Employee Engagement in the Banking Sector & Ways to Deal with Challenges Faces by Bank Employees

Employee engagement in banking sector is vital to combat stress, burnout, and high attrition. This blog explores key challenges bank employees face and offers effective engagement strategies to improve retention, motivation, and productivity.

On this page

The banking sector stands as one of the most demanding and dynamic industries, where precision, trust, and customer satisfaction are non-negotiable. However, behind the seamless financial operations lies a workforce often grappling with high stress, long hours, and evolving regulatory pressures. In such an environment, employee engagement in the banking sector becomes a strategic necessity, not just a cultural initiative.

With rising attrition rates, burnout, and operational silos, banks are actively seeking ways to create more human-centric workplaces. This has led to a growing focus on employee engagement activities in banks—ranging from recognition programs and wellness initiatives to digital communication tools and feedback mechanisms.

In this blog, we explore the challenges faced by the banking sector in keeping their teams motivated, connected, and productive. More importantly, we uncover actionable strategies and tech-enabled solutions to overcome these barriers and build a thriving, future-ready workforce.

8 Challenges faced by the banking sector

The banking sector faces unique challenges in employee engagement due to the nature of the industry. High-pressure environments, strict regulatory compliance, and the ever-evolving technological landscape can strain the morale and enthusiasm of banking professionals.

However, recognizing these challenges is the first step towards addressing them effectively.

Here are some of the challenges faced by the banking sector employees:

1. Heavy workload and stress

Bank employees often deal with a high volume of transactions and customer interactions. During peak hours, the pressure to meet service standards and sales targets can be intense, leading to stress and burnout. Managing this workload while maintaining quality customer service can be challenging.

2. Regulatory compliance

The banking industry is highly regulated to ensure financial stability and protect consumers. Bank employees must navigate a complex web of rules and regulations, including anti-money laundering (aml) and know your customer (kyc) requirements. Staying compliant and up-to-date with regulatory changes is a constant challenge.

3. Technology adaptation

With the rapid advancement of technology, banks are continually adopting new systems and software, such as KYB verification or cloud computing, to improve efficiency and security. Bank employees, especially older generations, may find it challenging to adapt to these technological changes. Training and support are crucial to help employees embrace and utilize these tools effectively.

Bank employees, especially older generations, may find it challenging to adapt to these technological changes. Training and support are crucial to help employees embrace and utilize these tools effectively.

4. Customer expectations

Customers have increasingly high expectations for seamless and personalized banking experiences. Meeting these expectations can be difficult, especially when faced with complex inquiries or dissatisfied clients. Handling customer complaints and ensuring customer satisfaction are ongoing challenges.

5. Security concerns

Bank employees handle sensitive financial information and are responsible for preventing security breaches and fraud. The ever-evolving tactics of cybercriminals require constant vigilance and training. Security breaches not only put customers at risk but also create additional stress for employees.

6. Sales targets and incentives

Many bank employees are required to meet sales targets, such as selling financial products or meeting cross-selling goals. The pressure to achieve these targets can lead to unethical practices or overly aggressive sales tactics, which may compromise the customer experience and employee morale.

7. Work-life balance

Long working hours, especially during busy periods, can disrupt employees' work-life balance. Maintaining a healthy equilibrium between work and personal life is essential for well-being and job satisfaction. Lack of balance can lead to burnout and decreased productivity.

8. Customer difficulties

While most customers are reasonable and cooperative, bank employees occasionally encounter difficult or irate customers. Handling these situations professionally and resolving issues to the customer's satisfaction requires patience and strong interpersonal skills.

Explore how Empuls can help banks drive excellence in the banking sector through enhanced engagement. Talk to our employee engagement specialist.

How to engage bank employees: 12 effective strategies

Engaging bank employees is essential for fostering a motivated and productive workforce. Here are 12 effective strategies for engaging bank employees, along with examples of banks that have successfully implemented them:

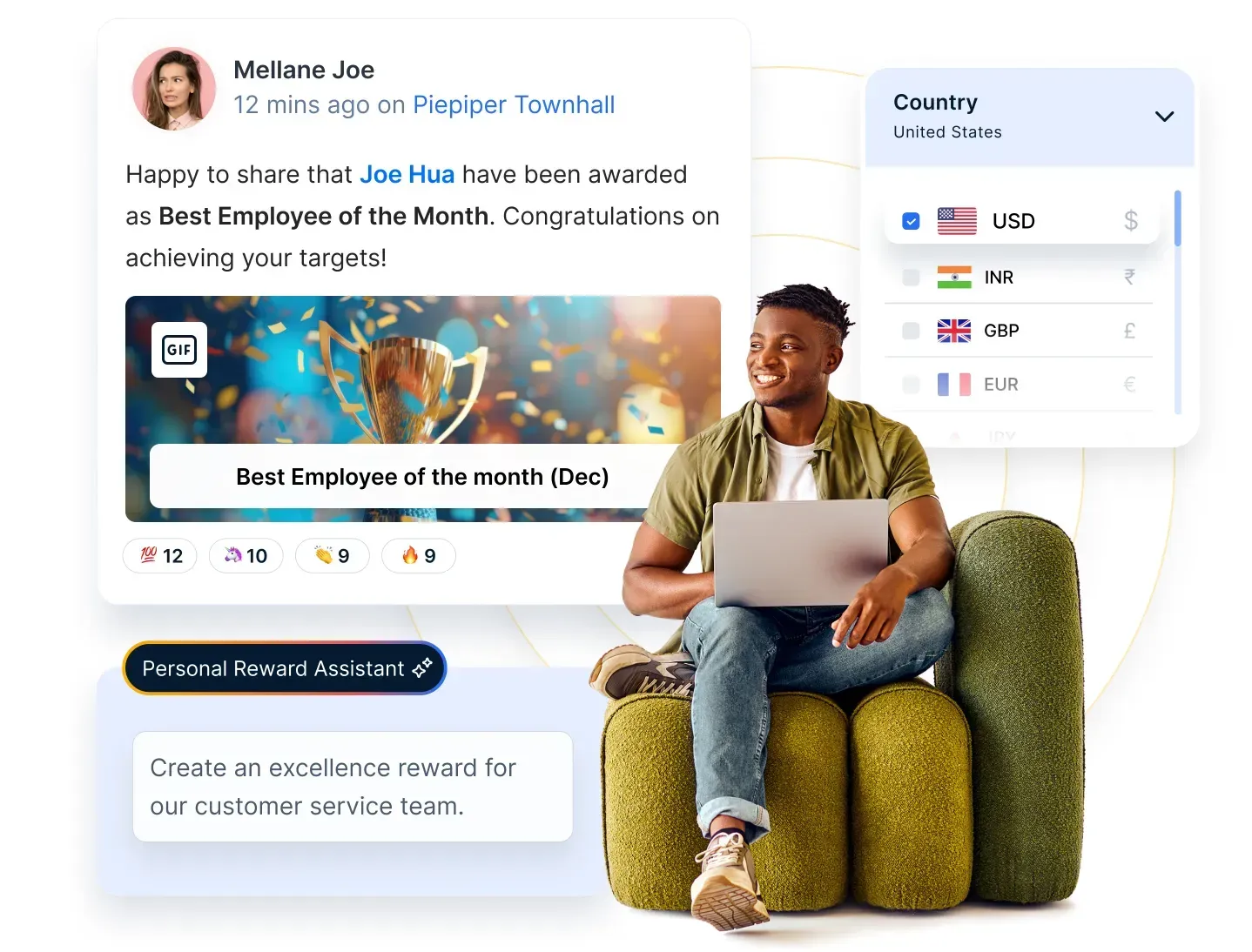

1. Recognize and reward performance consistently

Banking jobs can be high-pressure and target-driven. Employees often work behind the scenes in regulatory, operational, or financial roles with little appreciation. Without consistent recognition, motivation and retention can suffer. Recognition is a low-cost, high-impact way to show employees that their work matters.

Empuls enables real-time, peer-to-peer, and manager-led recognition with built-in award types (spot, value-based, jury, service awards, etc.). With smart AI nudges from Em, managers are reminded to appreciate efforts regularly. Recognition appears on a social feed, driving visibility and motivation.

Wells Fargo, one of the largest banks in the United States, implemented the "Spotlight Award" program to recognize and reward outstanding employee performance. This program encourages employees to go above and beyond their regular duties and promotes a culture of recognition and appreciation.

How it works:

1. Employees, supervisors, or peers can nominate individuals or teams for the Spotlight Award.

2. Nominations highlight specific actions or behaviors that exemplify Wells Fargo's values and contribute to the bank's success.

3. Award recipients receive a monetary bonus and public recognition within the organization.

Impact: Wells Fargo's Spotlight Award program has positively impacted employee engagement. It recognizes exceptional performance and motivates employees to deliver high-quality service consistently.

The bank fosters a culture of excellence and teamwork by publicly acknowledging and rewarding outstanding efforts.

2. Investment in training and development

Investing in continuous learning and development, banks empower their employees to stay up-to-date with industry trends and enhance their skills. Offering relevant courses, workshops, and career path guidance helps employees feel valued and motivated to excel in their roles.

JPMorgan Chase, a global banking leader, launched the "Path Forward" program to invest in the training and development of its employees. This program demonstrates the bank's commitment to helping its workforce adapt to industry changes and build skills for the future.

How it works:

1. "Path Forward" offers a range of training opportunities, including digital skills training, leadership development, and industry-specific certifications.

2. Employees can access online courses, attend workshops, and participate in mentorship programs.

3. The bank encourages employees to set career development goals and provides support to help them achieve these goals.

Impact:

1. Employees feel more engaged and confident in their roles, knowing that the bank invests in their professional growth.

2. The bank benefits from a more skilled and adaptable workforce that can navigate industry changes and provide better service to customers.

3. Employee turnover rates decrease as employees see opportunities for career advancement within the organization.

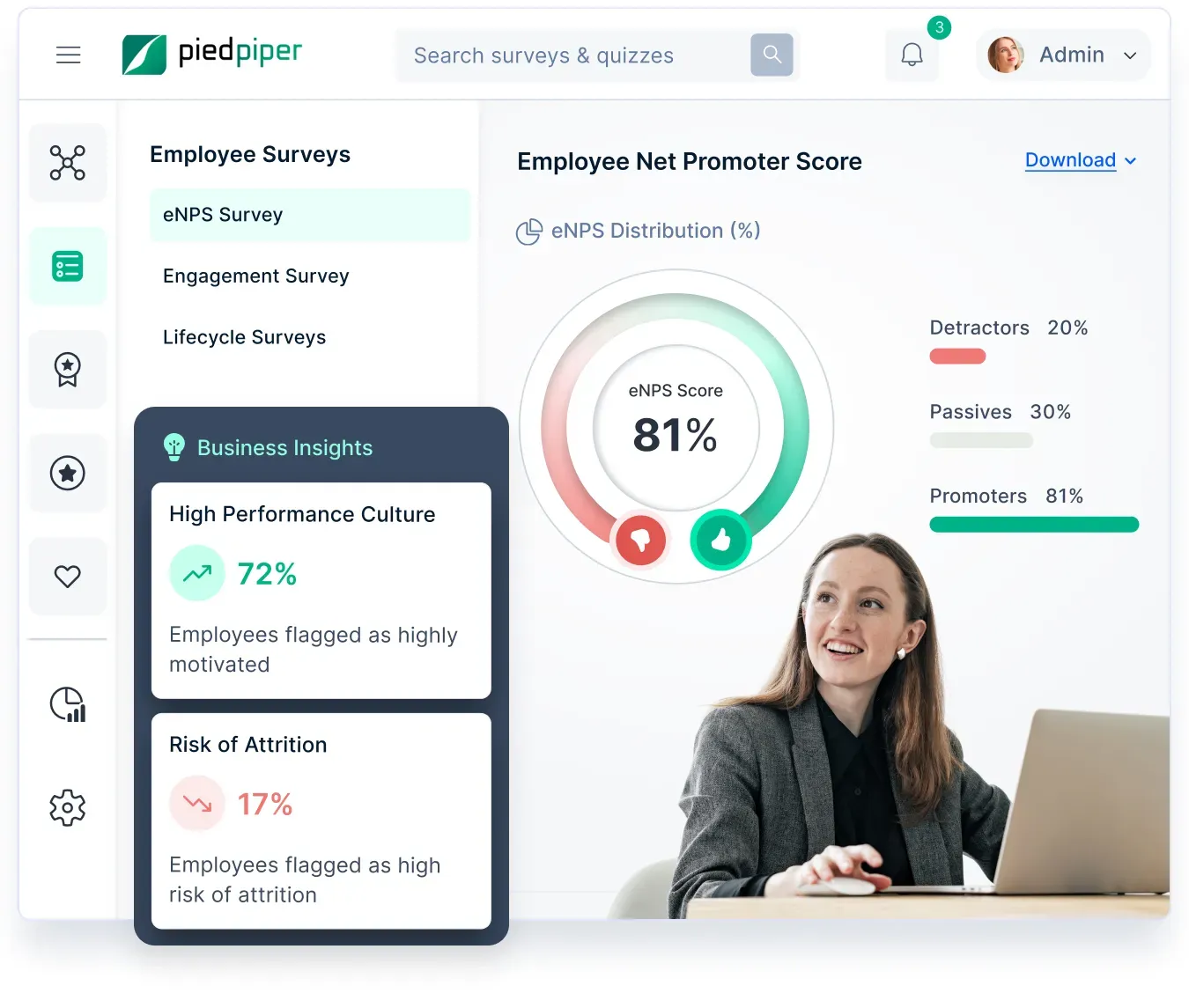

3. Use surveys to understand and act on employee sentiment

The financial sector is inherently high-stress, driven by a unique mix of intense regulatory oversight, rapid technological change, and high-stakes decision-making. Banks and financial institutions must constantly adapt to evolving compliance mandates, such as AML (Anti-Money Laundering), KYC (Know Your Customer), and data privacy regulations like GDPR and CCPA. This creates significant operational pressure on employees who are responsible for maintaining accuracy, mitigating risk, and meeting tight deadlines.

Additionally, innovation in fintech and growing competition from digital-first banks mean that traditional financial institutions are always playing catch-up—adopting new tools, processes, and platforms while still maintaining the reliability customers expect. This dual demand for compliance and agility puts front-line staff, operations teams, and even leadership under constant strain.

When employees in such environments feel unsupported, unheard, or disengaged, the risks multiply:

- Burnout becomes rampant, leading to decreased productivity and job dissatisfaction.

- Attrition rates rise, increasing hiring and training costs, and disrupting team cohesion.

- Mistakes occur more frequently, particularly in critical areas like transaction handling, customer communication, or compliance reporting.

- Ultimately, this can lead to reputational damage—one compliance breach or customer service failure can erode trust and trigger financial penalties or media scrutiny.

This is why active employee listening—through regular feedback loops, engagement surveys, and visible action—is not just a “nice-to-have” in banking. It’s a strategic imperative. Platforms like Empuls make it easier for HR and leadership to listen continuously, gather deep insights, and respond proactively—creating a culture where employees feel valued, and risks are minimized.

TD Bank, a leading North American bank, has implemented a comprehensive "Voice of the Employee" (VoE) program to promote open communication and gather feedback from employees. The bank recognizes that employees often have valuable insights into improving processes and the work environment.

How it works:

1. TD Bank conducts regular surveys and feedback sessions where employees can anonymously share their opinions, concerns, and suggestions.

2. The bank's leadership team reviews the feedback and takes action on the most critical issues raised by employees.

3. TD Bank also hosts town hall meetings and communication sessions to keep employees informed about company goals and strategies.

Impact:

1. The VoE program has fostered a culture of transparency and trust within TD Bank.

2. Employees feel heard and valued, leading to higher levels of job satisfaction and engagement.

3. The bank has been able to identify and address issues promptly, resulting in improved work processes and a more supportive work environment.

4. Employee wellness programs

Employee well-being is paramount. Banks can promote physical and mental wellness through initiatives like fitness challenges, access to wellness resources, and stress management workshops. Encouraging work-life balance and supporting mental health challenges can significantly improve overall job satisfaction.

Standard Chartered Bank, a global financial institution, launched the "Live Well" initiative to prioritize the physical and mental well-being of its employees. Recognizing that a healthy workforce is a more engaged and productive one, the bank invests in various wellness programs.

How it works:

1. "Live Well" includes initiatives such as gym memberships, wellness challenges, mental health support, and access to health resources.

2. The bank encourages employees to participate in wellness activities and provides incentives for achieving health and fitness goals.

3. Standard Chartered Bank also offers flexible work arrangements to help employees better balance their work and personal lives.

Impact:

1. The "Live Well" initiative has resulted in a healthier and more engaged workforce, with reduced absenteeism and improved productivity. 2. Employees report feeling supported in their well-being, leading to higher job satisfaction and reduced stress.

2. Standard Chartered Bank's commitment to employee wellness has also helped attract and retain top talent in a competitive industry.

5. Employee development and career growth opportunities

Demonstrating a commitment to employee growth and advancement is key to engagement. Banks can offer opportunities for career progression, promotions from within, and individual development plans that align with employees' career aspirations. Cross-training can also enrich employees' skills and job satisfaction.

Citibank, a global banking institution, has implemented a comprehensive "Career Progression Framework" to empower its employees with clear paths for career growth and development. This strategy focuses on helping employees advance in their careers within the organization.

How it works:

1. Citibank provides employees with a structured career development plan that includes skill-building, mentorship programs, and opportunities for advancement.

2. Regular performance evaluations and feedback sessions help employees understand their strengths and areas for improvement.

3. The bank encourages employees to set career goals and offers support, including financial assistance for relevant certifications or degrees.

Impact:

1. Employees are more motivated and engaged when they see a clear path for career progression within the organization.

2. Citibank benefits from a skilled and loyal workforce, reducing turnover and the costs associated with hiring and training new employees.

3. The "Career Progression Framework" enhances the bank's reputation as an employer of choice, attracting top talent.

6. Diversity and inclusion initiatives

A diverse and inclusive workplace fosters a sense of belonging among employees. Banks should actively promote an inclusive culture through training and awareness programs, diverse hiring practices, and support for employee resource groups.

These initiatives not only improve engagement but also reflect positively on the bank's reputation in the community and with customers.

Bank of America, a prominent banking institution, places a strong emphasis on diversity and inclusion (D&I) initiatives to create a more inclusive workplace. These programs aim to foster a sense of belonging among all employees.

How it works:

1. The bank actively recruits a diverse workforce and promotes a culture that values differences and perspectives.

2. Employee resource groups (ERGs) provide a platform for employees from various backgrounds to connect, share experiences, and contribute to the bank's diversity goals.

3. Bank of America offers unconscious bias training, D&I workshops, and leadership development programs that promote inclusivity.

Impact:

1. D&I initiatives lead to a more inclusive work environment where all employees feel respected and valued.

2. A diverse workforce brings a broader range of perspectives and ideas, which can lead to innovative solutions and improved customer service.

3. Bank of America's commitment to diversity and inclusion enhances its reputation as a socially responsible and forward-thinking employer.

7. Offer meaningful perks and financial well-being support

While bank employees are often highly financially literate, with a deeper understanding of budgeting, investments, and credit management than most, they are not immune to financial stress. In fact, this awareness can sometimes amplify their anxiety—especially when faced with the realities of rising living costs, inflation, housing expenses, education fees, or mounting debt. Even mid- and senior-level professionals may experience financial strain due to life events such as medical emergencies, family responsibilities, or unexpected job-related relocations.

What’s important to recognize is that financial stress doesn’t discriminate by knowledge level or income bracket. The pressure to meet financial obligations, support dependents, and plan for the future can affect mental health, job performance, and overall well-being—regardless of how savvy someone is with numbers.

This proactive approach builds loyalty, boosts morale, and reduces distractions caused by money-related anxiety. It transforms the workplace into a supportive ecosystem where employees feel both respected and protected.

Platforms like Empuls help banks achieve this by providing an all-in-one Perks & Benefits suite—equipped with global brand discounts, earned wage access, and customizable allowances that adapt to employees' unique needs and life stages.

8. Flexible work arrangements

Offering flexible work arrangements, such as remote work options or flexible hours, demonstrates trust in employees and supports their work-life balance. This flexibility can enhance job satisfaction and loyalty while accommodating individual needs and preferences.

HSBC, a global banking giant, has implemented flexible work arrangements to give employees more control over their work schedules and locations. This strategy recognizes that work-life balance is crucial for employee engagement.

How it works:

1. HSBC offers options such as remote work, flexible hours, compressed workweeks, and job-sharing arrangements.

2. Employees can choose the arrangement that best suits their needs, whether it's to accommodate family responsibilities, reduce commuting time, or enhance work-life balance.

3. The bank maintains a results-oriented approach, focusing on employee productivity rather than physical presence in the office.

Impact:

1. Flexible work arrangements improve employee satisfaction, reduce stress, and enhance overall well-being.

2. HSBC benefits from a more engaged and motivated workforce, as employees can better balance their professional and personal lives.

3. This strategy also contributes to the bank's reputation as an employer that values work-life balance and employee flexibility.

9. Mentorship and coaching programs

Implementing mentorship and coaching programs allows employees to receive guidance and feedback from more experienced colleagues. These programs can accelerate career development, boost confidence, and foster a strong sense of belonging within the bank.

Barclays, a global financial institution, has established a robust mentorship and coaching program designed to support the career growth and development of its employees. This strategy emphasizes the importance of learning from experienced professionals within the organization.

How it works:

1. Barclays matches employees with mentors who have relevant experience and expertise.

2. Mentorship pairs meet regularly to discuss career goals, challenges, and skill development.

3. The program also includes coaching sessions to help employees enhance their leadership and problem-solving skills.

Impact:

1. Mentorship and coaching programs create opportunities for employees to receive personalized guidance and support in their career journeys.

2. Barclays benefits from a more skilled and confident workforce, which can take on leadership roles and contribute to the bank's growth and innovation. 3. This strategy promotes a culture of continuous learning and development, enhancing overall employee engagement.

10. Employee volunteer and social responsibility initiatives

Encouraging employees to participate in volunteer and social responsibility initiatives reinforces a sense of purpose and community. Banks can organize volunteer activities or support charitable causes, allowing employees to contribute to causes they care about, which can lead to higher job satisfaction and engagement.

Santander Bank, a global banking group, encourages employees to participate in volunteer and social responsibility initiatives. This strategy aligns with the bank's values and allows employees to contribute to causes they are passionate about.

How it works:

1. Santander Bank provides paid time off for employees to volunteer in their communities.

2. The bank supports various charitable programs and partners with nonprofit organizations.

3. Employees can choose from a range of volunteer opportunities, from financial literacy education to environmental conservation efforts.

Impact:

1. Employee participation in volunteer and social responsibility activities fosters a sense of purpose and fulfillment beyond their regular job roles. 2. Santander Bank demonstrates its commitment to social responsibility and community engagement, enhancing its reputation as a responsible corporate citizen.

2. This strategy promotes a positive workplace culture by encouraging employees to collaborate on meaningful projects and give back to society.

11. Peer-to-peer recognition

Peer-to-peer recognition programs enable employees to appreciate and celebrate each other's achievements. These initiatives create a culture of appreciation, camaraderie, and teamwork, ultimately strengthening the sense of belonging and motivation among staff.

PNC Bank, a leading financial institution, has implemented a peer-to-peer recognition program called "Cheers for Peers." This strategy empowers employees to recognize and appreciate their colleagues' contributions and achievements.

How it works:

1. Employees can nominate their peers for recognition through an online platform or physical "cheers" cards.

2. Recognitions can be for outstanding teamwork, going the extra mile, or any other positive contribution.

3. The bank provides rewards or tokens of appreciation for recognized employees, such as gift cards or additional paid time off.

Impact:

1. Peer-to-peer recognition enhances the sense of camaraderie and teamwork among employees.

2. Employees feel valued and motivated when their efforts are acknowledged by their colleagues.

3. PNC Bank's "Cheers for Peers" program creates a culture of appreciation and positivity in the workplace, leading to increased job satisfaction and engagement.

12. Employee empowerment and decision-making

Empowering employees by involving them in decision-making processes and giving them autonomy in their roles can be highly engaging. When employees feel their opinions are valued and that they have a say in shaping the bank's direction, they become more invested in their work and the organization's success.

U.S. Bank, a major financial institution, has implemented the "Your Voice Matters" program, which empowers employees to have a say in decision-making processes within the organization. This strategy fosters a sense of ownership and engagement.

How it works:

1. U.S. Bank encourages employees to share ideas, suggestions, and feedback regarding improvements in processes, products, or customer service.

2. Employee input is actively sought through surveys, focus groups, and open-door policies with management.

3. The bank acknowledges and rewards employees for their contributions to the organization's success.

Impact:

1. Employee empowerment and involvement in decision-making enhance job satisfaction and engagement.

2. U.S. Bank benefits from valuable insights from employees who are closest to customer interactions and operational processes.

3. This strategy creates a culture of collaboration and innovation, leading to continuous improvements and a competitive edge in the industry.

Driving employee engagement in banking with Empuls

In the highly regulated, high-pressure world of banking, employee engagement is not just a cultural initiative—it's a business imperative. Enter Empuls, an AI-powered employee engagement platform that’s helping leading banks build connected, motivated, and resilient workforces.

Empuls empowers banking institutions to reimagine employee experience across branch and corporate locations through four powerful pillars:

1. Connect & align distributed teams

Banks often face communication silos across branches, departments, and regions. Empuls breaks these down with a dynamic social intranet, facilitating inclusive communication, real-time updates, and community engagement. Whether it’s celebrating a product launch or hosting a virtual town hall, Empuls keeps everyone in sync with the organization’s vision and goals.

2. Listen intelligently, act decisively

Through eNPS, pulse, and lifecycle surveys, Empuls enables HR leaders in banking to capture real-time sentiment and feedback. These insights, powered by advanced people analytics, help detect early signs of disengagement and guide strategic interventions—critical for high-stakes roles in finance.

3. Recognize contributions, motivate performance

Empuls supports automated and AI-assisted rewards and recognition programs, from peer-to-peer shoutouts to jury-based service awards. With regulatory-compliant workflows and a global rewards catalog—including gift cards, experiences, and banking-themed incentives—banks can foster a culture of appreciation while staying compliant and cost-efficient.

4. Support financial and emotional wellbeing

For a sector where financial literacy is high but stress levels often higher, Empuls offers perks, discounts, fringe benefits, and early wage access. Employees can save on essentials, access learning and wellness allowances, and manage unplanned expenses—reducing burnout and boosting retention.

Banking-grade security: ISO, GDPR, SOC2, and VAPT-compliant

Multilingual and multicurrency support: Ideal for global banking networks

White-labeled platform: Aligns with institutional branding

Seamless integration: Works with HRMS, MS Teams, Slack, and SSO platforms

Banks that invest in employee engagement platforms like Empuls report up to 1.5x growth in revenue, 87% increase in retention, and 30% higher customer satisfaction—a direct reflection of an empowered workforce.

Conclusion

As the banking sector continues to evolve in response to digital disruption, regulatory shifts, and rising customer expectations, investing in employee engagement in the banking sector is no longer optional—it’s a competitive advantage. By addressing the real-world challenges faced by the banking sector, from burnout to disengagement, banks can build resilient, motivated teams that drive both performance and trust.

Implementing the right employee engagement activities in banks, supported by AI-led platforms like Empuls, can help create a culture of appreciation, open communication, and continuous feedback. The result? A happier workforce, stronger employer brand, and ultimately, better outcomes for customers and stakeholders alike.

Now is the time for banks to put their people first—because when employees thrive, the entire institution flourishes.