The Ultimate Guide to Employee Benefits: Types, Importance, and Best Practices

This ultimate guide to employee benefits covers everything from types and importance to best practices for building a happier, more engaged workforce.

On this page

- Here's why your employees are the true backbone of your business

- The never-ending disappearing act: where does your paycheck go?

- What are employee benefits?

- Why are employees drowning in financial stress?

- Why employee benefit matter?

- Types of employee benefits companies must provide

- How to design an employee benefits program?

- Companies adopting this method

- How Empuls can help in creating an employee benefits plan

- Conclusion

Every business, no matter how big or small, intricate, or simple, relies on one crucial element for its success: its employees. They are the lifeblood of your organization, the ones who translate ideas into action and keep the wheels turning. Studies show a clear link between happy employees and organizational success.

Fortune magazine's "100 Best Companies to Work For" list provides compelling evidence. Over a seven-year period (1998-2005), the stock prices of these companies enjoyed an impressive 14% annual increase, significantly outperforming the market average. In contrast, companies not featured on the list saw a more modest 6% annual growth in their stock prices.

Even the most innovative product or service needs a team behind it to develop, market, and deliver it. Without a dedicated workforce, your brilliant ideas are just that - ideas. Your employees are the ones who bring those ideas to life and propel your business forward.

Here's why your employees are the true backbone of your business

Your employees are the ones who get things done. They handle day-to-day operations, manage projects, and ensure your products and services are delivered efficiently.

They are the bridge to your customers: Many employees directly interact with customers, shaping their perception of your brand. Happy, engaged employees provide exceptional customer service, fostering loyalty and driving sales.

They are a wellspring of innovation: Employees with diverse backgrounds and experiences bring fresh perspectives to the table. When empowered and valued, they can be a source of game-changing ideas and solutions.

They are your brand ambassadors: Your employees represent your company culture both inside and outside the workplace. A positive and enthusiastic workforce reflects well on your brand, attracting both customers and top talent.

The never-ending disappearing act: where does your paycheck go?

We've all heard it: money comes and goes. But sometimes, it feels like it goes a whole lot faster than it comes! This is especially true when you factor in the seemingly endless list of expenses: groceries, rent/mortgage, utilities, health insurance, car payments... the list goes on. But where exactly does each chunk of your hard-earned salary end up?

This isn't just a budgeting question – it's a question of understanding your financial reality. Unfortunately, taking a deep breath and a positive attitude will not solve this problem.

Decision fatigue: Here's the thing: making choices all day long takes a toll. Psychologists call this phenomenon "decision fatigue." Imagine you've just navigated a morning rush hour, tackled a mountain of emails, and dealt with a demanding client. By the time you reach lunchtime, your brain is fried.

This is when those impulsive decisions creep in – the extra pastry at the coffee shop, the unnecessary shopping spree, or the "must-have" car add-on you can't quite afford. Even the most rational person can fall victim to decision fatigue, leading to financial choices they might regret later.

As an employer, you are responsible for keeping your employees happy, motivated, and engaged. One of the ways to achieve this is by implementing an effective employee benefits program.

Employee benefits programs are an integral part of any organisation's compensation plan. They provide a range of benefits and perks to employees beyond their regular wages, including health and wellness benefits, retirement benefits, time-off benefits, employee perks and discounts, and educational assistance.

In this comprehensive guide, we will explore what employee benefits, their importance, and types, and how to design an effective program.

What are employee benefits?

Employee benefits are a set of incentives, perks, and privileges an employer provides to their employees in addition to their regular salaries and wages. They are designed to enhance the overall compensation package of the employees, thereby attracting and retaining top talent, improving employee morale, and increasing productivity.

Why are employees drowning in financial stress?

According to pwc, 60 % of full-time employees are stressed about their finances. This number surpasses even the peak of pandemic-related financial anxieties. Even high earners aren't immune – nearly half (47%) of those making over $100,000 annually still struggle with financial burdens.

The financial squeeze is tightening for many employees. 49% report difficulty meeting basic monthly expenses, a significant jump from 41% just last year. To make matters worse, the burden of credit card debt is also rising. Among employees with credit card balances, a staggering 44% struggle to make even the minimum payments on time, up from 37% in the previous year.

From stress to poor performance

Financial stress doesn't just impact your mood; it can wreak havoc on your ability to perform at work. Here's how:

Concentration and problem-solving: When you're worried about bills, it's hard to focus on complex tasks or think creatively.

Sleep deprivation: Around 77% of U.S. adults lose sleep due to financial anxieties. Sleep deprivation impairs cognitive function, making it even harder to concentrate and be productive at work.

Mood and irritability: Financial stress can lead to feelings of frustration and anger, which can strain relationships with colleagues and clients.

Beyond the paycheck: how employee benefit makes them happier

A competitive salary is essential to attract and retain top talent. But in today's job market, employees are looking for more than just a paycheck. Comprehensive employee benefit packages are increasingly becoming a deciding factor in job satisfaction and happiness.

Why employee benefit matter?

According to a Society for Human Resource Management study, 60% of employees prioritize employee benefit when deciding to stay with their current employer. This highlights the importance of a strong benefit package in retaining valuable talent. Studies consistently show a strong correlation between employee benefit and overall well-being. Here's how:

Reduced financial stress: Benefits like health insurance, retirement plans, and paid time off provide a financial safety net, alleviating stress and anxiety about unforeseen medical bills, future security, and taking a break.

Improved work-life balance: Generous paid leave policies, flexible work arrangements, and childcare assistance empower employees to manage personal responsibilities without sacrificing work performance. This fosters a healthier work-life balance, leading to increased happiness and reduced burnout.

Feeling valued and appreciated: A robust benefit package demonstrates that an employer cares about their employees' well-being beyond just their labor. This fosters loyalty, engagement, and a sense of belonging, leading to a happier and more motivated workforce.

- According to Glassdoor’s Employment Confidence Survey, about 60% of people report that benefits and perks are a major factor in considering whether to accept a job offer. The survey also found that 80% of employees would choose additional benefits over a pay raise.

- According to a survey conducted by the SHRM, 55% of HR professionals reported that their employees highly or somewhat valued employee discounts and 77% of organizations offer employee discounts or perks for their employees².

- According to a survey by Qualtrics, 66% of workers claim benefits are the most critical factor when choosing a job and 61% of employees would take a lower-paying job if it offers a robust benefits package.

- According to a survey by Zenefits, 78% of employees said they would trade a higher salary for better benefits and perks and 60% said they would take a pay cut for more flexible work arrangements.

- According to HBR, 51% of employees said they would switch employers for better wellness benefits and 35% said they have left a job due to poor wellness benefits.

Types of employee benefits companies must provide

Attracting and retaining talent in the workforce are two of the most important aspects of running a successful business venture. Employee benefits are non-wage compensations offered in addition to a staff member’s salary, and some of them can be quite valuable to retain talent and attractive for potential candidates.

As the proposed employee benefits package can play a significant role in negotiations between employers and talents they wish to be interested in, recognizing what your organization can offer is vital. If your business hires a combination of employees and independent contractors, one great way to create a stronger culture across your workforce is by offering benefits for international independent contractors.

Here are seven types of employee benefits your company should consider including in the package, in addition to the ones that are requested by law (such as minimum wage, overtime, compensation, and disability insurance).

1. Medical benefits

The most important employee benefits that the prospective staff cares about are their health-related ones. Medical benefits such as health insurance, dental insurance, life insurance, disability income protection, and long-term care will show the staff that your company values their contributions as well as their wellbeing.

Health and dental insurance, the most vital of all the above-mentioned medical benefits, will, among other things, help your employees get private rooms in hospitals should they need them, cover the costs of prescription drugs, and offer them a choice of different dental treatments.

Disability income protection covers the employee’s compensations in case they get sick or injured, while long-term care compensates for expenses for ill or injured employee’s care.

2. Pension and retirement benefits

Certain employee benefits aim at taking care of your workforce even after they retire. Pension covers a fixed amount of funds to the employee after retirement and at regular payment intervals.

Retirement benefits can include perks apart from a pension, like providing specific health-related advantages.

3. Family-supporting employee benefits

A considerable number of your staff members are likely to have spouses and children, while some of them might be in need to take care of their elderly family members.

Creating the employee benefits package that focuses on helping workers balance their family and work life is the right decision for every business, no matter how big or small.

Parental leave benefits include paid maternity, paternity, and/or adoption leave. This benefits offering generally also includes programs to help workers choose the best daycare for their children.

Dependent care benefits represent a notable aid for the employees that need their sick or disabled children or elderly relatives watched after attentively.

4. Education and training benefits

Respecting your employees’ wishes to learn and develop personally and professionally will grant your organization many points when it comes to acquiring and retaining talent.

Workers will highly value an employer willing to provide education and training benefits such as mentorship programs, seminars, conferences, or tuition reimbursements.

In the long run, these expenses will really pay off for your organization, bringing in and keeping competent, educated, satisfied employees who are happy to work in a company that cares about their needs.

5. Transportation and relocation benefits

Transportation benefits for employees will help them manage the costs of official travel. These perks may include reimbursements for using public transportation methods (buses, trains, or metros), covering the costs of other transportation types, or even providing vehicles such as cars or bicycles to drive to and from work.

Relocation assistance benefits help your staff members make an efficient and painless transition from their current locations to the location of your business.

Your company can even offer exclusive perks like travel benefits, which will attract many potential employees you wish to be interested in your organization. If you manage a construction site you can offer commercial auto insurance for contractors and protect your employees' vehicles.

6. Legal assistance benefits

Sometimes, your employees may need professional legal advice concerning matters such as family law or real estate planning. When it comes to real estate, they can even look for real estate brokers, allowing them to manage property transactions more efficiently and collaborate with them.

Allowing them to approach your company’s legal representatives with issues they need help with will help you score high with potential staff and the current workforce.

7. Working conditions and business expenses

The traditional understanding of the workplace is rapidly changing, and a mixture of different generations and demographics demands that companies keep up with the pace.

The demand for improving general working conditions shows no signs of stopping. Your organization should at least try to accommodate the requirements most employees today find essential at the workplace.

Offering your staff excellent general working conditions that include workplace flexibility, positive company culture, and other perks such as reasonable workload, low occupational stress, or job security will help you appeal to the best candidates for the positions in your company.

How to design an employee benefits program?

As an employer, offering benefits to your employees can help attract and retain top talent, improve job satisfaction, and promote a healthier workforce. However, managing an employee benefits program can be complex and time-consuming.

1. Determine the benefits you want to offer

Before you can start offering benefits, you need to determine what benefits you want to offer. Consider the needs and preferences of your workforce, as well as your budget. Common benefits include:

- Health insurance

- Retirement plans

- Paid time off

- Life insurance

- Disability insurance

- Wellness programs

- Flexible work arrangements

You may also consider offering perks like employee discounts, tuition reimbursement, or childcare assistance.

2. Understand legal requirements

When offering employee benefits, it's important to understand the legal requirements that apply. This can include federal laws like the Affordable Care Act and state and local laws.

You may also need to comply with regulations like the Employee Retirement Income Security Act (ERISA) and the Health Insurance Portability and Accountability Act (HIPAA).

Consult with legal and HR professionals to ensure you comply with all legal requirements.

3. Develop a budget

Offering employee benefits can be expensive. To develop a budget, consider the costs of each benefit you want to offer and administrative costs like hiring a benefits provider.

You may also want to consider cost-sharing arrangements, where employees pay a portion of their benefits. This can help reduce your overall costs.

4. Select a benefits provider

Many employers work with a benefits provider to administer their benefits program. When selecting a provider, consider cost, expertise, and customer service factors.

You may also want to consider working with a broker who can help you compare different providers and plans and negotiate better rates.

5. Communicate the benefits to employees

Once you have developed your benefits program, it's important to communicate it to your employees. This can help ensure that employees understand the value of their benefits and how to use them.

Consider hosting a benefits fair or providing employees with a comprehensive benefits guide. You may also want to offer personalised counselling sessions where employees can ask questions and get advice on selecting the best benefits for their needs.

6. Administer benefits program

Administering a benefits program can be complex and time-consuming. If you are working with a benefits provider, they will typically handle most administrative tasks like enrolling employees and managing claims.

However, you will still need to monitor the program and ensure it runs smoothly. This can include conducting regular audits, tracking usage and costs, and addressing any issues.

7. Evaluate program effectiveness

To ensure that your benefits program is meeting the needs of your employees and your business, it's important to regularly evaluate its effectiveness. This can include reviewing usage data, gathering employee feedback, and tracking key performance indicators like retention rates and healthcare costs.

Use this information to identify areas where you can improve your benefits program and adjust as needed.

8. Make adjustments as needed

Employee needs and preferences can change over time, as can your business needs. As such, it's important to regularly review and adjust your benefits program to ensure it remains relevant and effective.

Consider surveying employees to gather feedback on the benefits they value most, and work with your benefits provider to identify new benefits or cost-saving measures that you can offer.

Companies adopting this method

“Providing benefits can put you above 43 percent of competitors who don’t offer extra benefits.”- Business.org.

The advantages of offering a range of employee benefits are apparent in the success of companies such as Netflix, Motus, Genentech, Adobe, and Amazon.

1. Netflix

This online streaming giant is well known for its liberal benefits plan. With a workplace attitude of “work smarter, not harder,” Netflix employees enjoy healthcare programs, excellent life insurance policies, paid time off, and free food at the company.

The most generous benefit is paid maternity and paternity leave of up to one year that the employees can look after and spend time with their newborn children.

2. Motus

Motus offers its employees a range of benefit plans, including gym memberships, student loan reimbursements, and company day service. This offer has allowed them to hire and keep talented young professionals for whom student debts are a huge financial burden.

How Empuls can help in creating an employee benefits plan

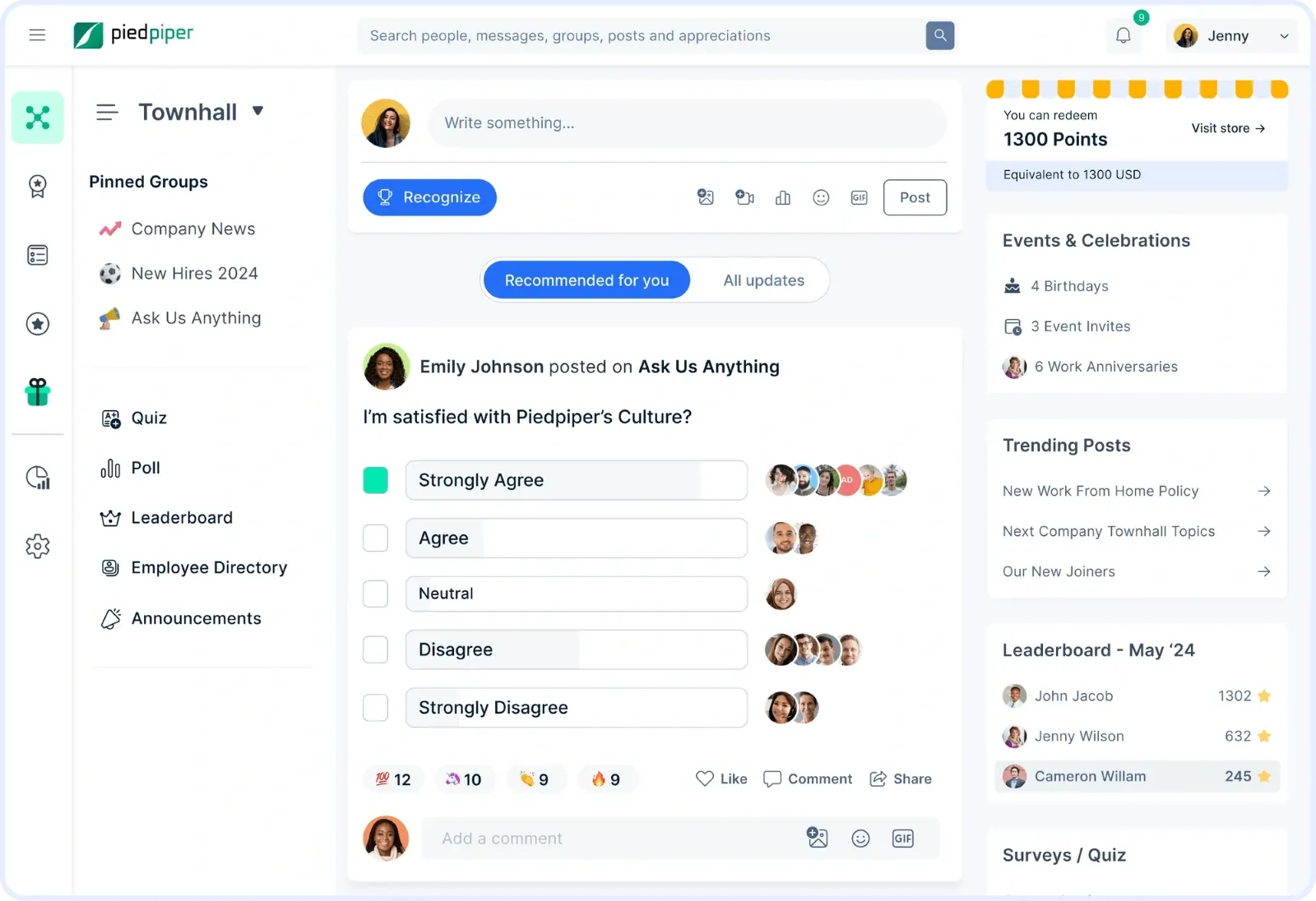

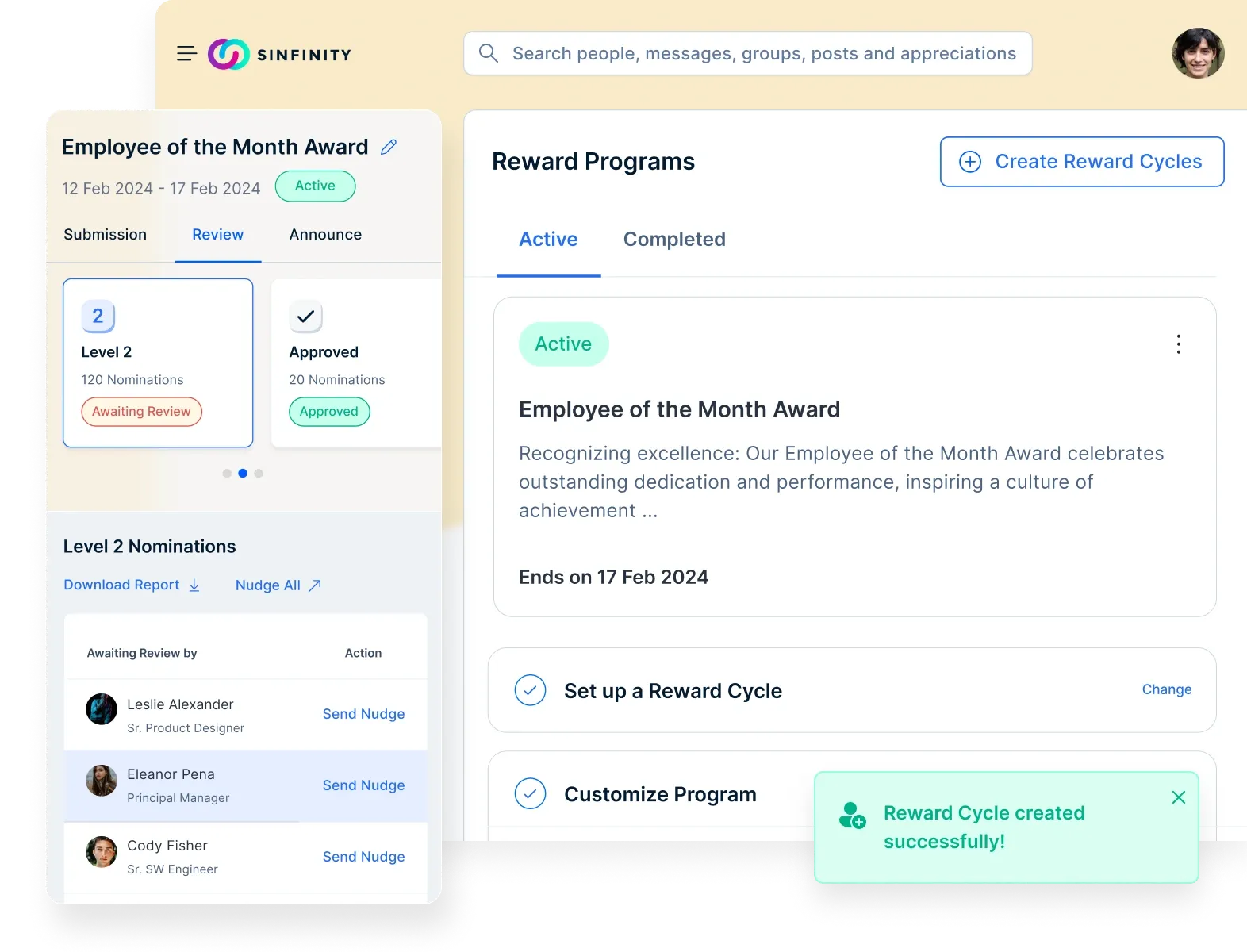

Empuls, by Xoxoday, offers a comprehensive, AI-powered employee engagement platform that not only recognizes and rewards employees but also streamlines the creation, management, and optimization of employee benefits programs.

Here’s how Empuls can directly support you in building a modern, impactful benefits plan:

1. One centralized platform for benefits administration

Get everything under one platform.

- Empuls acts as a single platform to manage a wide variety of employee benefits — from health perks and tax-saving benefits to fringe benefits and flexible lifestyle allowances.

- No more dealing with multiple vendors for different benefits like meals, wellness, education, travel, or childcare.

- It simplifies HR operations, saving time and reducing administrative overhead.

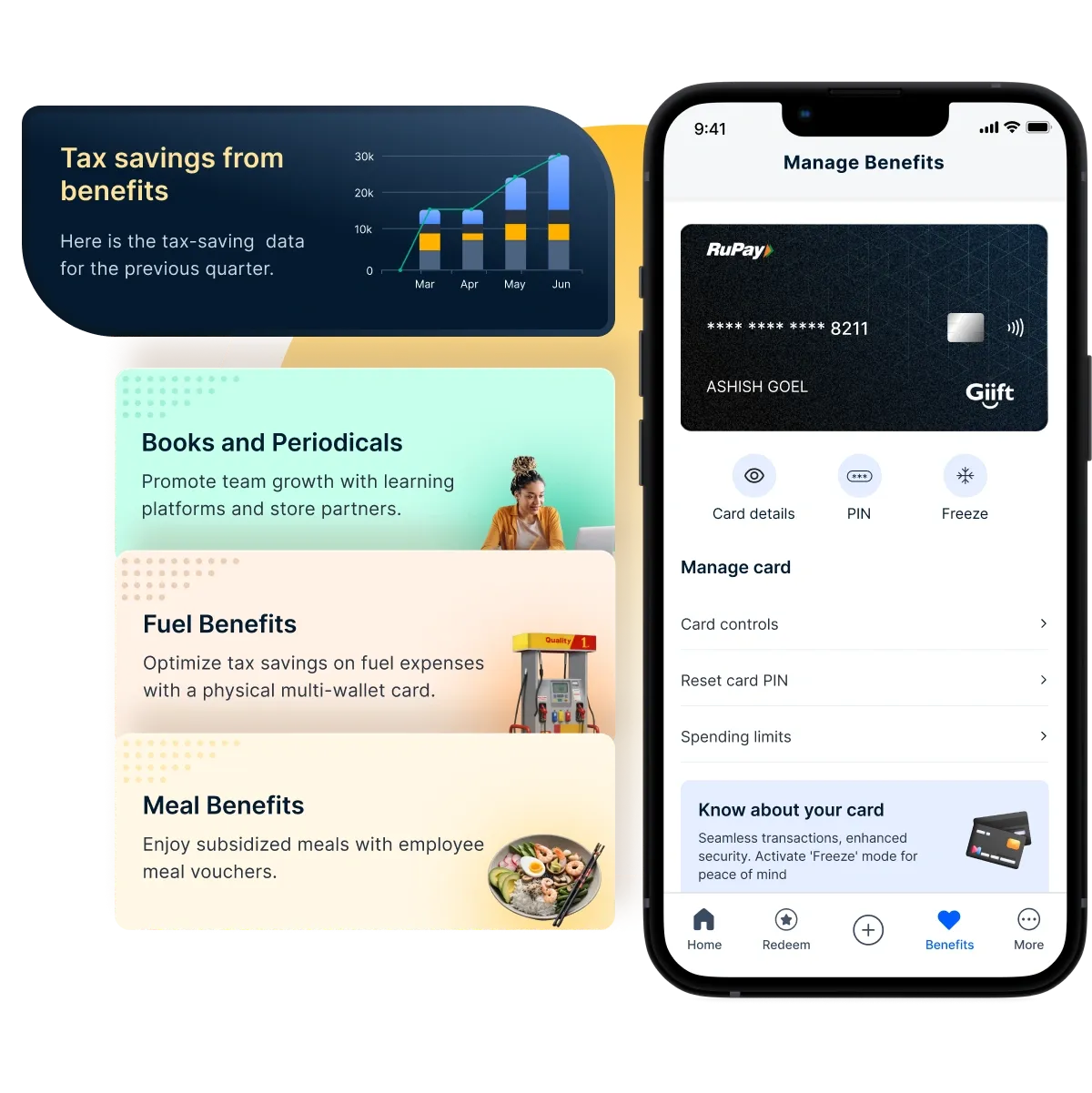

2. Flexible, tax-saving benefits for employees

- Empuls supports tax-compliant flexible benefits programs through tools like the RuPay-powered prepaid card.

- Employees can use allowances across meals, fuel, education, communication, health, and wellness — helping them save taxes and increase their salary-in-hand.

- It supports customized wallet settings, allowing businesses to define spending categories and limits per benefit.

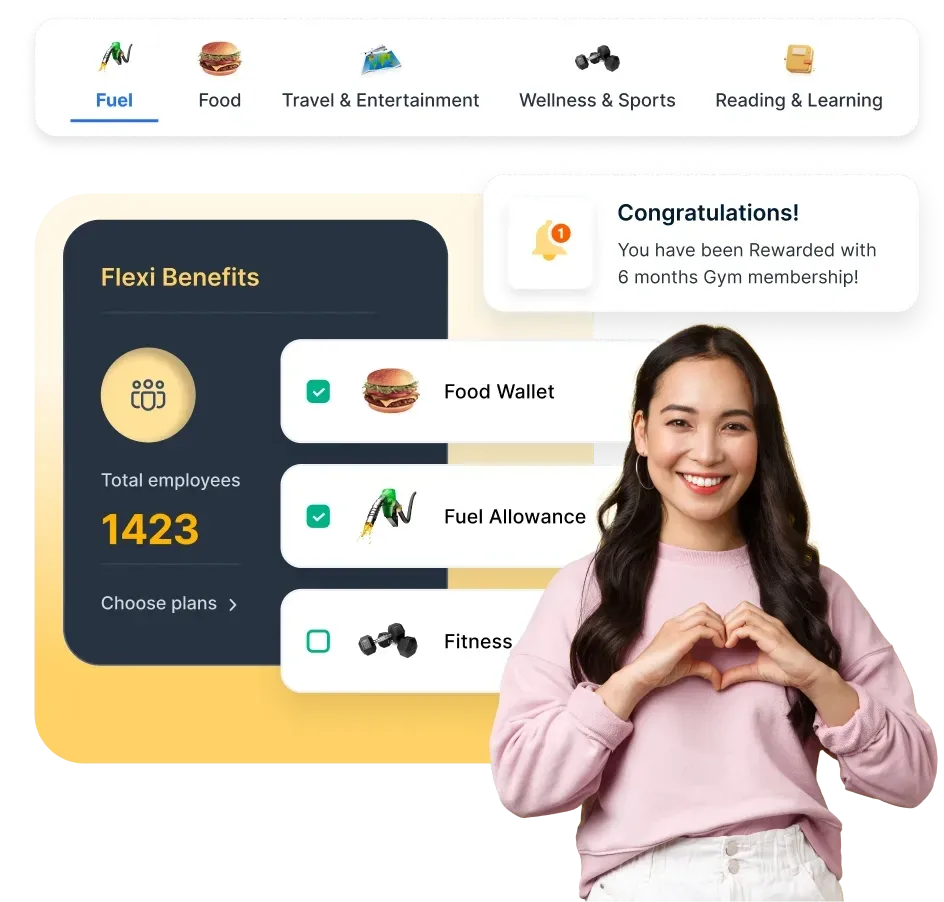

3. Fringe benefits to enhance lifestyle and wellness

- Empuls offers fringe benefits programs linked to Lifestyle Spending Accounts (LSAs).

- You can create allowances for fitness, mental well-being, learning, travel, remote work setup, and family care — all fully configurable.

- Employees get the freedom to pick what suits their lifestyle, leading to higher satisfaction and well-being.

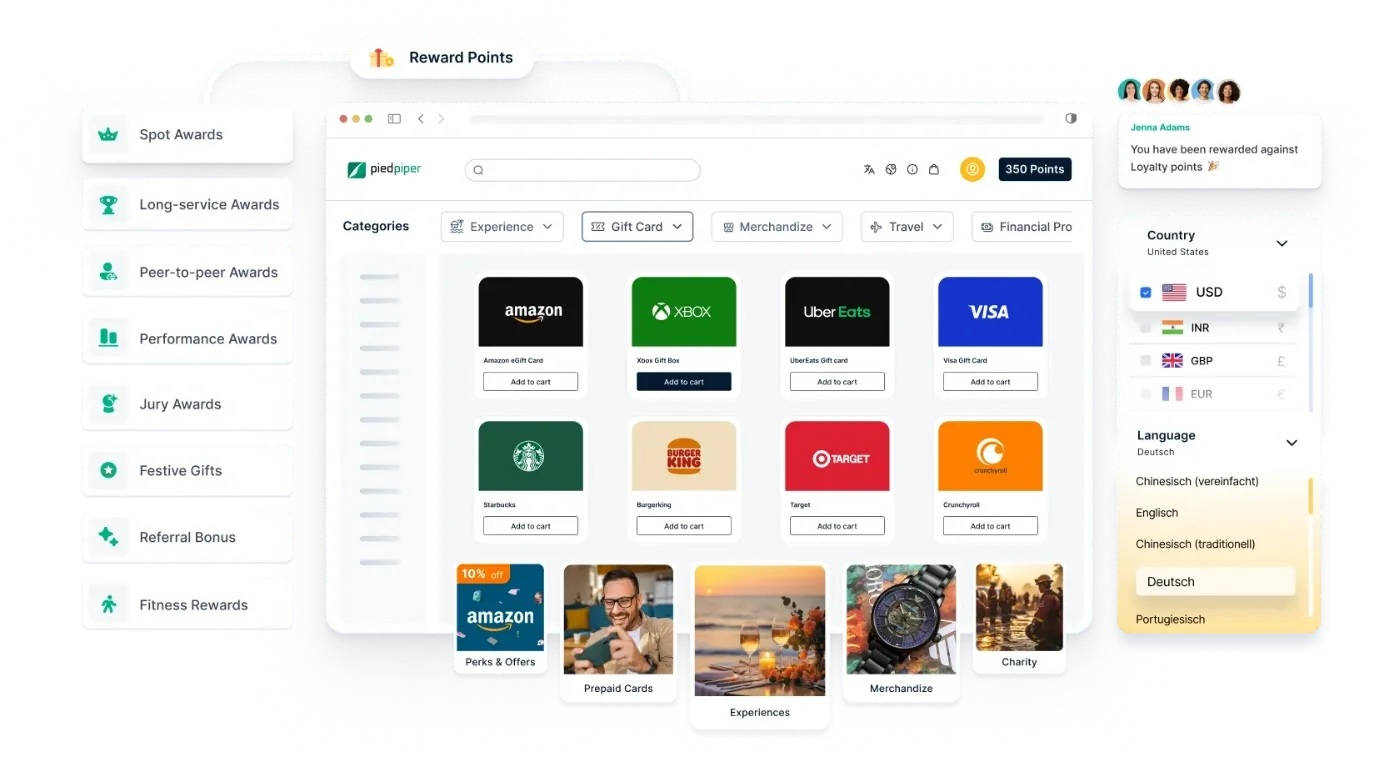

4. Global rewards marketplace

- Empuls provides access to 1M+ global rewards options across 100+ countries.

- Employees can redeem points and benefits for gift cards, merchandise, travel experiences, subscriptions, charity donations, and more.

- This flexibility ensures that employees feel genuinely rewarded and valued — not just financially but emotionally too.

5. Automation and customization for seamless experience

- Automated award cycles: Set up service awards, birthdays, and milestone recognitions automatically.

- Personalized experiences: Customize benefit communications, wishboards, and celebration workflows to match your company’s culture.

- Smart nudges: Empuls AI (Em) prompts employees to use their benefits or claim rewards without HR teams needing to chase them.

6. Analytics, reporting, and optimization

- Empuls offers real-time dashboards and detailed reporting on benefits adoption and utilization.

- HR can track which benefits employees use most, measure engagement, and make data-driven adjustments to future benefits plans.

- Built-in compliance and tax reporting tools ensure HR stays audit-ready and compliant with regulations.

Design employee benefits plan with Empuls for a happier, healthier workforce

Platform: Empuls by Xoxoday

Objective: Create a modern, flexible, and cost-effective employee benefits program to attract, engage, and retain top talent while improving overall financial, physical, and mental well-being.

1. Core tax-advantaged benefits

Delivered via: Empuls Multi-Benefit Card

Category | Monthly Limit | Annual Limit | Estimated Tax Saving (30% bracket) |

Meal Allowance | $100 | $1,200 | $360 |

Commuter Benefits | $300 | $3,600 | $1,080 |

Cell Phone Reimbursement | $100 | $1,200 | $360 |

Professional Development | $150 | $1,800 | $540 |

Total potential tax saving per employee: $2,340 annually

Administration:

- 100% digital onboarding

- Real-time spend tracking

- IRS, HIPAA, SOC 2, ISO 27001 compliant

- Immediate card activation for employees

2. Lifestyle spending accounts

Flexible allowances for:

- Fitness & wellness (e.g., gym memberships, online fitness classes)

- Learning & professional upskilling (e.g., Coursera, LinkedIn Learning)

- Remote work setup (e.g., ergonomic equipment, home internet)

- Travel and commuter benefits (e.g., Uber, Lyft, public transit passes)

- Family care (e.g., childcare subsidies)

Employee Experience:

- Select benefits through the Empuls app.

- Use direct pay or reimbursement methods.

- Freedom to use allowances without restrictions within set budgets.

3. Employee well-being

Support programs include:

- Early Wage Access (advance on earned income)

- Exclusive savings and cashback on 3,000+ brands

- Mental health support (Headspace, Calm, Talkspace)

Invest in your employees with Empuls — because happy employees build successful companies. Contact your Empuls engagement expert today!

Conclusion

Understanding employee benefits package isn't just about ticking boxes during enrollment. It's about taking charge of your financial well-being and crafting a future that aligns with your priorities. Your benefits are more than just a line item on your paycheck – they're a crucial part of your financial security and overall well-being.

By taking a proactive approach to understanding your benefits, making informed choices, and utilizing them strategically, you can maximize their impact and achieve your financial goals.