution further enhances the tax benefits and encourages employees to save for their retirement.

Additionally, Roth retirement accounts offer unique tax advantages. Contributions to Roth 401(k)s or Roth IRAs are made with after-tax dollars, meaning they are not tax-deductible upfront. However, qualified withdrawals from Roth accounts, including earnings, are tax free, providing tax free income during retirement.

3. Flexible spending accounts (FSAs)

Flexible Spending Accounts (FSAs) allow employees to set aside a portion of their pre-tax income to pay for eligible medical or dependent care expenses. These contributions are not subject to income or payroll taxes, reducing employees' taxable income. FSAs can be used for various expenses such as medical co-pays, prescription medications, childcare, and more.

It's important to note that FSAs typically operate on a "use-it-or-lose-it" basis, meaning funds not used within the plan year may be forfeited. However, some plans allow a limited rollover or a grace period to utilize remaining funds.

4. Transportation benefits

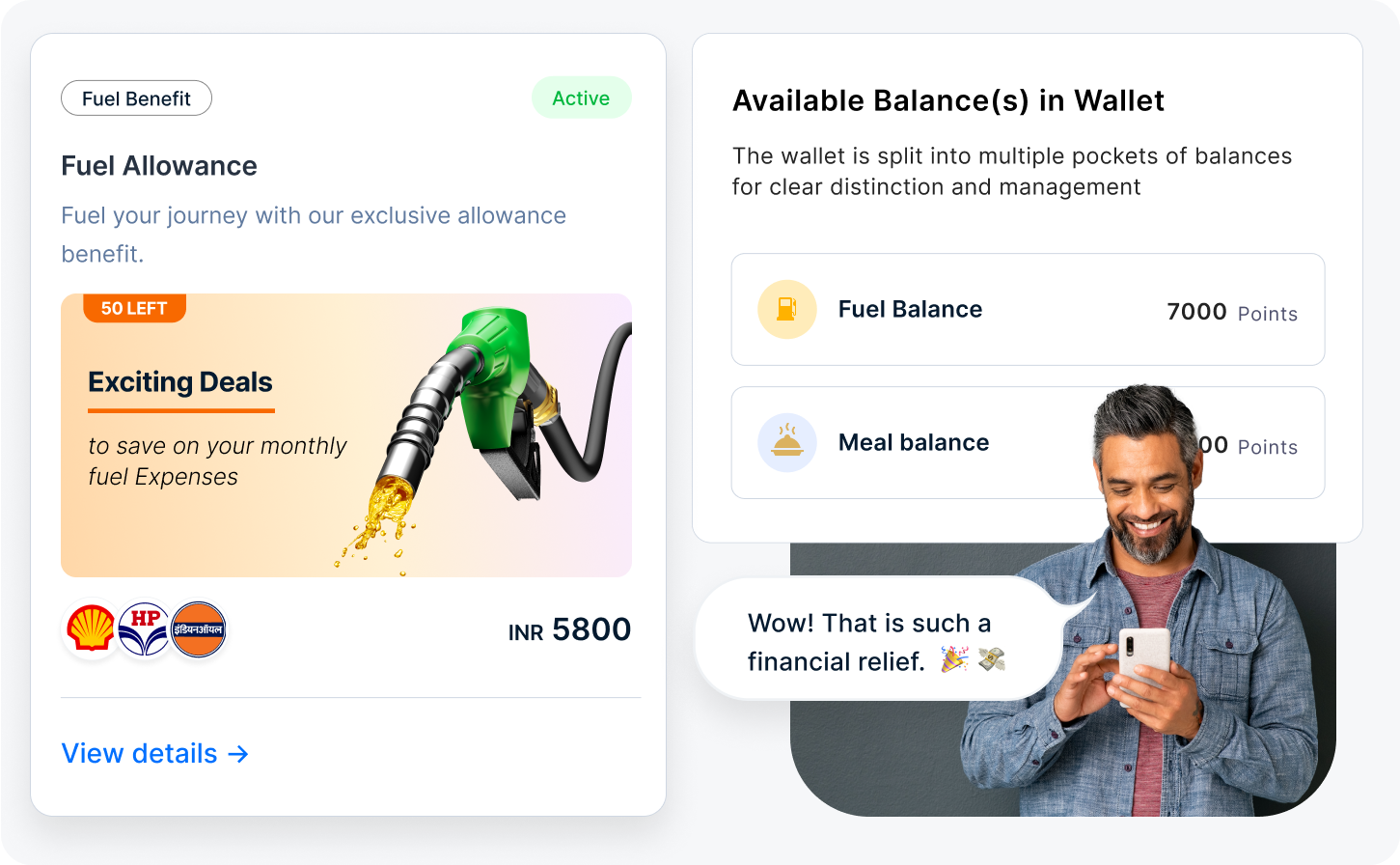

Employers can provide tax free commuter benefits to employees, promoting sustainable transportation options. Qualified transportation expenses, such as transit passes, vanpooling costs, fuel allowances, and qualified parking, can be offered as tax free benefits. These benefits reduce employees' taxable income, allowing them to save on taxes while commuting to work.

Employers can also provide tax free parking benefits by covering or subsidizing parking expenses for employees. This can be particularly advantageous for employees who work in areas with expensive parking fees.

5. Education assistance programs

Many employers recognize the importance of ongoing education and offer educational assistance programs to support their employees' professional development. Employer-sponsored educational assistance can include tuition reimbursement, scholarships, or direct payments for qualifying educational expenses.

Under certain conditions, these educational assistance programs can provide tax benefits. For example, employers can provide up to a certain amount of tax free educational assistance to employees each year, reducing the employees' taxable income.

6. Employee meal allowance

In some cases, employers may provide a meal allowance to employees as part of their compensation package. If this meal allowance is provided on a non-discriminatory basis and is not excessive, it may be considered a non taxable benefit.

However, the specific rules and limits for non taxable meal allowances can vary depending on the jurisdiction. It's important to consult local tax regulations or seek professional advice to determine the exact treatment in a particular jurisdiction.

Other lesser-known tax free employee benefits

While health insurance, retirement plans, flexible spending accounts, transportation benefits, and education assistance programs are commonly known tax free employee benefits, there are other lesser-known options that can provide additional financial advantages.

Let's explore some of these benefits:

1. Employee stock purchase plans (ESPPs)

Employee Stock Purchase Plans (ESPPs) allow employees to purchase company stock at a discounted price. The contributions made to ESPPs are typically deducted from employees' paychecks on an after-tax basis.

However, the benefit comes when the stock is sold. If certain holding period requirements are met, the gain from selling the stock may qualify for favorable tax treatment, resulting in potential tax savings.

2. Dependent care assistance programs (DCAPs)

Dependent Care Assistance Programs (DCAPs) enable employees to set aside pre-tax dollars to cover eligible dependent care expenses, such as childcare or care for elderly dependents. Similar to FSAs, contributions made to DCAPs reduce employees' taxable income, providing tax savings.

Employers can offer DCAPs as part of their benefits package to support employees in managing their dependent care expenses.

3. Adoption assistance programs

Employers can provide adoption assistance programs to employees who are expanding their families through adoption. Qualified adoption expenses, such as adoption fees, court costs, and attorney fees, can be reimbursed or directly paid by the employer. These reimbursements or direct payments are generally tax free up to a certain limit, reducing the employees' taxable income.

With these lesser-known tax free benefits, employers demonstrate their commitment to supporting their employees' diverse needs and life events while providing valuable tax advantages.

Considerations and limitations to consider when giving nontaxable employee benefits

While tax free employee benefits offer advantages for both employees and employers, there are important considerations and limitations to keep in mind. Understanding these factors ensures compliance with regulations and maximizes the effectiveness of these benefits. Here are a few key points to consider:

1. Employee eligibility and participation requirements

Certain tax free benefits may have eligibility criteria or participation requirements. For example, health insurance benefits may require employees to meet specific criteria or enroll during designated enrollment periods. Employers should clearly communicate these requirements to employees to ensure they understand the eligibility criteria and can take advantage of the benefits offered.

2. IRS regulations and reporting obligations for employers

Employers must comply with Internal Revenue Service (IRS) regulations when offering tax free employee benefits. This includes proper reporting of benefits on employees' W-2 forms and fulfilling any necessary reporting obligations. It is crucial for employers to stay updated with IRS guidelines and consult with tax professionals to ensure compliance.

3. Potential impact on other employee benefits

The implementation of tax free employee benefits may have an impact on other employee benefits, such as Social Security benefits or retirement contributions. It's important to assess the potential implications and communicate any changes or effects to employees, enabling them to make informed decisions about their overall financial planning.

4. Tax Implications for employees when leaving a job

Employees should be aware of the tax implications when leaving a job that provided tax free benefits. Depending on the specific benefit, there may be tax consequences or eligibility requirements for continued benefits after leaving employment. Understanding these implications helps employees navigate their transition effectively.

Empower your workforce with nontaxable benefits via Empuls

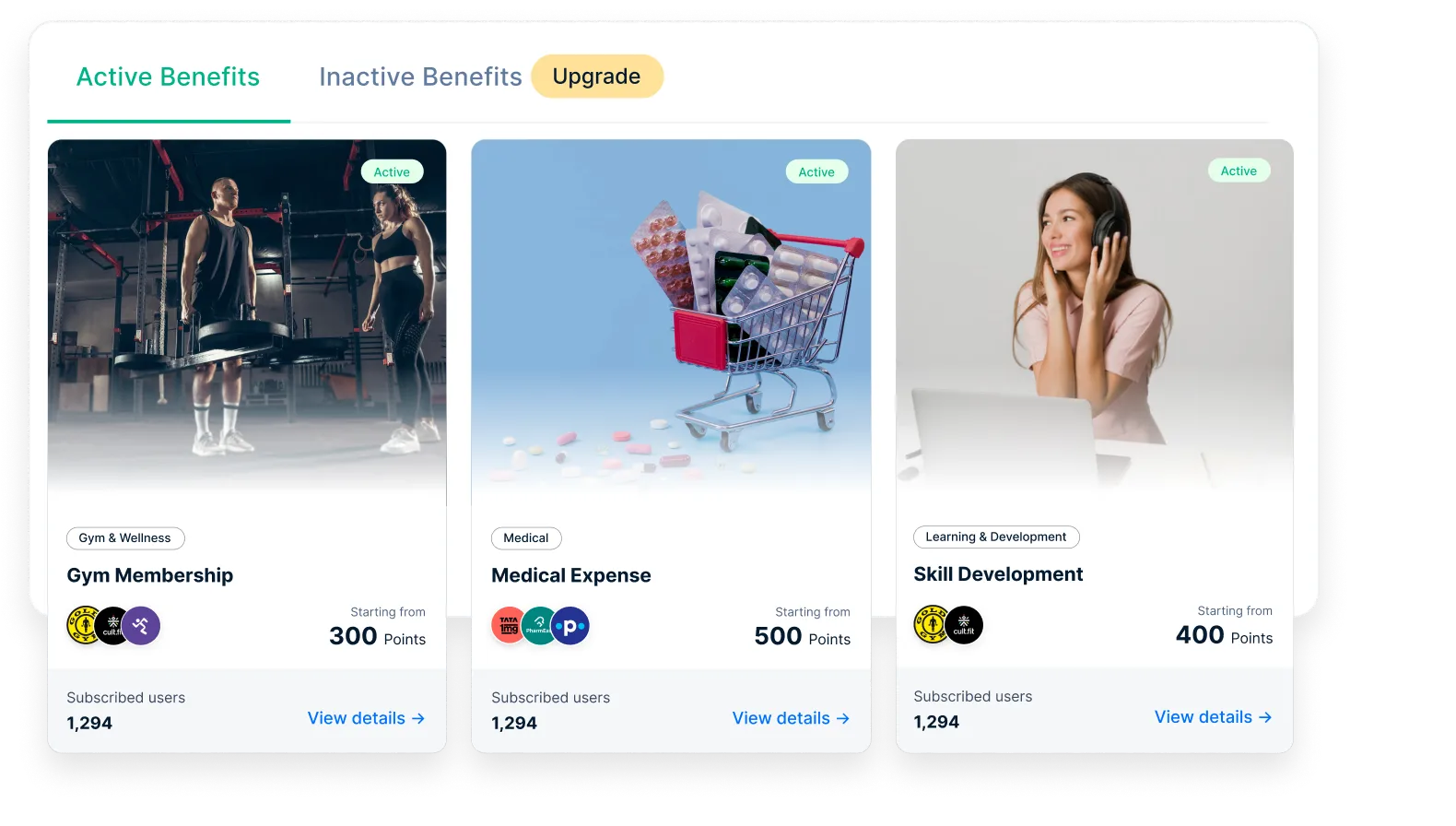

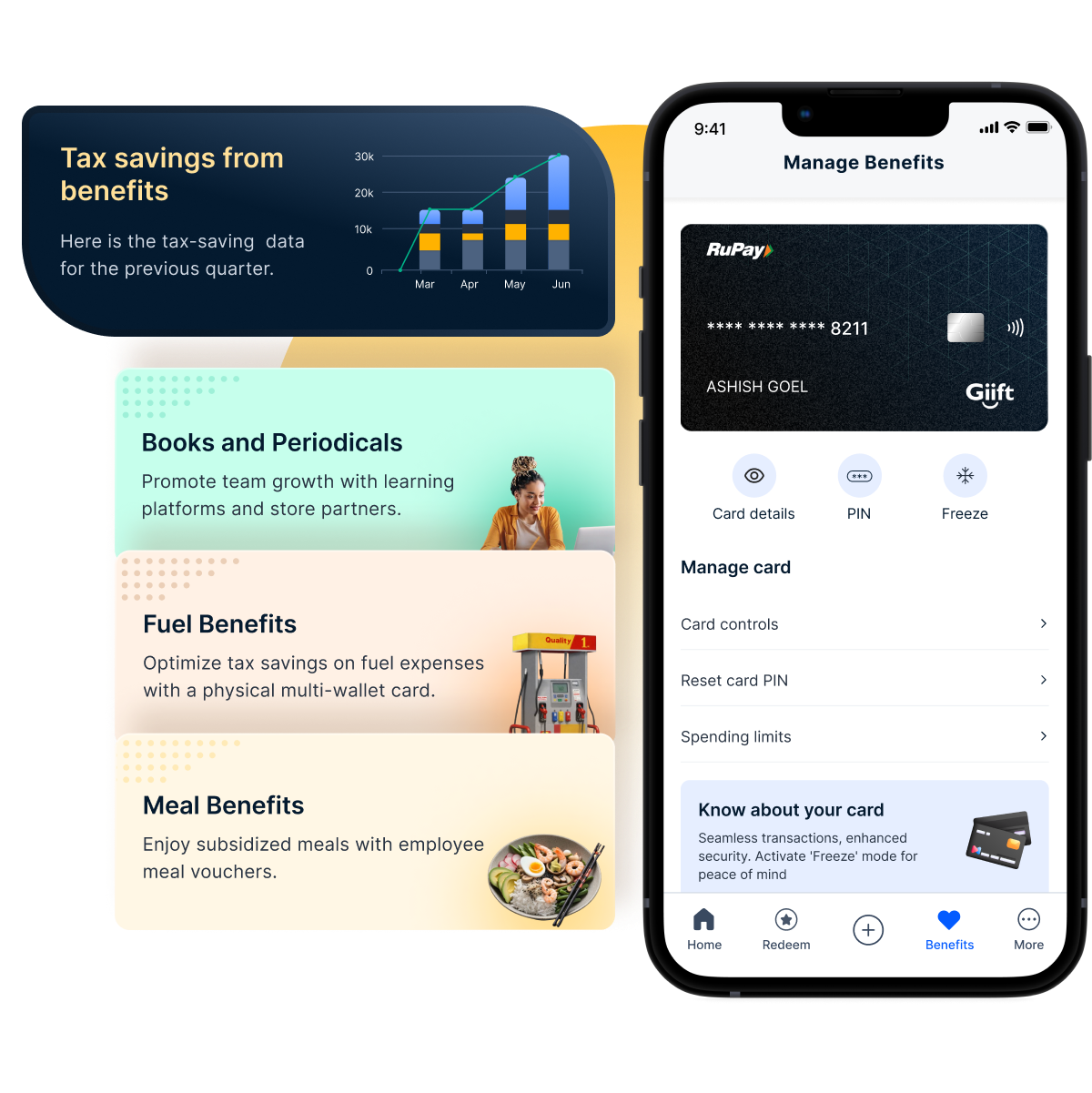

In today’s talent-driven market, smart employers are shifting from just offering higher salaries to delivering nontaxable employee benefits that improve take-home value and well-being. Enter Empuls—a comprehensive employee engagement platform that lets you offer flexible, compliant, and high-ROI nontaxable perks at scale.

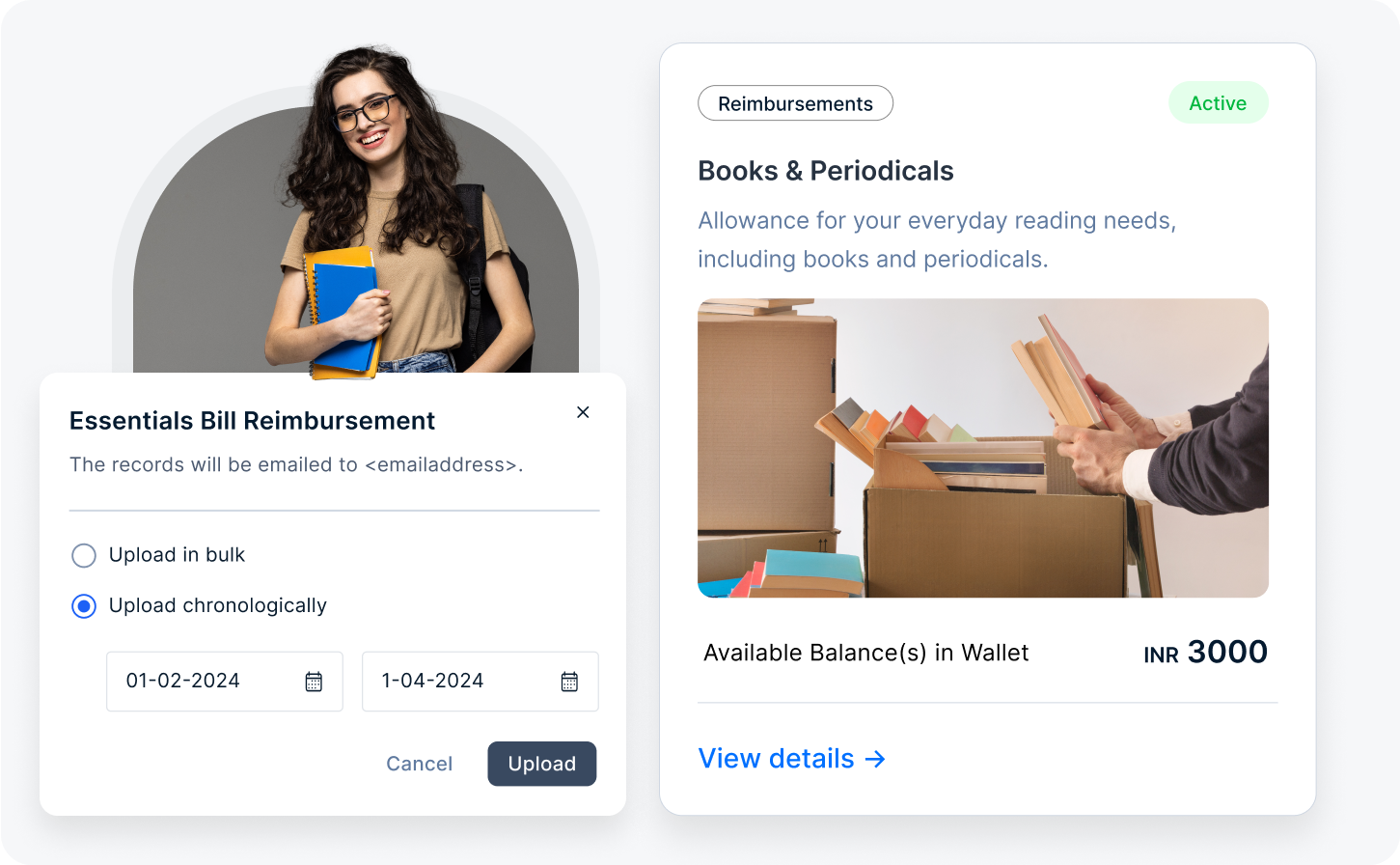

With Empuls Lifestyle Spending Accounts (LSAs) and multi-wallet tax-saving cards, organizations can provide tailored benefits that comply with local tax laws while enhancing employee satisfaction. These include:

- 🍱 Meal allowances for online and offline dining (Swiggy, Zomato, restaurants)

- ⛽ Fuel reimbursements—tax-free usage via authorized fuel partners

- 📚 Books & periodicals allowances to support continuous learning

- 📞 Telecom benefits for mobile and broadband needs

- 💪 Fitness & wellness reimbursements

- 🧠 Upskilling allowances for courses and certifications

- 👨👩👧👦 Family care support, including childcare and eldercare

All benefits are delivered through a single, easy-to-use platform, giving employees the freedom to pick what suits their lifestyle—and maximizing their savings without increasing taxable income.

Empuls not only streamlines benefit disbursal and compliance, but also ensures zero waste by offering pay-on-redemption and letting employees redeem only what they use—no breakage, no liability.

For HR teams, Empuls removes the administrative burden with automated workflows, real-time tracking, and analytics to measure program ROI and employee uptake. The result? A high-impact, low-cost strategy to boost retention, employer branding, and net income for your people.

Conclusion

tax free or non taxable employee benefits offer a win-win situation for both employees and employers. Employees enjoy increased take-home pay, cost savings, and improved well-being, while employers attract and retain top talent and benefit from potential tax savings.

With these benefits, employees can maximize their income and job satisfaction, while employers can create a positive work environment and stay competitive in the job market.

Prioritizing non taxable benefits is a smart strategy for all parties involved, ensuring a mutually beneficial relationship that promotes financial security and workplace happiness.

FAQs about non taxable employee benefits

Here are some frequently asked questions about non taxable employee benefits.

Which employee benefits are typically non-taxable?

Common non-taxable benefits include health insurance, educational assistance, retirement contributions, commuting benefits, wellness programs, and certain meal allowances.

Why are non-taxable benefits beneficial?

Non-taxable benefits can increase employees' overall compensation without being subject to income tax, resulting in greater take-home pay and potentially reducing their tax burden.

Are employee benefits taxable?

Employee benefits are subject to taxation. The value of most employee benefits, such as health insurance, retirement contributions, and company-provided vehicles, is considered taxable income. However, there are certain benefits that may be tax-exempt, such as certain educational assistance programs, certain health and wellness benefits, and some employee discounts.

Are all non-taxable benefits the same worldwide?

No, the tax treatment of employee benefits varies across countries and jurisdictions. It's important to understand the specific regulations and guidelines in your location.

Can non-taxable benefits be provided to all employees?

Non-taxable benefits should generally be provided on a non-discriminatory basis, meaning they should be offered to all eligible employees in a consistent and fair manner.

Are there limits to non-taxable benefits?

Yes, certain benefits may have specific limits or restrictions on their non-taxable status. For example, there could be maximum dollar amounts or eligibility criteria to consider.

Can non-taxable benefits change over time?

Yes, tax laws and regulations can change, impacting the eligibility and tax treatment of employee benefits. Staying updated with current tax laws is essential to ensure compliance.

Should I consult with a tax professional regarding non-taxable benefits?

It is advisable to seek professional advice from tax experts or consult with HR professionals who specialize in employee benefits to ensure accurate and compliant implementation of non-taxable benefits.