How to Calculate Employee Benefits and Perks: The Ultimate Handbook

Learn how to calculate employee benefits cost? Here is a comprehensive guide for calculating employee benefits and understanding their advantages.

On this page

Calculating employee benefits is crucial in creating competitive compensation packages that attract and retain top talent. Employee satisfaction has taken center stage in business success, so employers are more willing to offer comprehensive employee benefits.

These benefits are more than just healthcare and retirement plans. They ensure holistic care for employees by improving employees’ personal and professional lives.

While these benefits are good, they are an expense to businesses. Therefore, they must be optimized to help both employees and employers. You need to know what benefits are adding value to your business and what is not by calculating employee benefits accurately.

In this blog, we look at how to calculate the cost of employee compensation packages and arrive at how much you are investing in employee benefits.

Types of employee benefits you must know before calculating them

Before delving deeper into learning the process of calculating employee benefits, let’s understand the major types of employee benefits.

1. Statutory benefits

Statutory or mandatory benefits are legal requirements that businesses need to comply with. Employers need to pay contributions to the central or state government employee welfare schemes, insurance, retirement funds, etc. The employers are legally required to do so, no matter what. While most countries have such requirements, they are not the same.

An example of a statutory benefit could be the Employee Provident Fund in India. The EPF requires employers and employees each to deposit 12 percent of their basic salary per month every year to the employee’s EPF account.

The contributions to the EPF in India accrue an annual interest of 8.15 percent for the employees.

2. Fringe benefits

Fringe benefits are non-cash rewards given to employees. The term ‘fringe benefits’ is popularized by the Internal Revenue Service (IRS) in the US.

Although employers are not required to do this by law, they do it to keep the employees motivated and inspired. Fringe benefits are also meant to encourage employees to build long-term careers with businesses.

A few of the examples of such benefits include:

- Tuition reimbursements

- Company transportation

- Product discounts

- Paid vacations

An example of a brand offering these benefits to their employees is HubSpot, one of the most popular marketing solutions platforms in the world.

They have a wide range of fringe benefits to their employees, such as:

- Unlimited vacation and global week of rest

- Remote work

- Parental benefits

Employee resource groups, such as LGBTQ+ Alliance, Women@HubSpot, People of Color at HubSpot, etc.

3. No cost benefits

These benefits come at no cost to the business, hence the name. These are additional benefits that businesses offer their employees apart from statutory and fringe benefits.

While there is no cost involved in offering these benefits, they can profoundly increase the quality of work, personal life, and performance of employees.

Some of the biggest examples of these benefits are:

- Flexible scheduling

- Location flexibility

- Casual dress code

- Legal assistance

Google is a great example of a business that offers a trove of no-cost benefits to its employees.

They offer:

- Flexibility and time off at work

- Family support and care at the office

- Googley extras

How to calculate employee benefits (for an employee)

To understand the total value of your compensation, not just your take-home pay. Many employees don’t realize how much their employer contributes toward their well-being through benefits like insurance, retirement funds, and time off.

Step 1: List all the benefits you receive

Start by listing everything your employer provides in addition to your base salary, such as:

- Employer-paid health, dental, and vision insurance

- Retirement plan contributions (like a 401(k) match or PF)

- Paid time off (vacation, sick days, holidays)

- Bonuses or stock options

- Wellness programs (gym reimbursements, therapy access)

- Educational support or learning stipends

- Commuter, travel, or meal benefits

Step 2: Assign a monetary value to each benefit

Here’s how to estimate the annual value of each:

Step 3: Add it all together

Add these to find your total annual benefits value.

Total Benefits = $6,000 + $2,400 + $3,460 + $600 + $1,000 = $13,460

Step 4: Add to your base salary

Now calculate your total compensation:

Base Salary = $60,000

Total Compensation = $60,000 + $13,460 = $73,460/year

- Helps you see the full value of your job offer.

- Supports smarter decision-making during salary negotiations.

- Improves appreciation for the non-cash perks your employer provides.

How to calculate employee benefits – for your business

Understanding the actual cost of employee benefits is essential for business planning, HR budgeting, and designing competitive total compensation packages. For most organizations, benefits represent a significant portion of total employee spend—often ranging between 20% to 40% of the base salary.

The following factors affect the calculation of employee benefits:

- Type of employees

- Full-time employees

- Contract employees

- The number of employees

- The contribution of the employer to benefit schemes

Here’s a deeper look at how to calculate, evaluate, and leverage employee benefits from a business perspective:

Step 1: List all the benefits your company offers

Start by compiling a comprehensive list of all benefits your organization provides. Group them under categories such as:

1. Health & insurance benefits

- Employer-paid health, dental, and vision insurance premiums

- Life insurance

- Disability insurance (short-term and long-term)

- Workers’ compensation insurance

2. Retirement & financial benefits

- Employer 401(k) or PF contributions/matches

- Profit-sharing plans or stock options

- Annual or quarterly bonuses

- Financial wellness programs

3. Time-off benefits

- Paid vacation days

- Sick leave

- Paid holidays

- Parental or bereavement leave

- Sabbaticals or volunteer time off

4. Learning & development

- Tuition reimbursement

- Certification and upskilling programs

- Conference sponsorships

5. Lifestyle and well-being perks

- Gym memberships or wellness stipends

- Meal subsidies

- Travel or relocation allowances

- Commuter benefits

- Mental health support (therapy, mindfulness apps)

6. Other non-traditional benefits

- Flexible work arrangements

- Remote work setup allowances

- Employee recognition and reward programs

- Subscription services or cultural engagement perks

Step 2: Determine the annual cost of each benefit

For every benefit, calculate the per-employee cost per year. Use actual cost data from your payroll system, benefits provider, or HR platform.

Examples:

If benefits vary by department, location, or seniority, consider segmenting your calculations for accuracy.

Step 3: Add up total annual benefit cost per employee

Once you’ve quantified each benefit, sum them to get the total cost of benefits per employee per year.

Example:

- Health Insurance: $8,000

- 401(k) Match: $2,400

- PTO: $3,000

- Gym Stipend: $600

- Learning Budget: $1,000

Total = $15,000 per employee/year

Step 4: Add benefits to salary to calculate total compensation

To understand the total employment cost, add the annual salary to the benefits cost.

Example:

- Salary = $60,000

- Benefits = $15,000

Total Compensation= $75,000

This number reflects what your business is truly spending on one employee annually.

Step 5: Calculate benefits as a percentage of salary

This helps benchmark your benefits investment and compare across departments or industries.

Benefits % of Salary = (Total Benefits / Base Salary) × 100

Example: $15,000 ÷ $60,000 × 100 = 25% of salary spent on benefits

Companies typically aim for 20%–40%, depending on role type, location, and industry norms.

Step 6: Apply calculations across your organization

Now scale the process to:

- Calculate total benefits spend across the company

- Compare cost-per-employee by team or department

- Forecast benefits expenses for future hiring or policy changes

💡 Pro tips for businesses:

- Track usage vs. cost: Not all perks are used equally. Evaluate utilization data (e.g., how many employees redeem wellness stipends or attend learning programs) to optimize spend.

- Include hidden costs: Don’t forget administrative costs, platform subscriptions, or employer tax contributions when calculating total benefits.

- Audit annually: Employee needs to evolve. Review benefit costs, feedback, and ROI regularly to ensure you offer high-value, relevant perks.

- Communicate benefits clearly: Often, employees undervalue benefits simply because they’re unaware of them. Transparent communication boosts appreciation and retention.

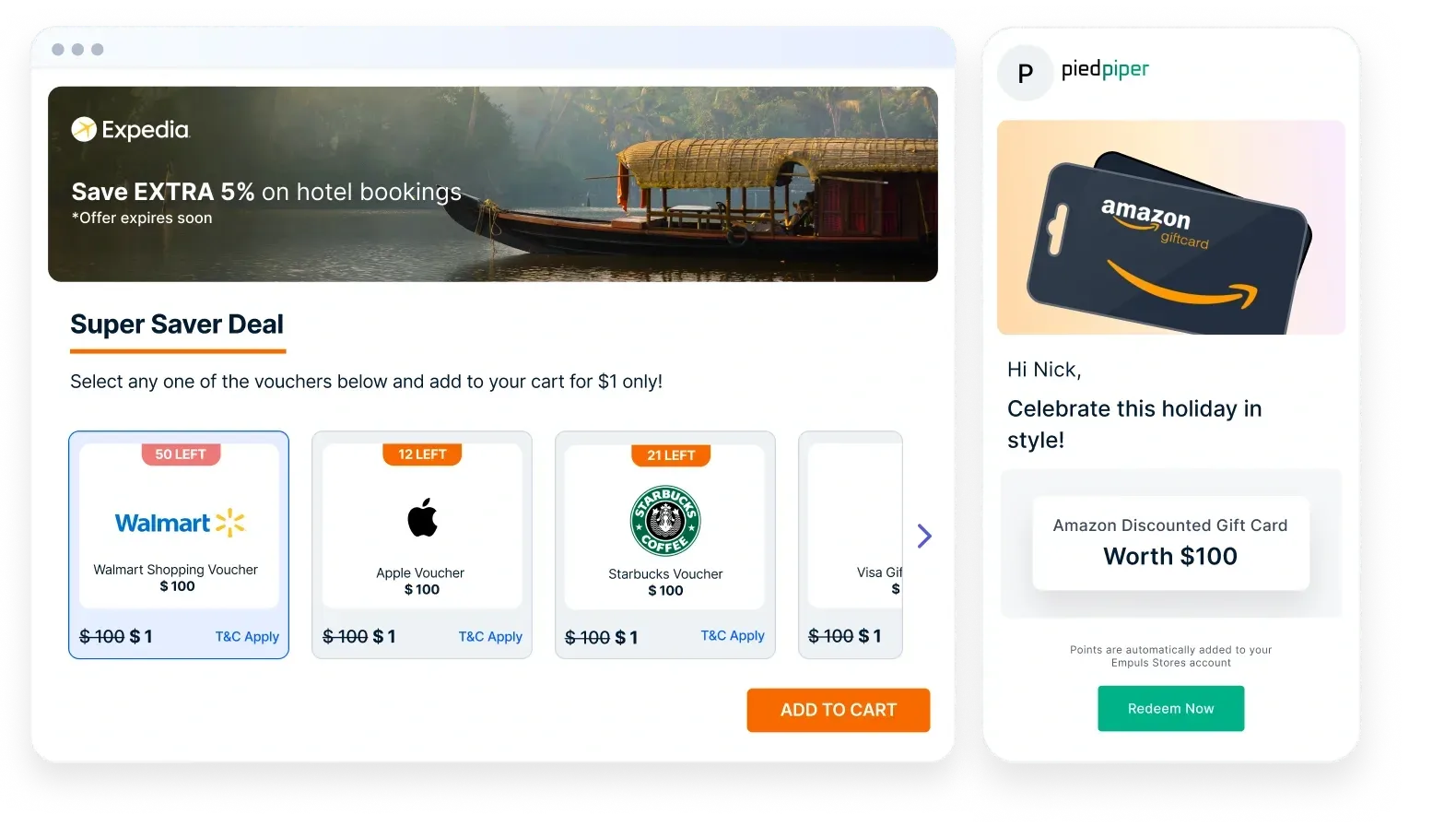

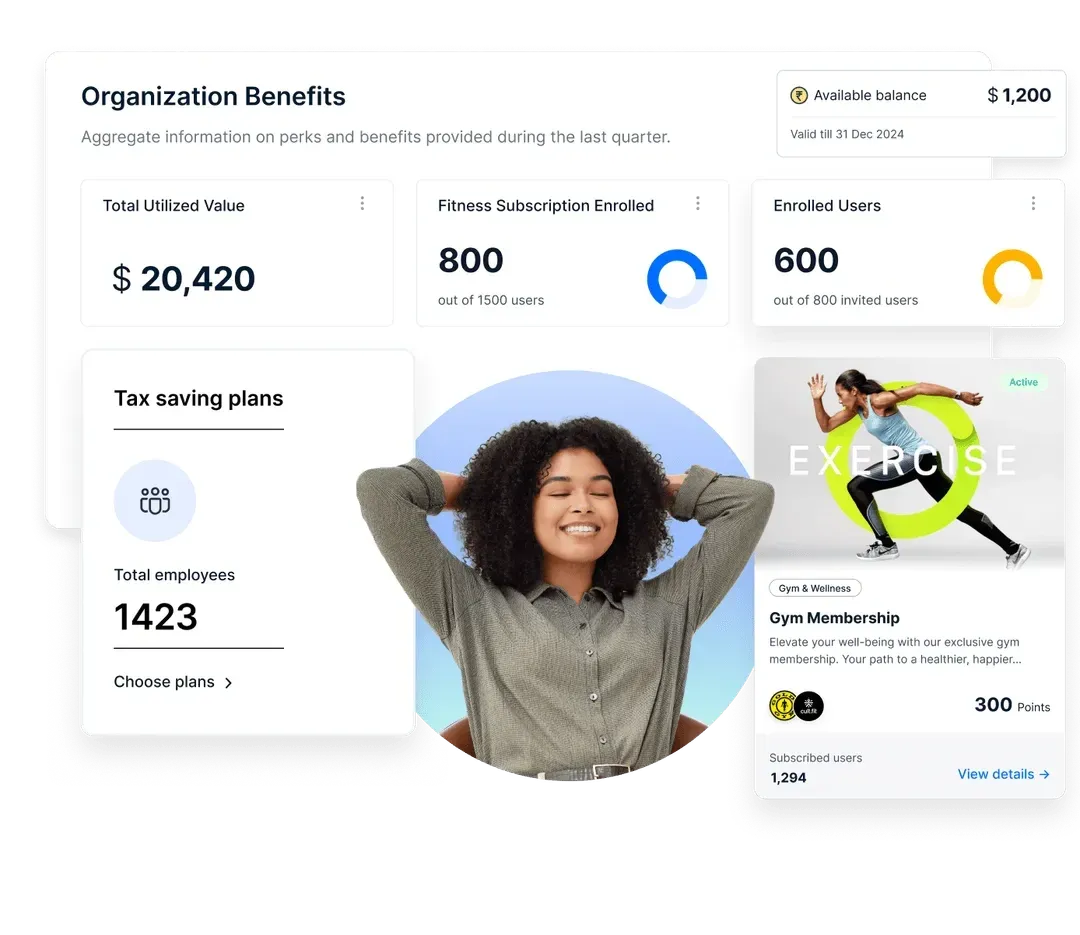

Tools like Empuls streamline perks and benefits management—offering dashboards to monitor usage, automate distribution (e.g., travel vouchers, rewards), and collect feedback on what's working. Empuls helps you measure impact and justify investment—turning benefits into a culture-building strategy.

What’s the importance of employee benefit costs

Employee benefits come at a cost; you need to understand this as a business. Instead of looking at it as an expense, consider it an investment for the growth of your business.

This approach is beneficial while calculating employee benefits and the ROI of these investments.

They can help your business in the following ways.

1. Boosts employee retention

The talent crunch is a real business problem that employers have been facing for a couple of years now. Employee benefits are a top strategy to instill a sense of loyalty in the workforce and retain them.

Happy and satisfied employees stick with their employers longer than unhappy employees.

2. It helps attract top talent

When you have an excellent employee benefits program and employees are happy working with you, it will attract more top talent. Most employees look at the benefits offered by employers before they accept an offer.

Further, when employees are happy, they also refer their friends and relatives to the business, which is an efficient way to find talent.

3. It helps improve productivity

Employee benefits make employees feel more valued and rewarded for their contributions to the business. This leads to your talent being happy and satisfied, and it leads to better productivity and efficiency at work.

As a result, they will be more inclined to work harder and stay loyal to the business.

4. Comply with legal requirements

Businesses have a legal obligation to provide sufficient benefits to their employees. By prioritizing employee welfare and offering adequate benefits, they can ensure compliance with legal requirements and mitigate the risk of facing employee-related legal challenges.

How to optimize benefit costs without sacrificing value

Offering employee benefits doesn’t have to drain your budget. The real key is maximizing impact per dollar spent by tailoring benefits to employee needs, automating delivery, and tracking effectiveness—all without compromising the employee experience.

Here’s how companies can do just that and how Empuls makes it easier:

1. Offer curated perks & exclusive discounts at scale

Rather than building your own vendor network or offering costly one-off perks, Empuls gives you access to a global perks marketplace with over 6,000+ brands across 50+ countries.

What you can offer through Empuls:

- Cashback and discounts (5%–50%) on essentials, travel, electronics, wellness, food, and moreDiscounted gift cards that employees can share with friends and family

- Limited-time offers, curated deals, and local + global brand access

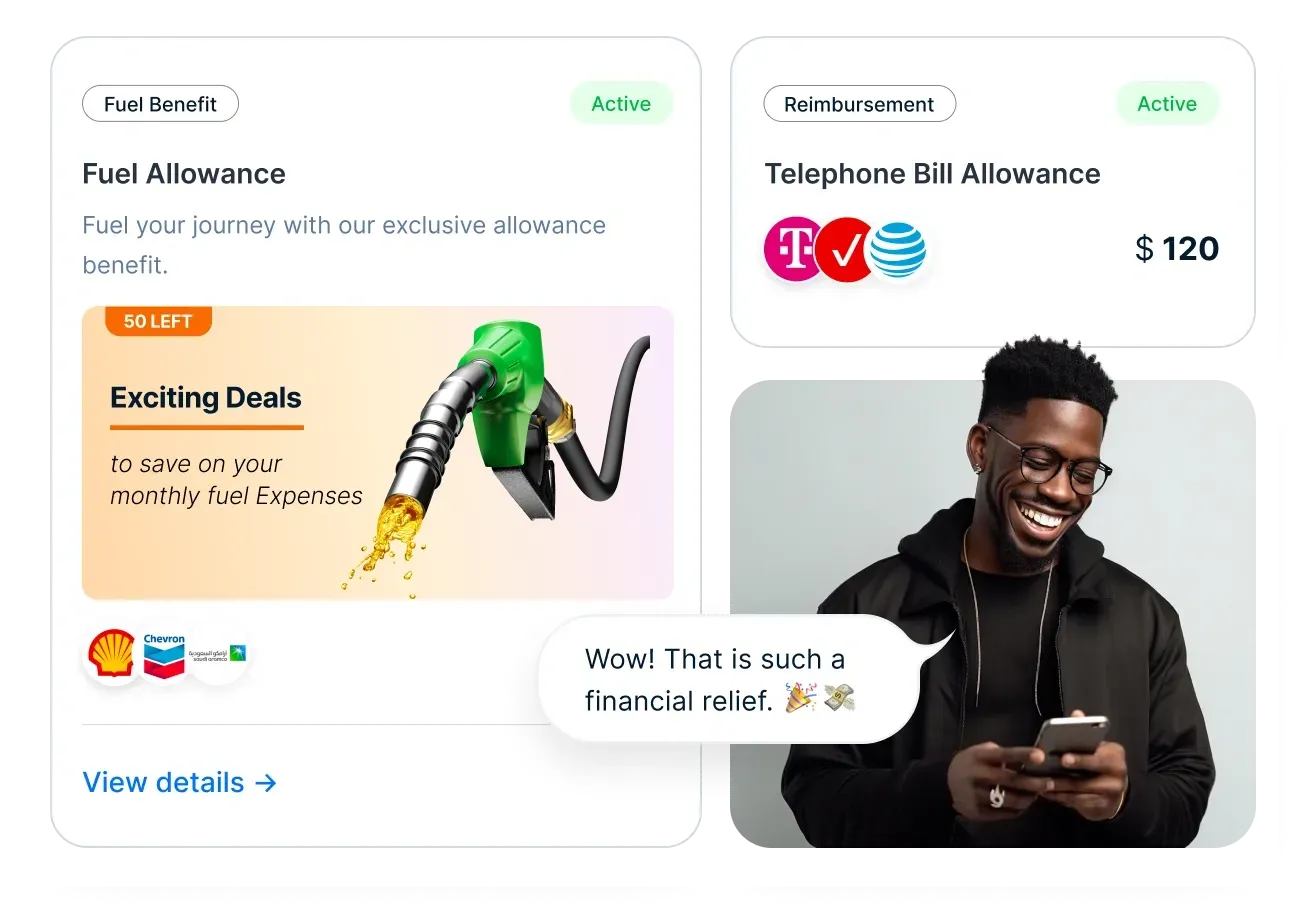

2. Enable tax-saving benefits with multi-wallet cards

One of the most innovative ways to reduce costs (for boththe company and employees) is by offering tax-saving benefits that comply with local regulations.

Empuls supports tax-saving categories like:

- Meal allowances (online and offline food expenses)

- Fuel reimbursements (for travel and commute)

- Books, periodicals, and telecom (learning & connectivity)

- Wellness and health-related benefits

These benefits can be disbursed through a single multi-wallet card, simplifying administration and maximizing savings.

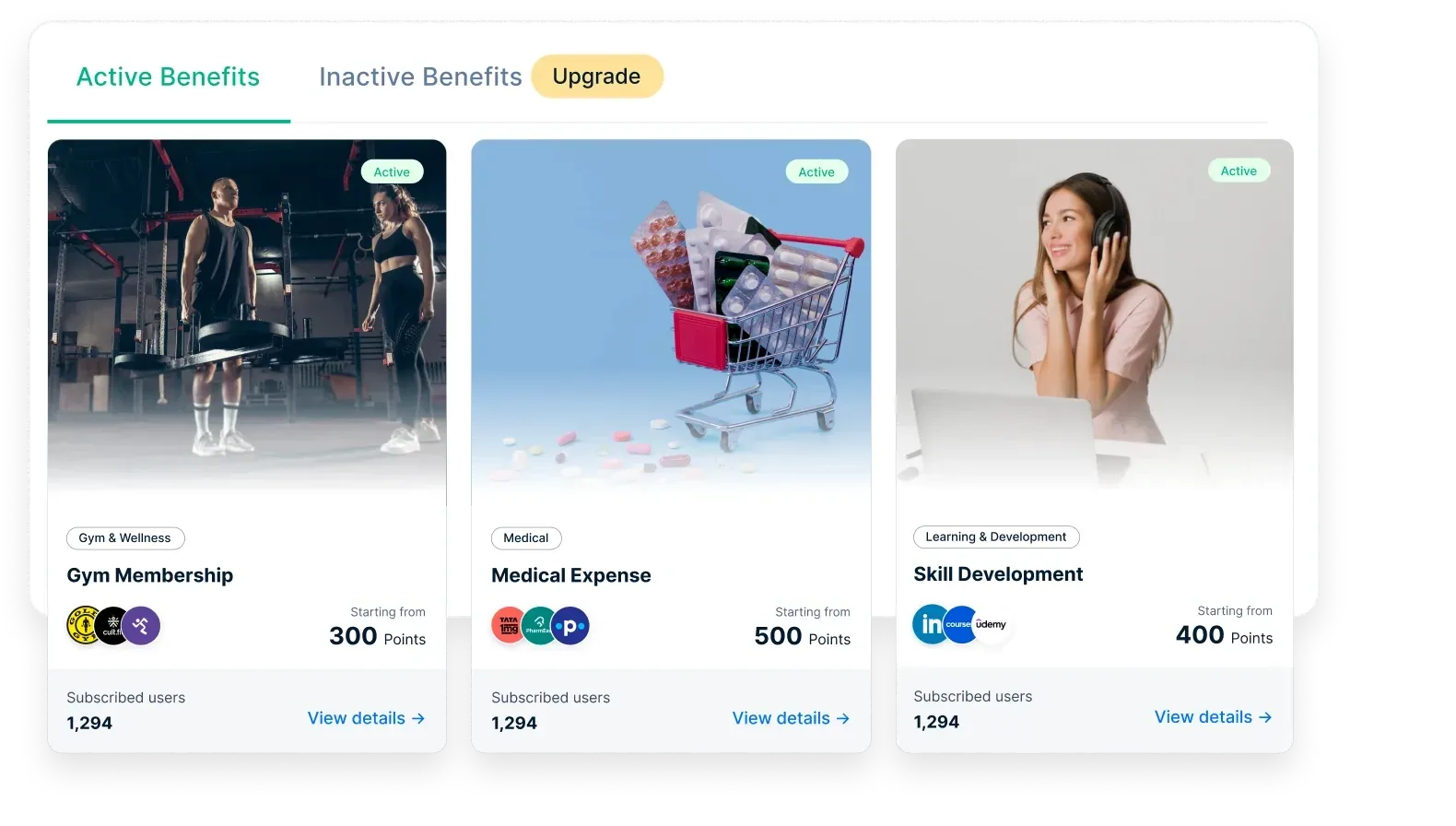

3. Provide flexible fringe benefits with lifestyle spending accounts (LSAs)

Modern workforces are diverse—and so are their needs. Empuls helps companies go beyond traditional offerings by setting up flexible LSAs. These allow employees to choose what matters most to them.

Empuls-supported fringe benefit categories:

- Fitness & wellness memberships

- Upskilling and education courses

- Family care (childcare, elder care, fertility support)

- Remote work setup and travel

- Mental health and mindfulness

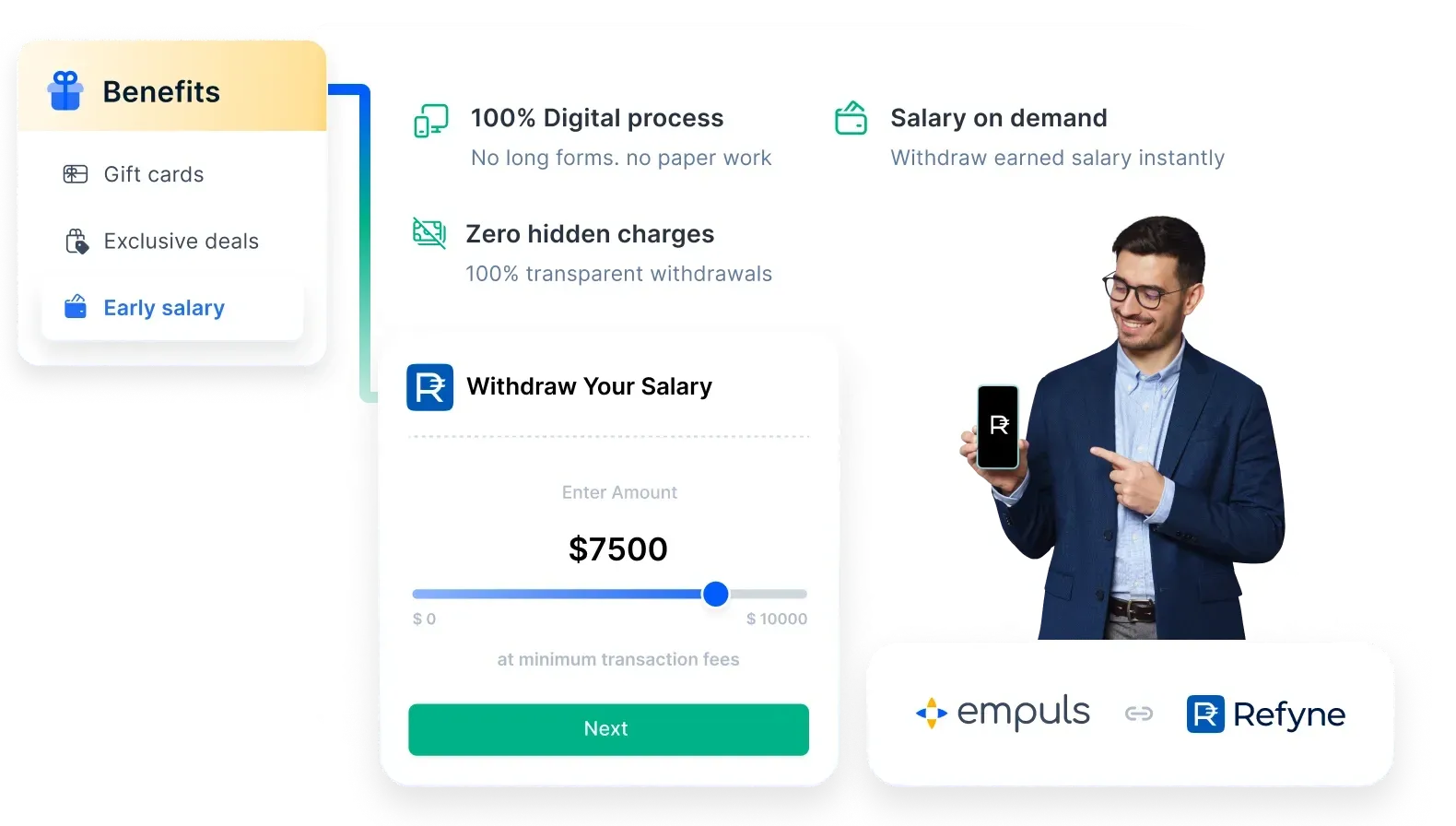

4. Offer salary advance and earned wage access

Short-term financial stress can impact employee productivity, mental health, and retention. Instead of high-interest loans, give your people access to their earned wages—on demand.

With Empuls salary advance, employees can:

- Withdraw part of their salary before payday

- Track earned wages in real time

- Avoid debt traps and unnecessary financial strain

5. Track utilization & ROI with real-time insights

Many companies offer perks without knowing if they’re being used. Empuls helps track:

- Which benefits are being claimed most

- Savings generated per employee

- Program adoption rates across departments

- Overall ROI on your perks and benefits budget

🚀 Smart benefits. Real savings. Happier employees.

Empuls makes it easy to design a cost-effective, high-value benefits program that caters to modern employee expectations. By combining curated discounts, tax-saving allowances, flexible fringe benefits, and financial wellness tools, Empuls helps you:

- Reduce benefits wastage

- Boost utilization and employee satisfaction

- Stretch your budget with measurable ROI

Conclusion

The importance of employee benefits cannot be stressed enough. While they look like an expense to the business, the advantages of these employee support programs far outweigh the costs.

That’s why calculating employee benefits is crucial for businesses, as understanding its costs helps them determine the ROI and optimize it further for better efficiency.

Hence, as a business, you must treat employee benefits as an investment and strategy that brings long-term benefits rather than a business expense.

FAQs

1. How to calculate benefits for employees?

To calculate employee benefits, list all offered benefits (e.g., health insurance, bonuses, paid time off), assign a monetary value to each, and add them to find the total cost per employee.

2. How to calculate benefits as a percentage of salary?

Divide the total annual value of benefits by the employee’s annual salary, then multiply by 100. For example, if benefits are worth ₹1,00,000 and salary is ₹5,00,000, benefits equal 20% of wages.

3. What types of benefits should be included in the calculation?

Include health insurance, retirement contributions, bonuses, paid leave, wellness perks, and any other non-salary compensation the employee receives.

4. Why is it important to calculate employee benefits accurately?

Accurate benefit calculations help with budgeting, total compensation analysis, employee retention, and compliance with labor laws and tax reporting.

5. Do benefit costs vary by employee type or location?

Yes, benefit costs can vary based on factors like full-time vs part-time status, seniority, job role, and geographical location due to different regulations and cost structures.