9 benefici per i dipendenti non tassabili per massimizzare il reddito e la soddisfazione sul posto di lavoro

Non taxable employee benefits offer a smart way to boost employee take-home pay and satisfaction without increasing taxable income. Discover key employee benefits that are tax free, explore real-world examples, and learn how to offer these perks seamlessly through platforms like Empuls.

In questa pagina

- Quali sono i benefit per i dipendenti non imponibili?

- Tipi comuni di benefici per i dipendenti esenti da imposte o non tassabili

- Other lesser-known tax free employee benefits

- Considerations and limitations to consider when giving nontaxable employee benefits

- Empower your workforce with nontaxable benefits via Empuls

- Conclusione

- Domande frequenti sui benefici per i dipendenti non imponibili

When it comes to employee compensation, salary is just one piece of the puzzle. In today’s competitive job market, organizations are going beyond base pay to offer benefits that enhance the employee experience—while also providing financial relief. One of the most valuable yet often overlooked components of a total rewards package is non taxable employee benefits.

These are perks and incentives provided by employers that are exempt from federal income tax, offering a win-win scenario: employees receive added value without an increase in taxable income, and employers enjoy improved retention, engagement, and morale. From health insurance and commuter benefits to childcare assistance and educational support, a wide variety of employee benefits are tax free under certain conditions.

Understanding which benefits qualify can help both HR professionals and employees make informed decisions that maximize value while staying compliant with tax regulations.

In this blog, we’ll break down the definition of non-taxable benefits, explore their advantages, and share real-world non taxable benefits examples that can transform the way you think about compensation and workplace well-being.

Quali sono i benefit per i dipendenti non imponibili?

Non taxable employee benefits refer to various perks and incentives provided by employers that are exempt from certain taxes and deductions. These benefits offer financial advantages for employees by reducing their taxable income, resulting in lower tax liabilities. Additionally, employers can benefit from tax deductions or exclusions for providing these benefits.

I benefit per i dipendenti non imponibili o esenti da imposte sono parte integrante di un pacchetto retributivo completo, a complemento dello stipendio e di altri benefit tradizionali. Possono spaziare dalla copertura assicurativa sanitaria ai piani pensionistici, ai conti di spesa flessibili, alle agevolazioni per il trasporto, all'assistenza scolastica e altro ancora.

Uno dei vantaggi principali dei benefit esenti da imposte è che aiutano i dipendenti ad aumentare la loro retribuzione. Riducendo la parte imponibile del loro reddito, i dipendenti possono effettivamente aumentare il loro stipendio. In questo modo possono destinare più fondi ai loro obiettivi finanziari, che si tratti di risparmiare per la pensione, pagare gli studi o affrontare le spese quotidiane.

Altri vantaggi dei benefit per i dipendenti non imponibili:

- Risparmio sui costi per i dipendenti.

- Maggiore soddisfazione e benessere dei dipendenti.

- Attirare e trattenere i migliori talenti.

- Risparmi fiscali per i datori di lavoro.

Tipi comuni di benefici per i dipendenti esenti da imposte o non tassabili

Esistono diversi tipi di benefit per i dipendenti esenti da imposte che i datori di lavoro possono offrire per migliorare i pacchetti retributivi dei loro dipendenti. Vediamo alcuni dei più comuni:

1. Prestazioni dell'assicurazione sanitaria

L'assicurazione sanitaria fornita dal datore di lavoro è un benefit molto diffuso che spesso comporta vantaggi fiscali. I premi pagati dai dipendenti per l'assicurazione sanitaria sponsorizzata dal datore di lavoro sono in genere esenti dalle imposte sul reddito e sui salari. Ciò riduce il reddito imponibile dei dipendenti, con conseguenti minori oneri fiscali. Inoltre, i datori di lavoro possono dedurre il costo dell'assicurazione sanitaria come spesa aziendale.

Inoltre, i conti di risparmio sanitario (HSA) sono un altro vantaggio fiscale associato all'assicurazione sanitaria. I contributi agli HSA sono versati al lordo delle imposte e i fondi possono essere utilizzati per pagare spese mediche qualificate. I contributi e i guadagni HSA crescono in esenzione d'imposta e anche i prelievi per spese mediche qualificate sono esenti da imposte.

2. Prestazioni pensionistiche

Le prestazioni pensionistiche, come i piani 401(k) e i conti pensionistici individuali (IRA), offrono ai dipendenti l'opportunità di risparmiare per il proprio futuro godendo di vantaggi fiscali. I contributi versati a questi piani pensionistici sono in genere fiscalmente differiti, il che significa che non sono soggetti all'imposta sul reddito nell'anno in cui vengono versati. Le imposte vengono invece differite fino al momento del prelievo durante il pensionamento.

I datori di lavoro possono anche fornire contributi corrispondenti ai conti pensionistici dei dipendenti, che spesso sono deducibili dalle tasse per il datore di lavoro. Questo contributo complementare aumenta ulteriormente i benefici fiscali e incoraggia i dipendenti a risparmiare per la pensione.

Inoltre, i conti pensionistici Roth offrono vantaggi fiscali unici. I contributi ai conti Roth 401(k) o Roth IRA sono effettuati con dollari al netto delle imposte, il che significa che non sono deducibili in anticipo. Tuttavia, i prelievi qualificati dai conti Roth, compresi i guadagni, sono esenti da imposte e forniscono un reddito esente da imposte durante la pensione.

3. Conti di spesa flessibile (FSA)

I Flexible Spending Account (FSA) consentono ai dipendenti di accantonare una parte del loro reddito al lordo delle imposte per pagare le spese mediche o di assistenza ai dipendenti. Questi contributi non sono soggetti a imposte sul reddito o sui salari, riducendo il reddito imponibile dei dipendenti. Gli FSA possono essere utilizzati per varie spese, come ticket sanitari, farmaci da prescrizione, assistenza all'infanzia e altro ancora.

È importante notare che gli FSA funzionano in genere secondo il principio "usa o perdi", il che significa che i fondi non utilizzati entro l'anno del piano possono essere persi. Tuttavia, alcuni piani consentono un rollover limitato o un periodo di grazia per utilizzare i fondi rimanenti.

4. Vantaggi del trasporto

I datori di lavoro possono offrire ai dipendenti agevolazioni fiscali per i pendolari, promuovendo opzioni di trasporto sostenibili. Le spese di trasporto qualificate, come gli abbonamenti di transito, i costi di van pooling, le indennità per il carburante e i parcheggi qualificati, possono essere offerti come benefici esentasse. Questi benefici riducono il reddito imponibile dei dipendenti, consentendo loro di risparmiare sulle tasse mentre si recano al lavoro.

I datori di lavoro possono anche fornire agevolazioni fiscali per il parcheggio, coprendo o sovvenzionando le spese di parcheggio dei dipendenti. Questo può essere particolarmente vantaggioso per i dipendenti che lavorano in aree con tariffe di parcheggio costose.

5. Programmi di assistenza all'istruzione

Molti datori di lavoro riconoscono l'importanza della formazione continua e offrono programmi di assistenza alla formazione per sostenere lo sviluppo professionale dei propri dipendenti. L'assistenza formativa sponsorizzata dal datore di lavoro può includere il rimborso delle tasse scolastiche, le borse di studio o il pagamento diretto di spese formative qualificate.

A determinate condizioni, questi programmi di assistenza educativa possono offrire benefici fiscali. Ad esempio, i datori di lavoro possono fornire ai dipendenti fino a un certo importo di assistenza educativa esente da imposte ogni anno, riducendo il reddito imponibile dei dipendenti.

6. Indennità di pasto per i dipendenti

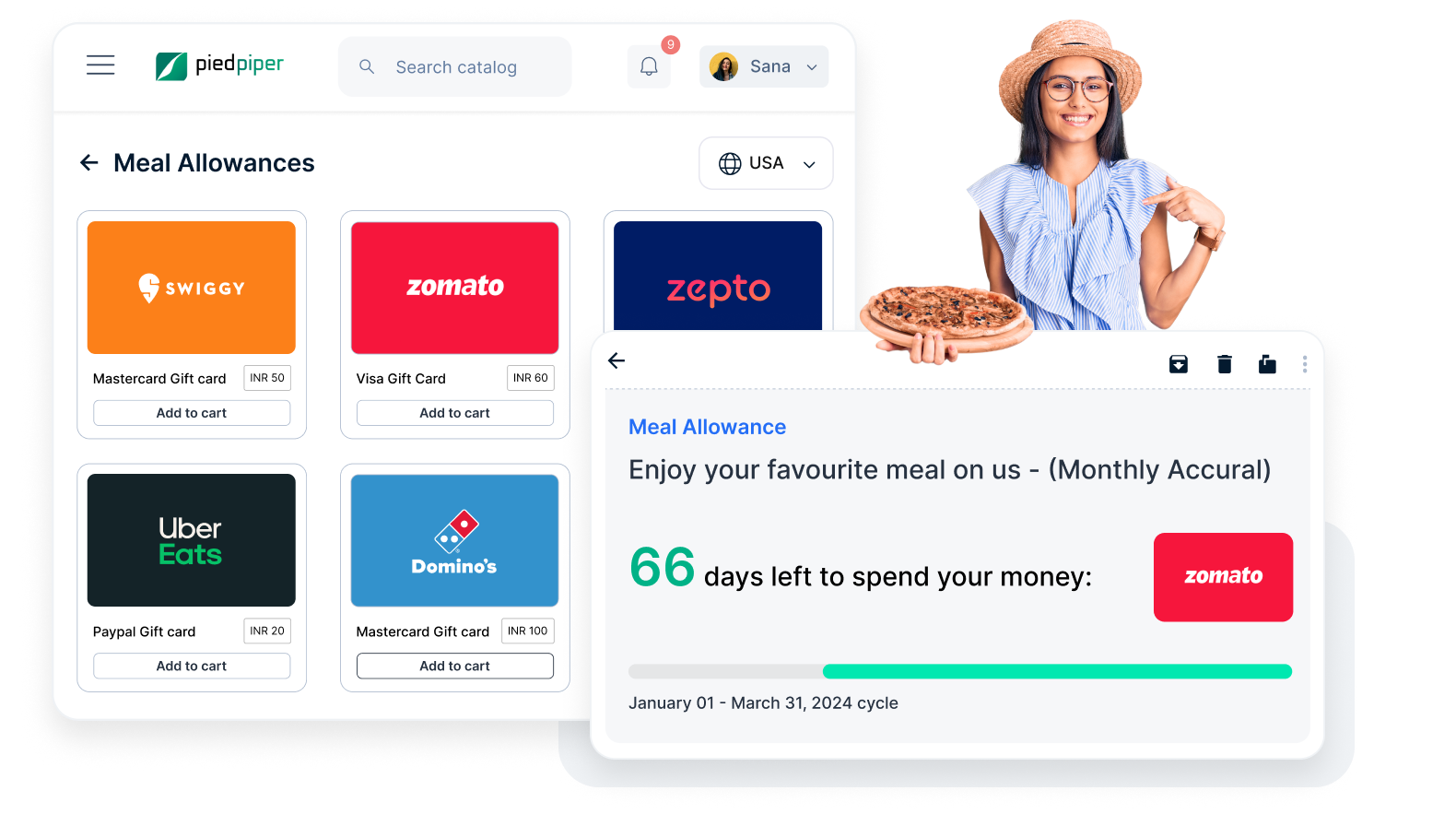

In some cases, employers may provide a meal allowance to employees as part of their compensation package. If this meal allowance is provided on a non-discriminatory basis and is not excessive, it may be considered a non taxable benefit.

However, the specific rules and limits for non taxable meal allowances can vary depending on the jurisdiction. It's important to consult local tax regulations or seek professional advice to determine the exact treatment in a particular jurisdiction.

Other lesser-known tax free employee benefits

While health insurance, retirement plans, flexible spending accounts, transportation benefits, and education assistance programs are commonly known tax free employee benefits, there are other lesser-known options that can provide additional financial advantages.

Let's explore some of these benefits:

1. Piani di acquisto di azioni da parte dei dipendenti (ESPP)

Employee Stock Purchase Plans (ESPPs) allow employees to purchase company stock at a discounted price. The contributions made to ESPPs are typically deducted from employees' paychecks on an after-tax basis.

However, the benefit comes when the stock is sold. If certain holding period requirements are met, the gain from selling the stock may qualify for favorable tax treatment, resulting in potential tax savings.

2. Programmi di assistenza per persone a carico (DCAP)

Dependent Care Assistance Programs (DCAPs) enable employees to set aside pre-tax dollars to cover eligible dependent care expenses, such as childcare or care for elderly dependents. Similar to FSAs, contributions made to DCAPs reduce employees' taxable income, providing tax savings.

Employers can offer DCAPs as part of their benefits package to support employees in managing their dependent care expenses.

3. Programmi di assistenza all'adozione

I datori di lavoro possono offrire programmi di assistenza all'adozione ai dipendenti che stanno allargando la propria famiglia attraverso l'adozione. Le spese di adozione qualificate, come le spese di adozione, le spese processuali e le spese legali, possono essere rimborsate o pagate direttamente dal datore di lavoro. Questi rimborsi o pagamenti diretti sono generalmente esenti da imposte fino a un certo limite, riducendo il reddito imponibile dei dipendenti.

Con queste agevolazioni fiscali meno conosciute, i datori di lavoro dimostrano il loro impegno a sostenere le diverse esigenze e gli eventi della vita dei loro dipendenti, offrendo al contempo preziosi vantaggi fiscali.

Considerations and limitations to consider when giving nontaxable employee benefits

Sebbene i benefit per i dipendenti esenti da imposte offrano vantaggi sia per i dipendenti che per i datori di lavoro, ci sono importanti considerazioni e limitazioni da tenere a mente. La comprensione di questi fattori garantisce la conformità alle normative e massimizza l'efficacia di questi benefit. Ecco alcuni punti chiave da considerare:

1. Requisiti di ammissibilità e partecipazione dei dipendenti

Alcune prestazioni esenti da imposte possono prevedere criteri di ammissibilità o requisiti di partecipazione. Ad esempio, le prestazioni di assicurazione sanitaria possono richiedere ai dipendenti di soddisfare criteri specifici o di iscriversi durante determinati periodi di iscrizione. I datori di lavoro devono comunicare chiaramente questi requisiti ai dipendenti per assicurarsi che comprendano i criteri di idoneità e possano usufruire dei benefici offerti.

2. Regolamenti dell'IRS e obblighi di rendicontazione per i datori di lavoro

Employers must comply with Internal Revenue Service (IRS) regulations when offering tax free employee benefits. This includes proper reporting of benefits on employees' W-2 forms and fulfilling any necessary reporting obligations. It is crucial for employers to stay updated with IRS guidelines and consult with tax professionals to ensure compliance.

3. Impatto potenziale su altri benefici per i dipendenti

L'implementazione di benefit per i dipendenti esenti da imposte può avere un impatto su altri benefit per i dipendenti, come le prestazioni di previdenza sociale o i contributi pensionistici. È importante valutare le potenziali implicazioni e comunicare qualsiasi modifica o effetto ai dipendenti, per consentire loro di prendere decisioni informate sulla loro pianificazione finanziaria complessiva.

4. Implicazioni fiscali per i dipendenti quando lasciano un lavoro

I dipendenti devono essere consapevoli delle implicazioni fiscali quando lasciano un lavoro che prevedeva benefici esenti da imposte. A seconda dello specifico benefit, possono esserci conseguenze fiscali o requisiti di idoneità per continuare a godere dei benefici dopo la cessazione del rapporto di lavoro. La comprensione di queste implicazioni aiuta i dipendenti a gestire la transizione in modo efficace.

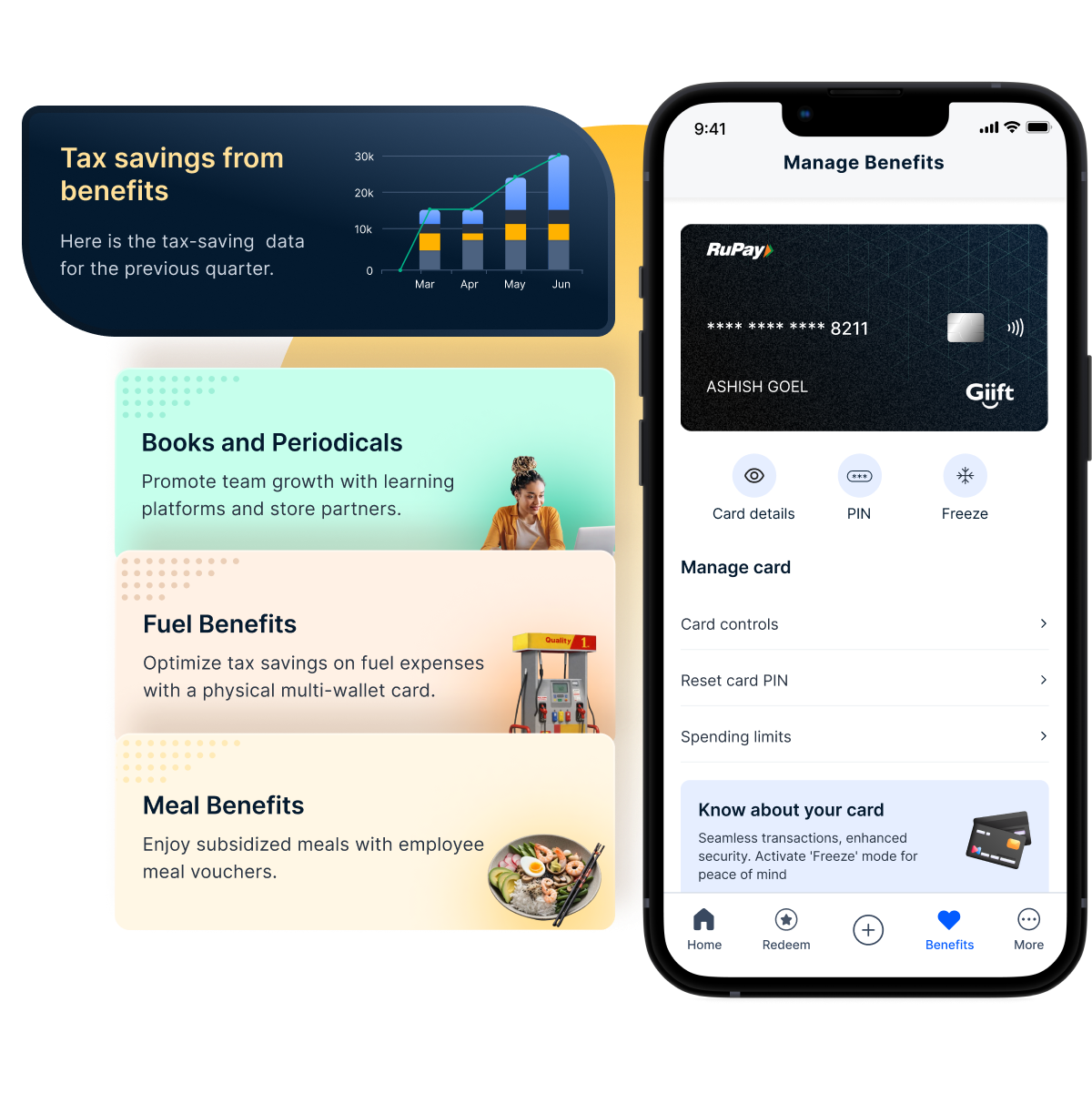

Empower your workforce with nontaxable benefits via Empuls

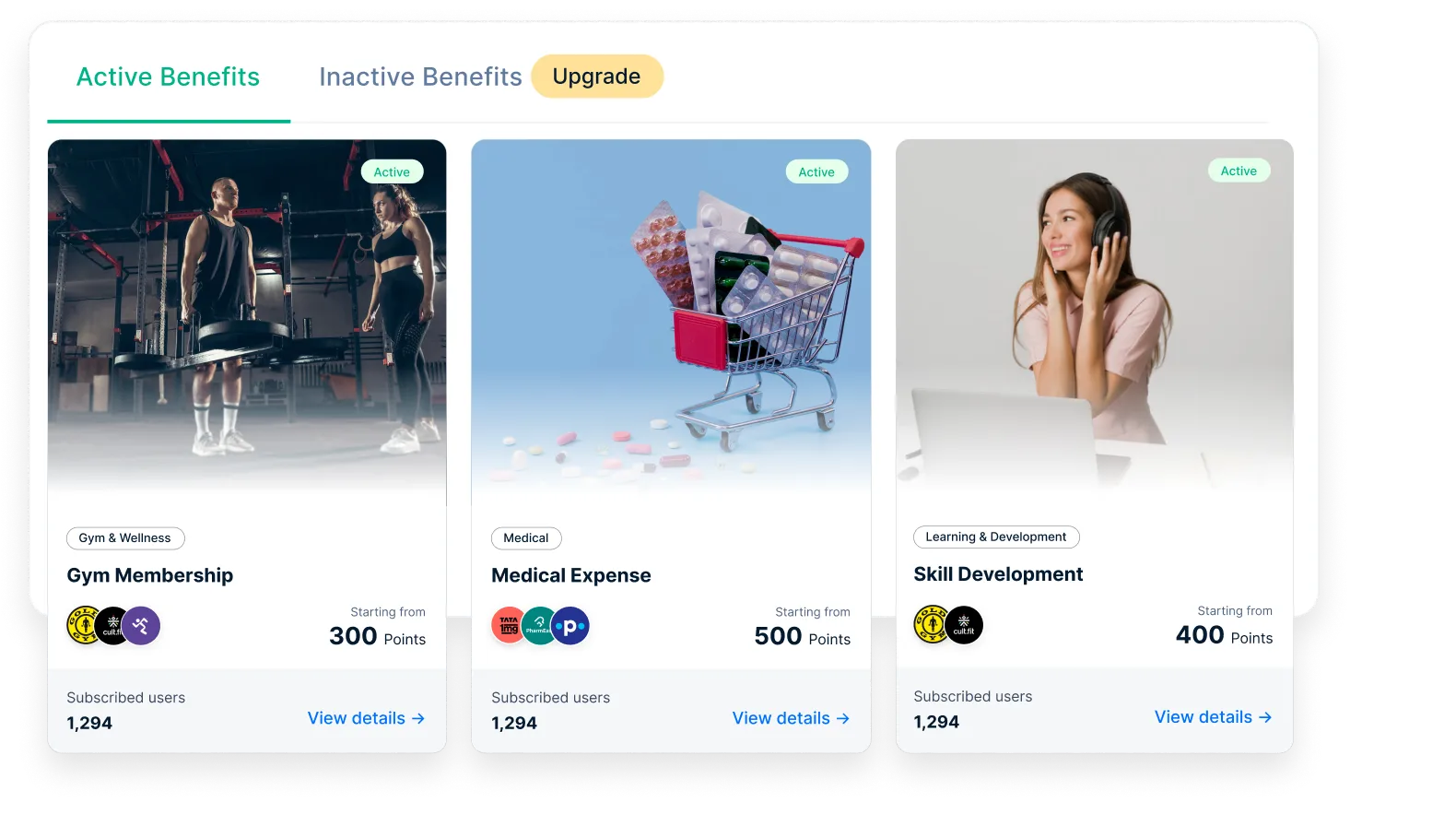

In today’s talent-driven market, smart employers are shifting from just offering higher salaries to delivering nontaxable employee benefits that improve take-home value and well-being. Enter Empuls—a comprehensive employee engagement platform that lets you offer flexible, compliant, and high-ROI nontaxable perks at scale.

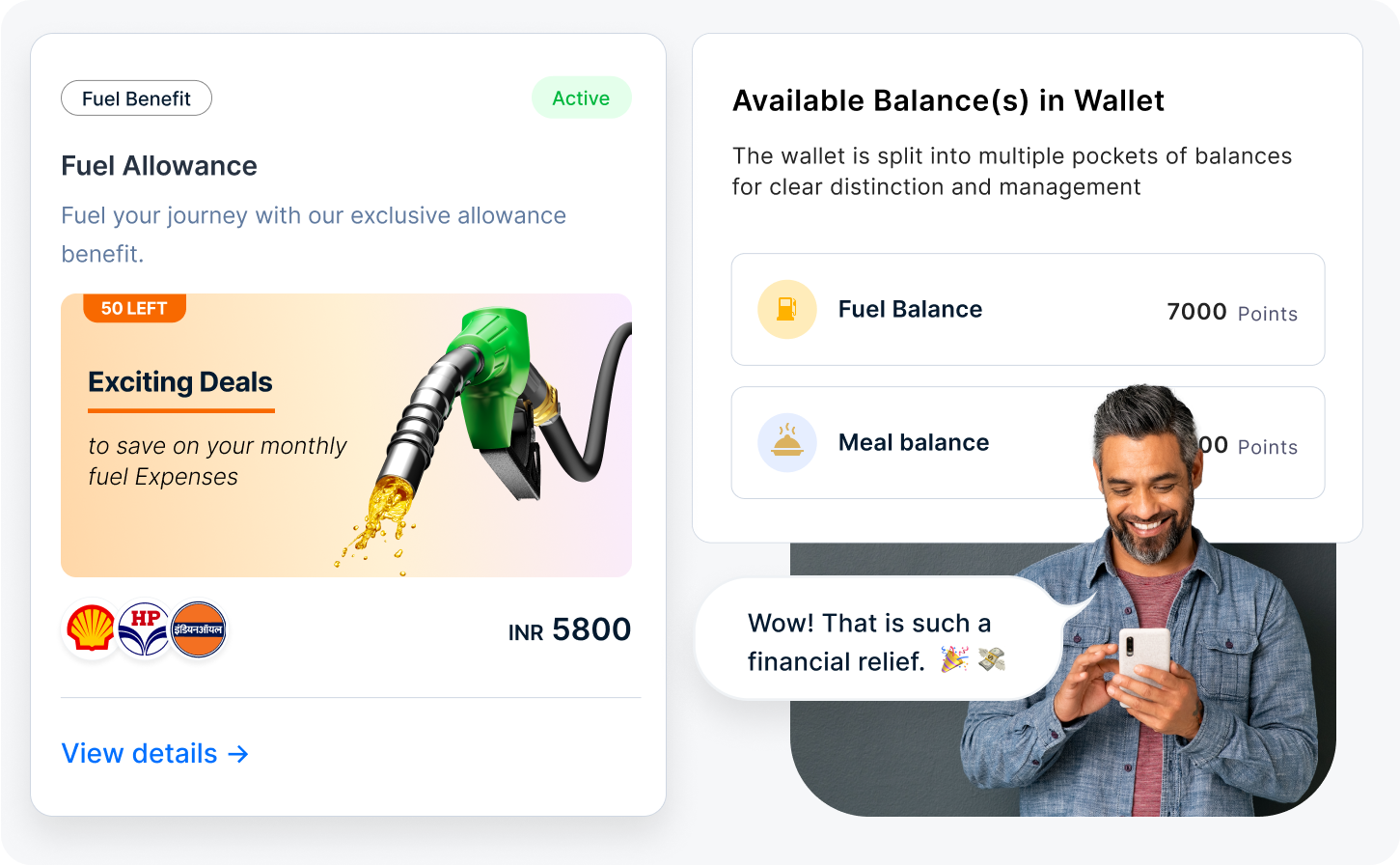

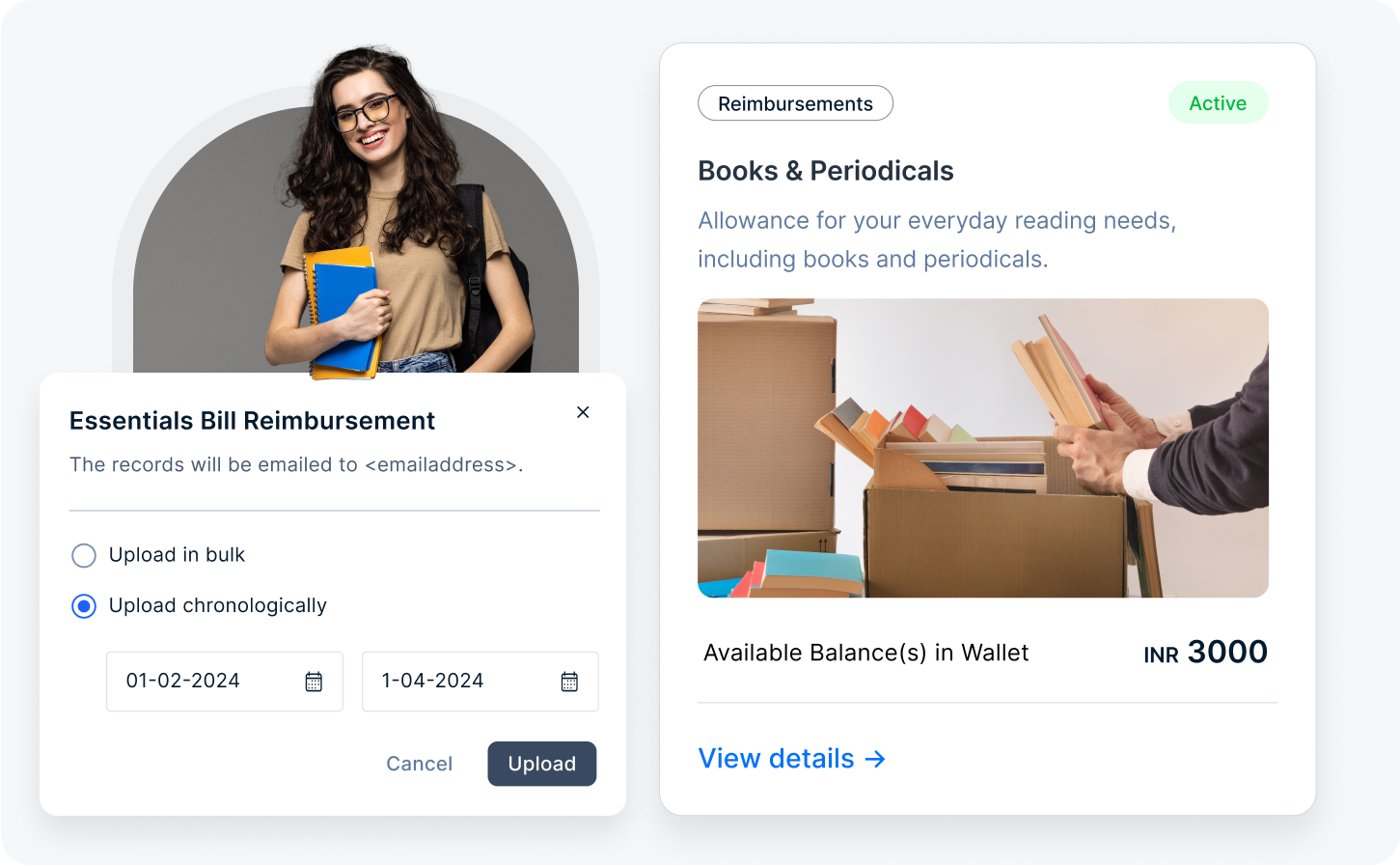

With Empuls Lifestyle Spending Accounts (LSAs) and multi-wallet tax-saving cards, organizations can provide tailored benefits that comply with local tax laws while enhancing employee satisfaction. These include:

- 🍱 Meal allowances for online and offline dining (Swiggy, Zomato, restaurants)

- ⛽ Fuel reimbursements—tax-free usage via authorized fuel partners

- 📚 Books & periodicals allowances to support continuous learning

- 📞 Telecom benefits for mobile and broadband needs

- 💪 Fitness & wellness reimbursements

- 🧠 Upskilling allowances for courses and certifications

- 👨👩👧👦 Family care support, including childcare and eldercare

All benefits are delivered through a single, easy-to-use platform, giving employees the freedom to pick what suits their lifestyle—and maximizing their savings without increasing taxable income.

Empuls not only streamlines benefit disbursal and compliance, but also ensures zero waste by offering pay-on-redemption and letting employees redeem only what they use—no breakage, no liability.

For HR teams, Empuls removes the administrative burden with automated workflows, real-time tracking, and analytics to measure program ROI and employee uptake. The result? A high-impact, low-cost strategy to boost retention, employer branding, and net income for your people.

Conclusione

I benefit per i dipendenti esenti da imposte o non imponibili offrono una situazione vantaggiosa sia per i dipendenti che per i datori di lavoro. I dipendenti godono di una maggiore retribuzione, di risparmi sui costi e di un maggiore benessere, mentre i datori di lavoro attraggono e trattengono i migliori talenti e beneficiano di potenziali risparmi fiscali.

Grazie a questi vantaggi, i dipendenti possono massimizzare il loro reddito e la loro soddisfazione lavorativa, mentre i datori di lavoro possono creare un ambiente di lavoro positivo e rimanere competitivi sul mercato del lavoro.

Dare priorità ai benefici non imponibili è una strategia intelligente per tutte le parti coinvolte, che garantisce un rapporto reciprocamente vantaggioso che promuove la sicurezza finanziaria e la felicità sul posto di lavoro.

Domande frequenti sui benefici per i dipendenti non imponibili

Ecco alcune domande frequenti sui benefit per i dipendenti non imponibili.

Quali benefici per i dipendenti sono tipicamente non tassabili?

Tra i benefici comuni non imponibili vi sono l'assicurazione sanitaria, l'assistenza scolastica, i contributi pensionistici, i benefici per i pendolari, i programmi di benessere e alcune indennità per i pasti.

Perché le prestazioni non imponibili sono vantaggiose?

I benefit non imponibili possono aumentare la retribuzione complessiva dei dipendenti senza essere soggetti all'imposta sul reddito, con conseguente aumento della retribuzione e potenziale riduzione dell'onere fiscale.

I benefici per i dipendenti sono imponibili?

I benefit per i dipendenti sono soggetti a tassazione. Il valore della maggior parte dei benefit per i dipendenti, come l'assicurazione sanitaria, i contributi pensionistici e i veicoli forniti dall'azienda, è considerato reddito imponibile. Tuttavia, vi sono alcuni benefit che possono essere esenti da imposte, come alcuni programmi di assistenza educativa, alcuni benefit per la salute e il benessere e alcuni sconti per i dipendenti.

Tutte le prestazioni non imponibili sono uguali in tutto il mondo?

No, il trattamento fiscale dei benefit per i dipendenti varia a seconda dei Paesi e delle giurisdizioni. È importante comprendere le normative e le linee guida specifiche del proprio Paese.

I benefit non imponibili possono essere forniti a tutti i dipendenti?

I benefit non imponibili devono essere generalmente erogati su base non discriminatoria, ossia devono essere offerti a tutti i dipendenti aventi diritto in modo coerente ed equo.

Ci sono limiti alle prestazioni non imponibili?

Sì, alcune prestazioni possono avere limiti o restrizioni specifiche per il loro status di non imponibilità. Ad esempio, potrebbero esserci importi massimi in dollari o criteri di ammissibilità da considerare.

Le prestazioni non imponibili possono cambiare nel tempo?

Sì, le leggi e i regolamenti fiscali possono cambiare, influenzando l'ammissibilità e il trattamento fiscale dei benefit per i dipendenti. Per garantire la conformità è essenziale tenersi aggiornati sulle leggi fiscali in vigore.

Devo consultare un professionista fiscale per quanto riguarda le prestazioni non imponibili?

È consigliabile rivolgersi a esperti fiscali o consultare professionisti delle risorse umane specializzati in benefit per i dipendenti per garantire un'implementazione accurata e conforme dei benefit non imponibili.